Market News

Week ahead: Inflation data, Q2 earnings, Hyundai IPO and jobs data key market triggers to watch

.png)

6 min read | Updated on October 14, 2024, 08:01 IST

SUMMARY

The market is consolidating in a narrow range, indicating potential weakness in the upcoming sessions. Key factors that will capture the attention of market participants include September quarter earnings, the Hyundai Motor India IPO, U.S. retail sales data and the ECB interest rate.

Stock list

Foreign Institutional Investors (FIIs) gradually increased their short positions in index futures last week, signalling a shift in momentum towards the bears.

Sectorally, the Pharmaceuticals (+2.1%) and Automobiles (+1.9%) advance the most last week, while FMCG (-2.0%) and Metals (-1.7%) lost the most. Meanwhile, the broader markets fared better than the benchmark peers. The NIFTY Midcap 100 index rose 1.2%, while the Smallcap 100 index was up 1.3%.

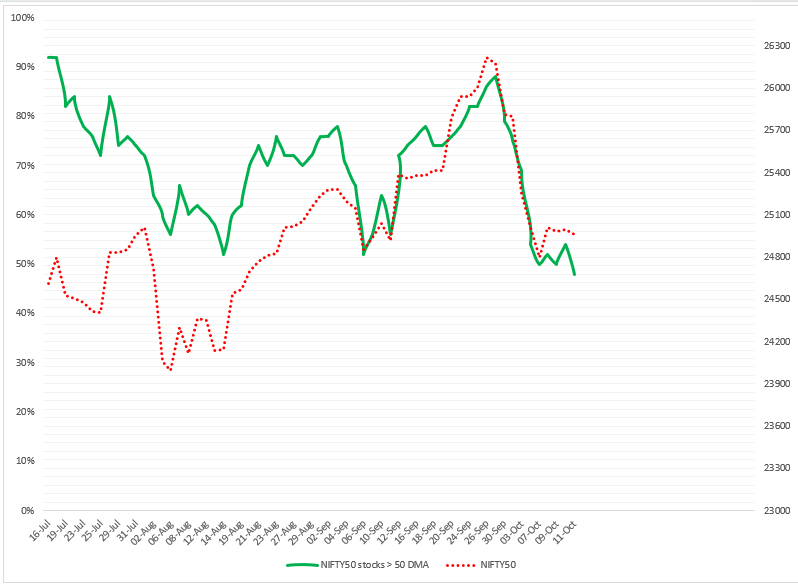

Index breadth- NIFTY50

The breath indicator, which tracks the percentage of NIFTY50 stocks trading above their 50 day moving average (DMA), hovereed around 50% last week without showing any significant signs of recovery.

As of Friday, 48% of the NIFTY50 stocks are trading above their 50 day moving average, signaling potential weakness in the market. If the the percentage falls below 40%, the index could face increased selling pressure, pushing prices lower from current levels.

