Market News

Trade setup for 20 March: BANK NIFTY falls for eight sessions in a row, weekly expiry in focus

5 min read | Updated on March 20, 2024, 08:30 IST

SUMMARY

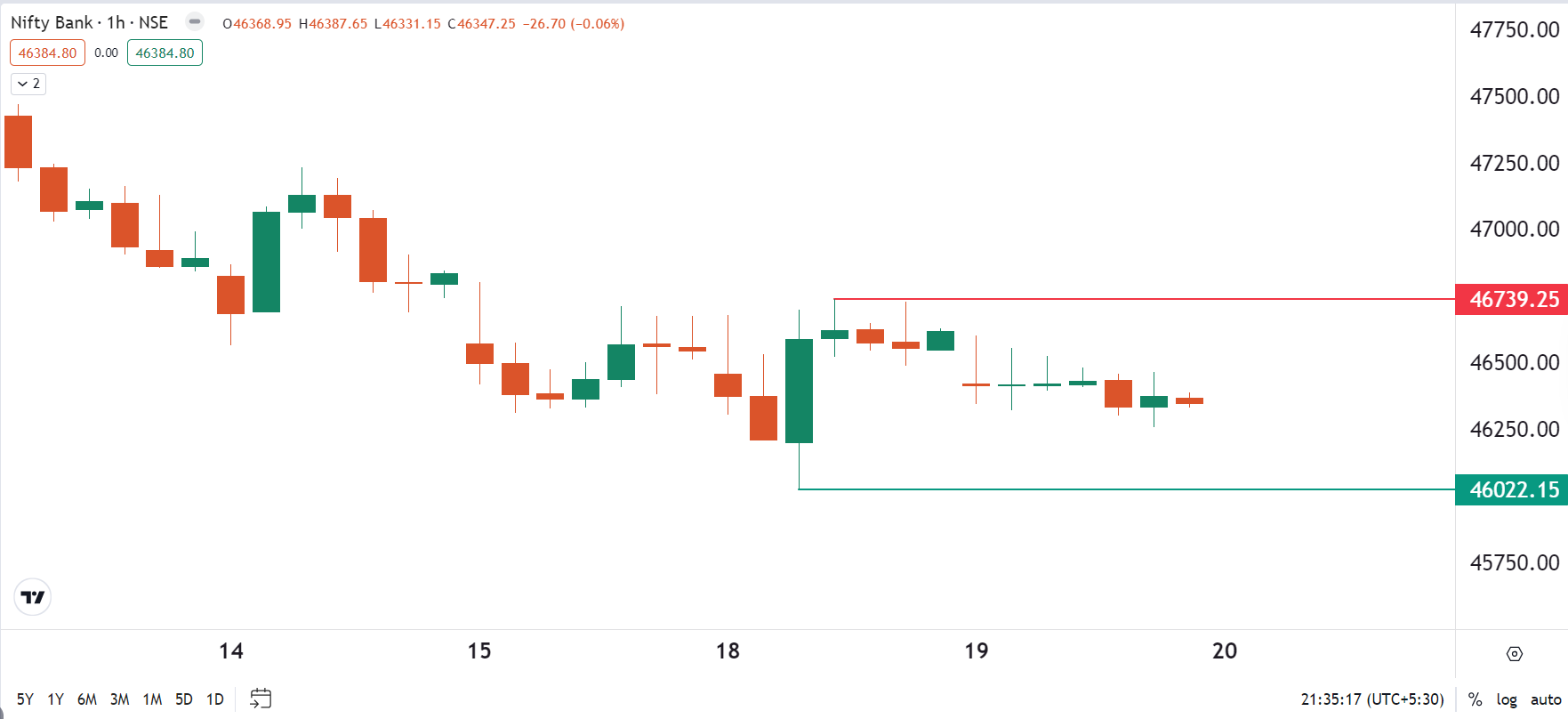

Traders should closely monitor price action near the highs and lows of the 18th March hammer candle, highlighted on the hourly chart below. A decisive break above or below this range could provide crucial clues about the BANK NIFTY's future direction.

Trade setup for 20 March: Key things to know before market opening.

Asian markets update 7 am

Indian markets are set to open higher today, mirroring a positive handover from Wall Street. The GIFT NIFTY is currently trading 0.2% higher, suggesting a positive start for the NIFTY50. However, Asian markets are showing a mixed picture. Japan's Nikkei 225 is up 0.6%, while Hong Kong's Hang Seng Index is trading slightly lower by 0.1%.

U.S. market update

U.S. stocks rose on Tuesday ahead of the Federal Reserve's rate decision and economic projections, the focus of a two-day policy meeting that began on Tuesday. While most analysts expect the Fed to hold rates steady, a recent uptick in inflation data has investors paying close attention to Fed Chair Jerome Powell's press conference for clues of Fed’s future monetary policy direction.

The Dow Jones Industrial Average gained 0.8% to close at 39,110, while the S&P 500 added 0.5% to end the day at 5,178. The Nasdaq Composite gained 0.3% to close at 16,166.

NIFTY50

- March Futures: 21,886 (▼1.1%)

- Open Interest: 2,38,707 (▼5.9%)

The NIFTY50 broke out of its three-day consolidation and closed below its 50-day moving average (DMA) amid a sharp sell-off in IT heavyweights. The index also closed below the key swing low of 21,840 and traded below key support levels for most of the day, highlighting the overall weakness.

As you can see in the chart below, yesterday we pointed out that the index was consolidating at a key support zone, but had failed to provide a follow through price action from the sharp one-day corrections since January. Today, the index has also broken this pattern along with key supports. As you can see in the chart, with a close below 21,860, the NIFTY50 has negated the higher high and higher low structure on the daily time frame. The next immediate support for the NIFTY50 is now around the 21,500 zone and the hurdle remains at 22,200.

