Market News

Weekly market outlook: NIFTY50 and BANK NIFTY at support - What should traders do?

6 min read | Updated on March 17, 2024, 17:30 IST

SUMMARY

Traders can brace themselves for a volatile week ahead. After the announcement of India's general election, the U.S. Federal Reserve meeting is the key event to watch. On the domestic front, fortnightly mutual fund stress test reports could add further volatility in mid and smallcap stocks.

US Fed meeting and FIIs action to drive market direction this week

Markets snapped a four-week winning streak amid a broad-based sell-off and sharp correction in the midcap and smallcap indices. Both the NIFTY50 and SENSEX lost 2% to close at 22,023 and 72,643 respectively.

The broader markets extended their losing streak and saw a sharp correction last week. The NIFTY Midcap 100 fell 4.6%, while the Smallcap 100 lost 5.4% in the previous week. This took the smallcap index down more than 15% from its recent high.

Except for IT (+1.0%), all the other major sectoral indices closed in red last week. Realty (-9.4%), Media (-8.3%), PSU Banks (-7.9%) and Metals (-6.7%) were the key laggards.

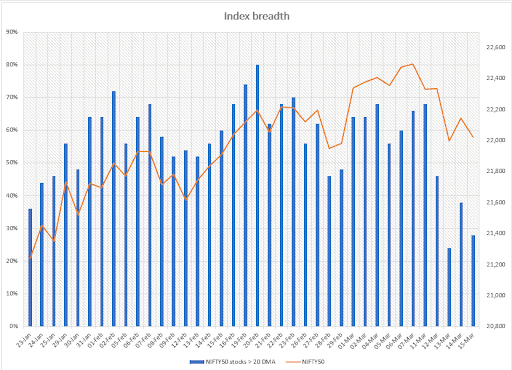

Index breadth- NIFTY50

Our breadth indicator accurately pointed to the recent decline in the NIFTY50. Just before the weekly expiry, only 24% of NIFTY50 stocks were trading above their 20-day moving average (DMA), indicating underlying weakness.

The chart below illustrates this point. Currently, only 28% of the NIFTY50 stocks are above its 20-DMA. This reading is well below the typical range of 40% to 60%. With the breadth indicator hovering at the lower end of its range, traders may wish to monitor price action near the NIFTY50's key support levels for further directional clues.

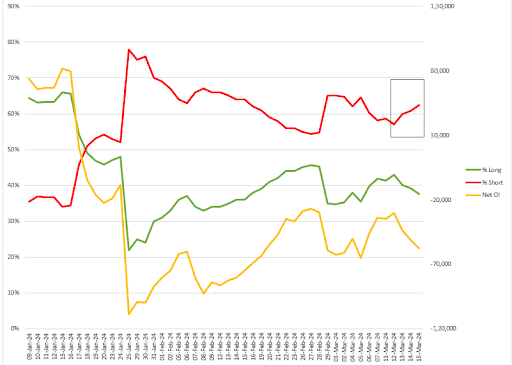

FIIs positioning in the index

After starting the previous week with a neutral long-short ratio of 42:58, the foreign institutional investors (FIIs) gradually increased their short positions in the index futures and increased it to 62%. Currently, the FIIs open interest (OI) in the index futures is 62% short and the net OI stands at -57,390 contracts, up almost 70% from the previous week.

As you can see from the chart below, FIIs gradually increased their short positions ahead of the expiry and have maintained the shorts so far. As pointed out earlier, we advise our readers to keep a close eye on the FIIs addition and liquidation of index futures OI to get a clear understanding of the ongoing trend.

The addition in short OI was also in line with the flows of FIIs in the cash market. During the week, the FIIs sold shares worth ₹816 crore on a net basis, offloading biggest shares closer to the weekly expiry. On the other hand, the domestic institutional investors (DIIs) remained net buyers and purchased shares worth ₹14,147 crore, taking the net institutional flows to ₹13,330 crore.

F&O - NIFTY50 outlook

For the 21 March expiry, the initial OI build-up of call writers is concentrated at the 22,000 and 22,500 strikes. The put base is established at the 22,000 and 21,800 strikes. Based on options data, traders are expecting NIFTY50 to trade between 21,500 and 22,600 this week.

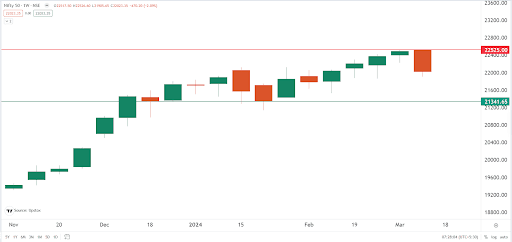

The NIFTY50 formed a bearish engulfing candle on the weekly chart, erasing most of the gains made over the past two weeks. The index closed below the previous week's low and the 20-day moving average, suggesting short-term weakness. According to the experts, the NIFTY50 is still consolidating between 21,800 and 22,500 with a negative bias. They believe that this week's price action near the 50-DMA, which also coincides with the swing low of 21,860, will be crucial. Immediate resistance for the index is at 22,250.

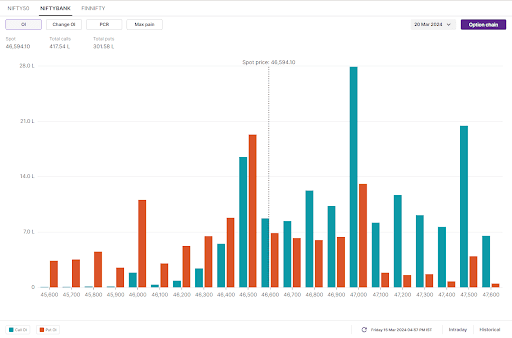

F&O - BANK NIFTY outlook

For the 20 March expiry, significant call OI on BANK NIFTY was observed at 47,000 and 48,000 strikes, while the maximum put writing occurred at 46,500 and 45,000 strikes. Based on the options data, traders are expecting BANK NIFTY to trade between 44,800 and 48,000 in the upcoming week.

The BANK NIFTY also formed a bearish candle on the daily chart, snapping a four-week winning streak, dragged by a sharp sell-off in PSU banks. Currently, the index is consolidating in the wider range of 44,800 and 48,600 with a slight negative bias. Moreover, the index has formed a three-doji candle on the daily chart for the past four trading sessions, indicating investor indecision. According to experts, the BANK NIFTY protected its 50 DMA on Friday's close, and going forward, price action near this support will provide further directional clarity.

Heading into the week, investors are pricing in three rate cuts in 2024, a sharp reversal from the six cuts originally priced in at the start of the year.

Domestically, stress test reports for mid and smallcap mutual funds are now coming in. These reports will now be published on a fortnightly basis. These SEBI-mandated tests assess fund liquidity and risk tolerance in the event of market downturns and potential investor redemptions.

Currently, both the NIFTY50 and the BANK NIFTY are testing important support levels at their 50-DMAs. Monitor price action near these levels, especially for the BANK NIFTY. Interestingly, both indices currently have a positive structure on the daily chart, with higher highs and higher lows in place. A close below the immediate swing low on the daily chart, or the formation of a reversal pattern near the 50-DMA, will provide further directional clues.

And we'll keep you updated on all these important developments via our morning trade setup blog, which is available every day before the market opens at 8 am.

About The Author

Next Story