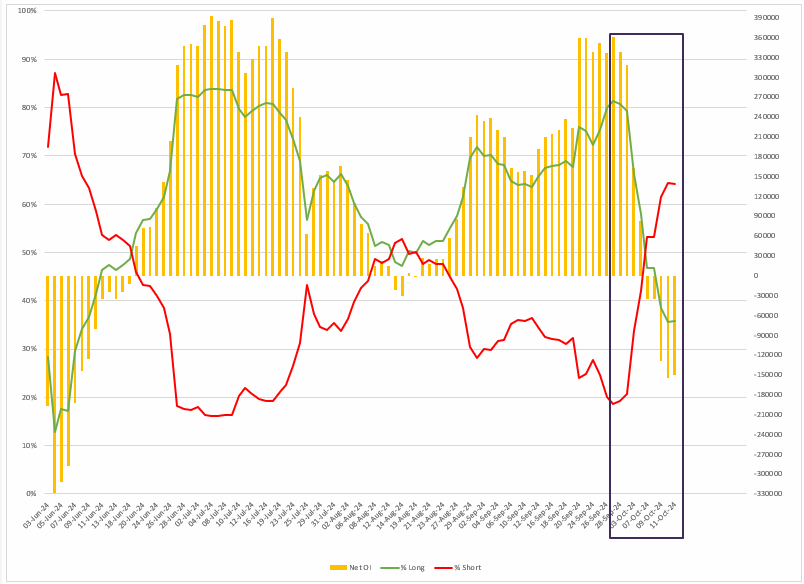

FIIs positioning in the index

Foreign Institutional Investors (FIIs) gradually increased their short positions in index futures last week, signalling a shift in momentum towards the bears. The long-to-short ratio in index futures reversed dramatically from 58:42 in the previous week to 34:64 on Friday. Moreover, FIIs open interest in index futures turned net short, with a position of 1.5 lakh contracts.