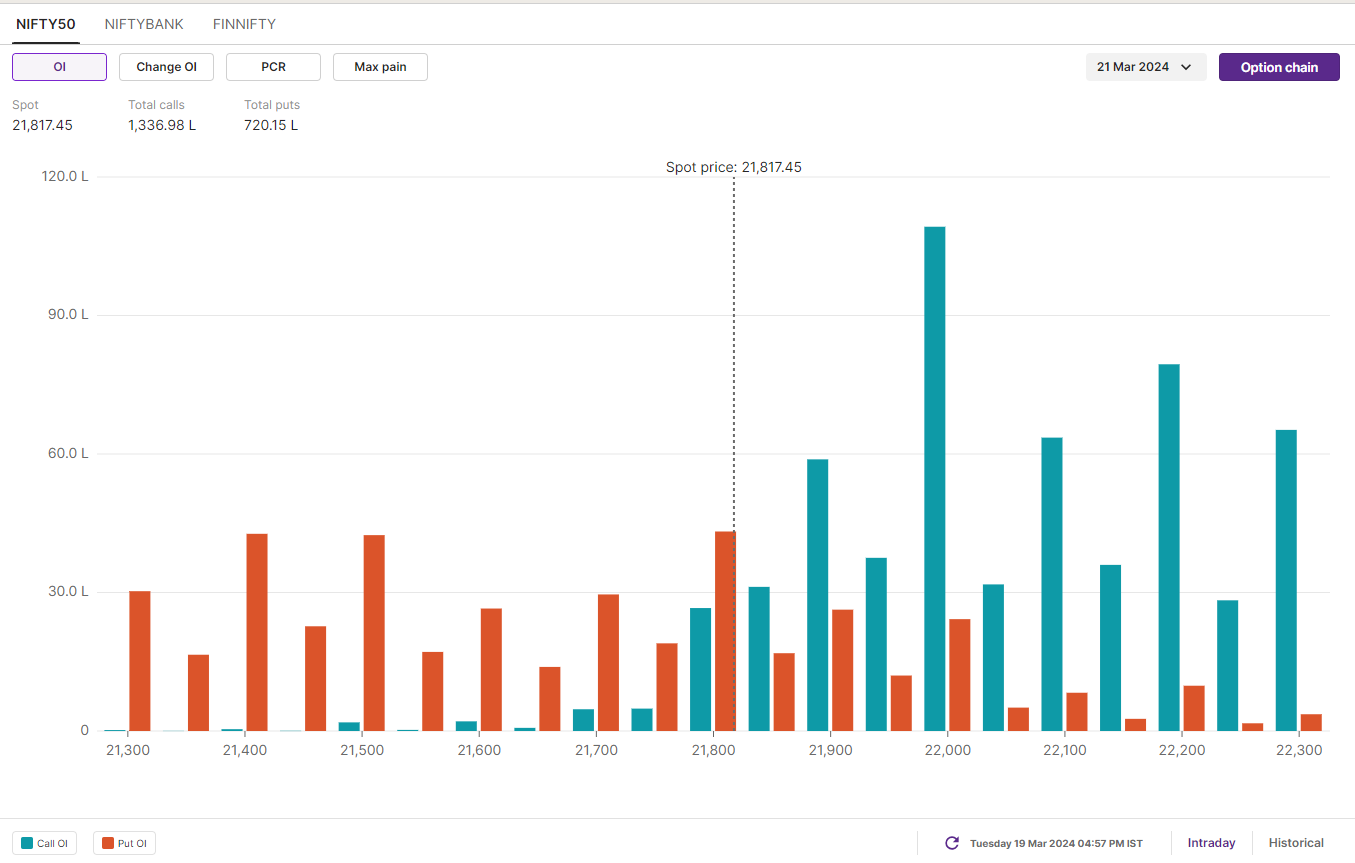

Open interest (OI) build-up for 21 March Expiry shows significant call base at 22,000 and 22,200 strikes. On the other hand, the put writers have made base at 21,800 and 21,500 strikes. Based on the options data, traders are expecting NIFTY50 to trade between 21,450 and 22,300 this week.

BANK NIFTY

- March Futures: 46,449 (▼0.6%)

- Open Interest: 1,29,151(▼0.6%)

The BANK NIFTY extended its downtrend for the eighth consecutive day and closed lower. The index formed an inside bar candle on the daily chart and traded within the range of the previous candle. In five out of the last six trading sessions, the index has formed a neutral doji candlestick pattern, highlighting investor indecision.

As we pointed out in yesterday's blog, the BANK NIFTY has formed a hammer pattern on the daily chart, which is considered a reversal pattern. We also highlighted that the reversal patterns would be confirmed by the following day's close. Today, the BANK NIFTY traded within the range of the hammer candlestick.

With the weekly contracts expiring today, traders are advised to monitor the price action near the high and low of the hammer candlestick formed on the 18th March. For the benefit of our readers, we have highlighted the low and high of the hammer candlestick on the hourly chart below. Experts believe that a close above or below the marked area on the hourly chart will provide further directional clues.

On the options front, the 47,000 and 47,500 call options have significant open interest. On the other hand, put writers have made their bases at the 46,000 and 45,500 strikes. Based on the options data, traders are expecting the BANK NIFTY to trade within a range of 47,500 and 45,000 for today’s expiry.

FII-DII activity

Stock scanner

Catch up on Tuesday’s trading insights from NIFTY 200! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

About The Author

Next Story