Market News

What is driving option volatility on expiry?

4 min read | Updated on July 19, 2024, 20:53 IST

SUMMARY

Once a contract expires, an option will either be worthless or valuable. On expiry day, strikes that are close to being in the money will have activity like this – but this is a bit extreme. With only a few hours (or minutes) until expiry, a contract will only have a small amount of extrinsic value associated with it.

market volatility on expiry day

Yesterday, the Nifty Bank had its weekly expiry and closed at 45,908.30 up nearly 1% for the trading session. Any call option with a strike price of 45900 or less expired in-the-money. Over the last several weeks and months, we have seen large price swings on near-the-money strikes within a few hours of market close on expiration day. Since there is now an expiry on every day, this is often a daily occurrence. For example, yesterday saw the prices for call options with the 45900-strike price rise from ₹6 at 2PM to over ₹314 (+5,092%) within 45 minutes. What is the cause of this?

Once a contract expires, an option will either be worthless or valuable. On expiry day, strikes that are close to being in the money will have activity like this – but this is a bit extreme. With only a few hours (or minutes) until expiry, a contract will only have a small amount of extrinsic value associated with it. If a contract is out-of-the-money and then becomes in-the-money, it will have both intrinsic and extrinsic value which will increase the price. In addition, as a contract becomes more in-the-money, it will have a higher delta. The delta is an option Greek and this value is the amount that an option’s price for every rupee change in the underlying price. If delta is higher, as is the case with in-the-money options, then the price will increase more as the underlying price goes up. However, a higher delta doesn’t explain what is happening on expiration days.

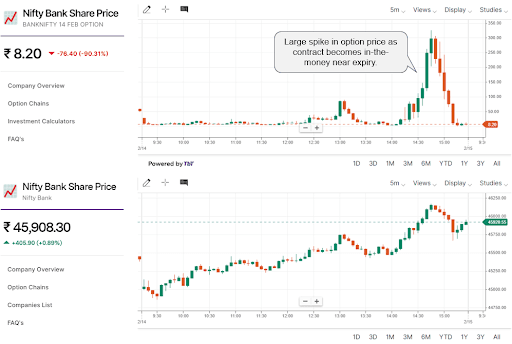

Below is a chart of the 45900-strike call option and the Nifty Bank below that.

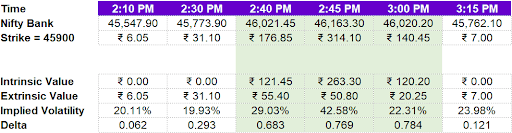

Looking at the 45900 CE at 2:10pm, the Nifty Bank was at 45,547.90 and the option was at R6.05. It had no intrinsic value and the implied volatility was 20%. At 2:30pm, the Nifty Bank had moved up over 200 points which increased the option price to ₹31.10. The implied volatility was still around 20% and the delta had increased from 0.062 to 0.293 as the option contract became closer to being in-the-money. At this point, the option had no intrinsic value meaning that if the Nifty Bank didn’t move for the next hour, this contract would expire worthless. However, the option had an extrinsic value of ₹31.10.

At 2:45pm, the option contract was in-the-money as the Nifty Bank rose to 46,163.30. The option price jumped to ₹314.10. The contract had an intrinsic value of ₹263.30 and the extrinsic value nearly doubled to ₹50.80! The delta increased to 0.769 but the implied volatility spiked to 42.58%. In the table below, you can see the rise in implied volatility from 2:30pm to 2:45pm.

Implied volatility is an artifact of demand when it comes to option pricing. Within a very short period of time, there will be minimal time decay and likely minimal underlying price movement. If a large number of traders demand to buy an option contract, then the price will go up. Since time and the underlying price remain roughly the same, implied volatility will have to rise. Looking at the table above, you can see this increase in demand by seeing the rise in implied volatility from 2:30pm to 2:45pm.

So, what is going on?

What is likely happening is that there are traders focused on the price action or chart of the option contracts rather than the underlying. They are trading on the technical momentum of the option price chart disregarding the fact that options are not like stocks as they have a finite lifespan. This is especially true on expiry day. These traders are pushing up the extrinsic value beyond where it should be this close to expiry. As the option price spikes, option sellers move-in as they see the spike in implied volatility as a selling opportunity. This pushes implied volatility back in-line. If you look at the table above, you can compare the prices at 2:40pm and 3:00pm. The Nifty Bank price is almost identical. However, implied volatility is 670 bps lower at 3:00pm. Traders that bought this contract on technical momentum between 2:40pm and 2:45pm likely lost due to overpaying for implied volatility.

How can you take advantage of this?

Today is the weekly expiry for the Nifty. Traders should be mindful of intrinsic value – what the payoff will be on expiry – as well as extrinsic value. If you see a large spike in price, particularly an option contract that is shifting from being out-of-the-money to in-the-money, you should think twice before following the trend. The last thing you want to do is overpay for extrinsic value that will be rapidly decaying as the market close approaches.

About The Author

Next Story