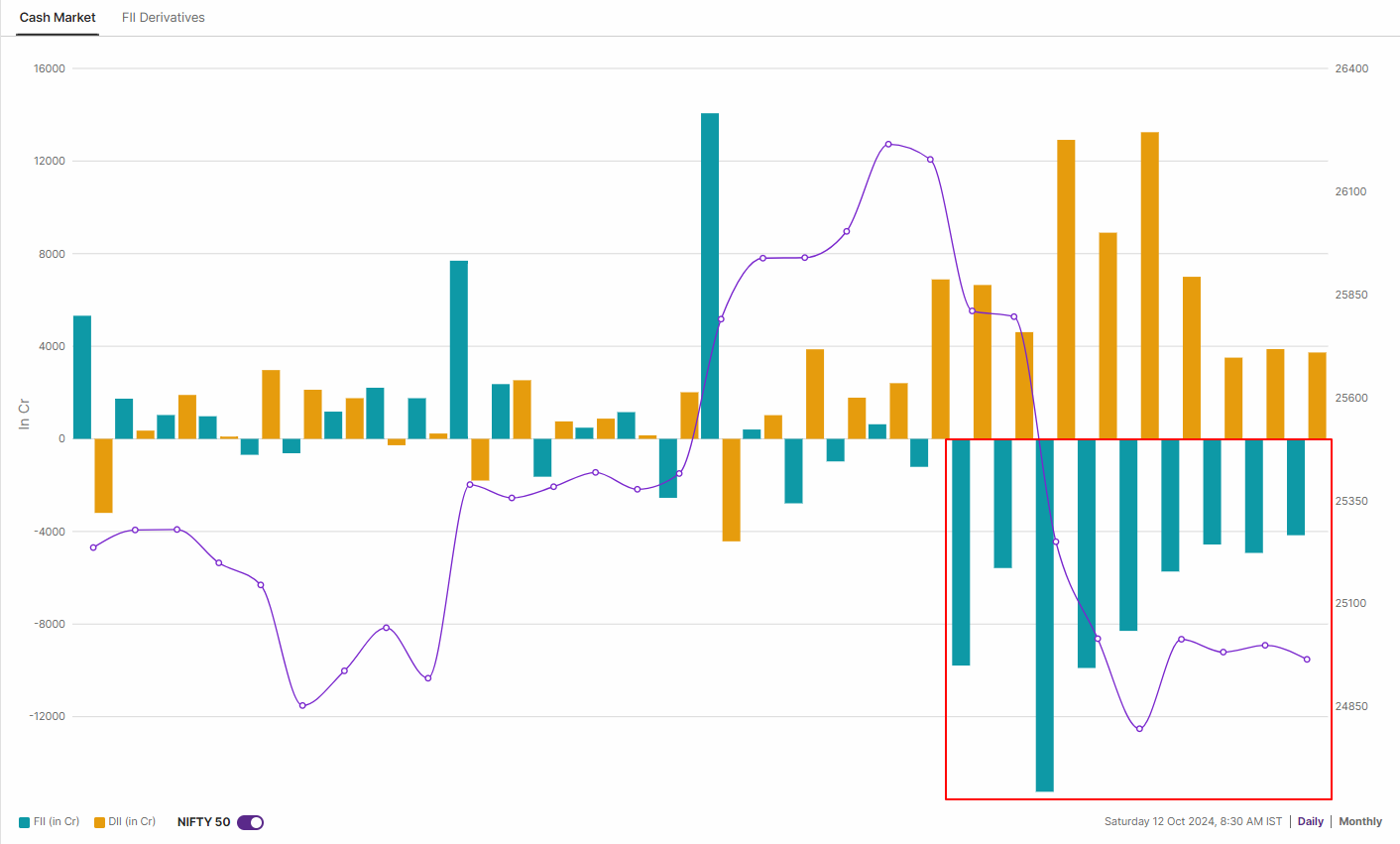

The increase in short positions in index futures matched the selling by FIIs, who dumped shares worth ₹27,674 crore, taking the total net outflow so far in October 2024 to ₹58,394 crore. On the other hand, Domestic Institutional Investors (DIIs) supported the market by buying shares worth ₹57,792 crore, resulting in a net institutional outflow of ₹602 crore for the month so far.

