Market News

Weekly wrap: Strong finish for NIFTY50, SENSEX as IT stocks lead the way this week

.png)

4 min read | Updated on July 12, 2024, 22:19 IST

SUMMARY

With TCS setting the right tone, investors' focus will turn to the Q1 FY25 results of other companies next week. Corporate earnings will drive the market, while FIIs' position ahead of the Union Budget will also impact the sentiment.

- FIIs' buying helped the key indices to scale fresh record highs this week.

- SENSEX closed at an all-time high of 80,519.34, up 622 points, on Friday, marking its best single-day rise in the week.

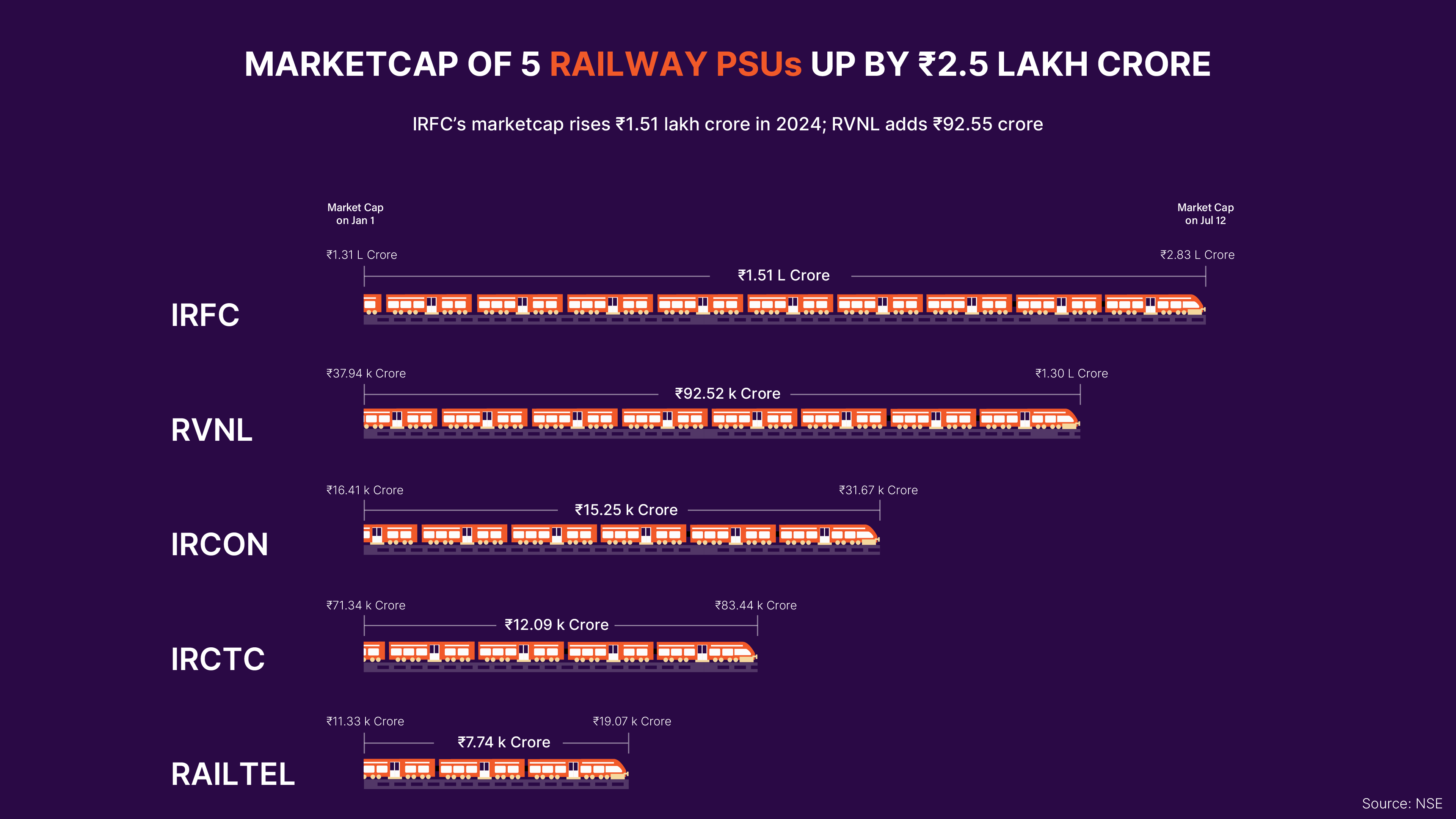

- Five rail stocks, including IRFC and RVNL, added a total of ₹2.78 lakh crore to their market valuation in 2024, so far.

It's that time of the week again. We are back with all the actions on the D-street this week, marked by NIFTY extending the weekly gains.

Benchmark indices NIFTY and SENSEX inched up to settle at record-high levels in a range-bound trade this week. NIFTY edged up 178 points, or 0.07%, while SENSEX advanced 522 points, or 0.06%, on a weekly basis. Stock markets moved in a narrow range and witnessed volatility as investors awaited more cues on inflation and interest rates to take positions.

FIIs' buying helped the key indices reach new record levels this week. On the other hand, profit-taking ahead of the earnings season, high valuation concerns, and uncertainty over Fed rate cuts kept the stock markets in a range.

Stock markets opened on a weak note on Monday, with indices settling marginally down due to the absence of any major trigger. The Uttar Pradesh government announcing tax sops on hybrid vehicles fueled buying in auto shares, while the progressing monsoon boosted FMCG stocks. SENSEX and NIFTY closed at fresh highs of 80,351.64 and 24,433.20, respectively, on gains in FMCG and auto shares.

SENSEX and NIFTY saw volatile sessions in the next two days as investors awaited the start of the earnings season for further direction.

The US's 0.1% inflation decline in June to a one-year low triggered expectations of a rate cut by the US Fed in September. Better-than-expected numbers from TCS and positive management commentary also lifted IT shares.