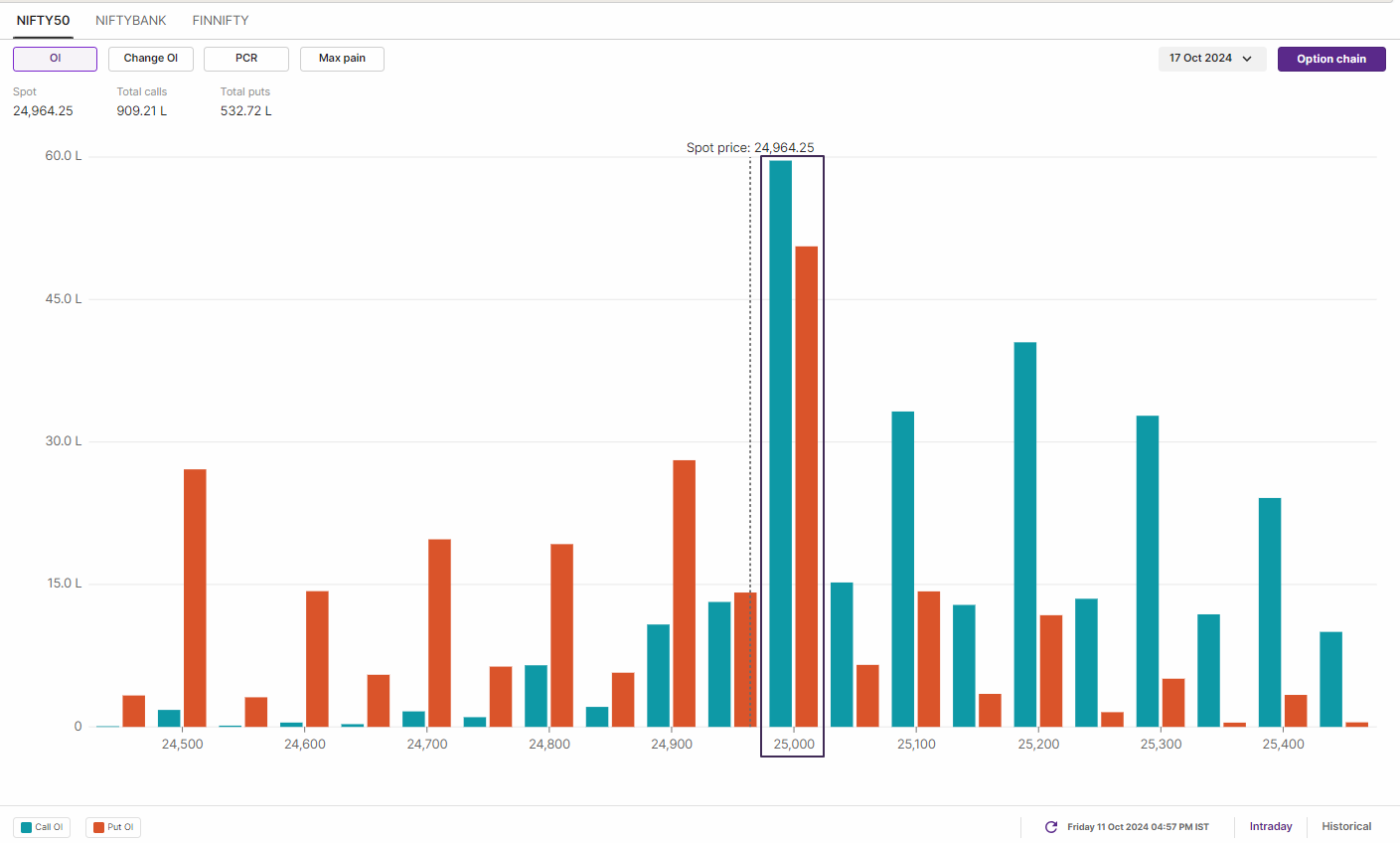

F&O - NIFTY50 outlook

The open interest build-up for the 17 October expiry has seen significant call and put options placed at the 25,000 strike, indicating a range-bound movement in the index. However, traders will want to monitor the change in open interest closely in the coming days as the index has been consolidating around the 25,000 level for the past three sessions.

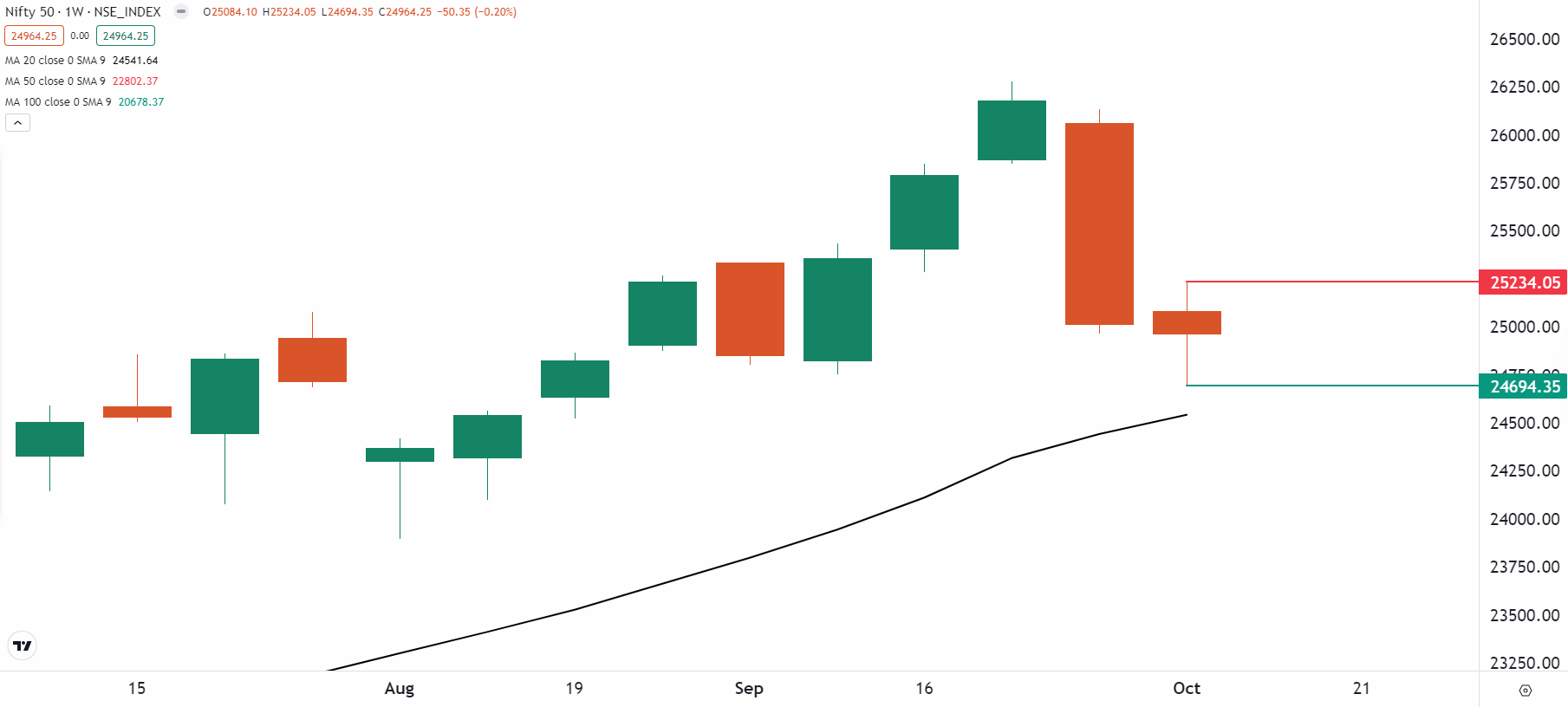

The NIFTY50 index formed a doji candle on the weekly chart following last week’s 4.4% decline, signaling indecision among investors at current levels. Despite this, the index closed the week slightly below the previous week’s, suggesting potential weakness.

As shown in the chart below, the index is consolidating within a range of 25,250 and 24,700, spanning roughly 550 points. Unless the index breaks out of this range on the closing basis on daily timeframe, trend is likely to remain sideways, with sharp volatility continuing in the near-term.