SENSEX closed at an all-time high of 80,519.34, rising by 622 points or 0.78% on Friday, which was also its best single-day rise in the week.

NIFTY settled at a record high of 24,502.15 by gaining 186.20 points or 0.77% in a day.

Among sectoral indices, NIFTY FMCG (4%) and NIFTY IT (3%) were the top gainers this week. NIFTY Metal, PSU Bank and Realty indices dropped up to 3%. Auto and Bank also declined.

Five rail stocks add more than ₹2.5 lakh crore market cap ahead of Budget 2024

The public sector undertaking (PSU) stocks are under focus amid speculations of the government's infrastructure push in the Union Budget 2024. Amid the rally in the broader market, five railway PSU stocks, including IRFC and RVNL, added a total of ₹2.78 lakh crore to their market valuation in 2024 so far, based on a series of initiatives taken by the government to boost railway infrastructure and launch new trains.

IT shares shine after TCS results

IT shares TCS, Infosys, Wipro, Tech Mahindra, HCL Tech, and Coforge rallied on Friday after the IT bellwether TCS reported better-than-expected financial results for the June quarter. The IT giant also expressed hopes that FY2025 would be better than FY2024. Rising hopes of a rate cut amid softer inflation in the US also boosted the IT shares. The NIFTY IT index zoomed by 4% on Friday.

FMCG consumption share gain on better monsoon

The NIFTY FMCG index was the top gainer this week, following gains in Godrej Consumer, Dabur India, ITC, HUL, and Nestle. FMCG shares were buoyed by progress in monsoon and kharif sowing. Positive updates by FMCG companies for the June quarter also boosted the shares.

What lies ahead?

With TCS setting the right tone, investors' focus will turn to the Q1 FY25 results of other companies next week. Corporate earnings will drive the market, while FIIs' position ahead of the Union Budget will also impact the sentiment. Stock-specific buying is also expected. The US market will see key data releases of retail sales and industrial production numbers. Besides, investors will watch out for Fed chair Jerome Powell's speech on Monday for further cues.

Next Story