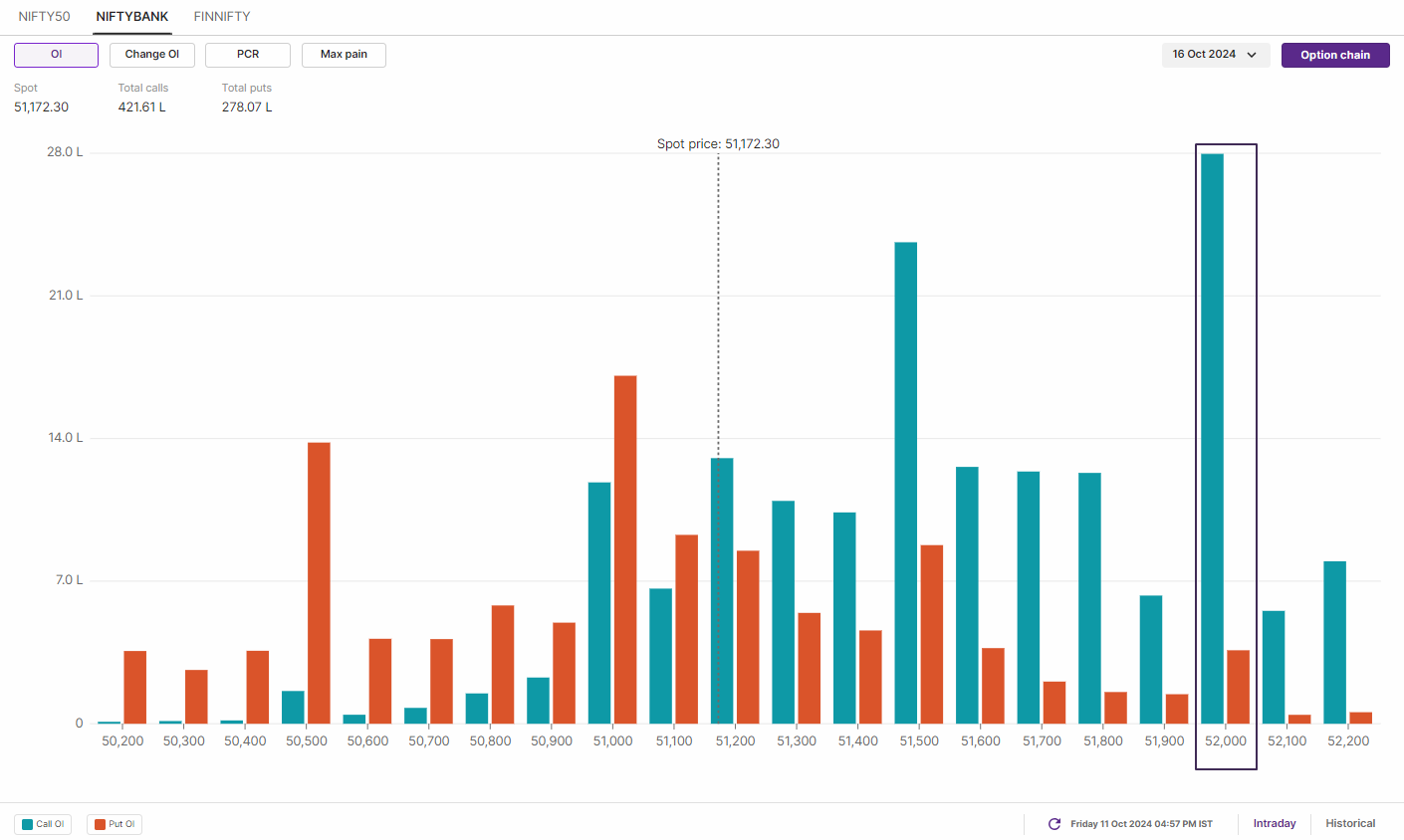

F&O - BANK NIFTY outlook

The open interest positioning for the 16 October expiry is skewed towards call options, with highest concentration at 52,000 and 51,500 strike prices. This suggests that the index may encounter around these levels. On the other hand, the highest put option base is at the 51,000 and 50,500 strikes, indicating potential support for the index around these levels.

The BANK NIFTY index has formed a hammer candlestick pattern on the weekly chart, although not a perfect one. A hammer is a bullish reversal pattern that typically forms after a downtrend, signalling potential upward movement. However, for confirmation, the next candle must close above the high of the hammer.

As shown in the chart below, the index is currently consolidating between the 51,800 and 50,200 levels. In addition, the index closed below its 20-week moving average, indicating further weakness and suggesting caution in the near term.

🗓️Key events in focus: Globally, the retail sales data and jobless claims in the United States will be in focus. Additionally, the European Central bank will announce its interest rate decision on Thursday.

On the domestic front, Market participants will be closely watching the release of the September CPI and WPI inflation data on October 14. In August, CPI inflation rose slightly to 3.65% from 3.6% in July, while wholesale inflation dropped to a four-month low of 1.31%, down from 2.04% in July.

All eyes will be on the U.S. third-quarter earnings this week, with major companies like Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, Netflix, and American Express set to announce their results.

🛢️Oil: Crude oil prices extended their gains for the second week in a row as investors assessed the potential impact of supply disruptions in the Middle East and Hurricane Milton. Brent Crude ended the week 1% higher at $78 a barrel, while West Texas Intermediate (WTI) also gained 1% to close at $75.

📌Spotlight: The IPO of India’s second largest car company Hyundai will open on 15 October. The company has set the IPO price in the range of ₹1,865 and ₹1,960 per share for its ₹27,870 crore public issue. The IPO of the Indian subsidiary of the Korean Hyundai Motor Company will be the largest public issue in India, surpassing the ₹21,000-crore offering of the Life Insurance Corporation (LIC).

📊Stocks in focus: Based on the price and open interest, long build-up was seen in National Aluminum, Divi’s Laboratories and Deepak Nitrite. Similarly, to track the OI and price losers, log in to Upstox ➡️F&O➡️Futures smart list ➡️OI gainers.

📓✏️Takeaway: The broader trend of the NIFTY50 and BANK NIFTY remains weak and both the the indices are consolidating after a sharp fall in first week of October.

The NIFTY50 index has immediate support around 24,700 and the resistance is at 25,500 level. Unless the index breaks this range on closing basis, the trend may remain range-bound. However, a break of this range may provide directional clues.

To stay updated on any changes in these levels and all intraday developments, be sure to check out our daily morning trade setup blog, available before the market opens at 8 am.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

Next Story