Market News

Stock Market Weekly Recap: SENSEX, NIFTY slide for 3rd week on FII outflows, NIFTY Auto sees biggest decline

.png)

5 min read | Updated on October 19, 2024, 09:47 IST

SUMMARY

Benchmark indices SENSEX and NIFTY continued their slide for the third straight week despite a breather on Friday. SENSEX dropped 152 points on a weekly basis, while NIFTY lost 110 points largely due to losses in three of five trading sessions.

Stock list

- This week, FIIs turned net sellers, selling equities worth over ₹16,330 crore on a net basis in the first four sessions in the cash segment.

- IT shares closed on a mixed note this week after quarterly financial results.

- Bajaj Housing Finance shares dropped around 4% this week after the one-month IPO lock-in period ended on October 15.

Hi folks, it’s that time of the week again when we take stock of all the actions in the financial markets.

Benchmark indices SENSEX and NIFTY continued their slide for the third straight week despite a breather on Friday. SENSEX dropped 152 points on a weekly basis, while NIFTY lost 110 points largely due to losses in three of five trading sessions.

Stock markets dropped to two-month lows mid-week following heavy selling by foreign institutional investors (FIIs) triggered by rising US bond yields and a flare-up in tensions in the Middle East region.

Continuing FII outflows from Indian markets also dampened the sentiment on the D-Street this week.

While there was optimism over the Chinese stimulus package previously, rising US bond yields amid growing geopolitical tensions eroded appetite for riskier assets like emerging markets. Retail inflation data also dented hopes of a rate cut by the RBI, hurting investor sentiment.

Stock markets opened this week on a firm note, with buying in IT and banking shares taking indices higher by around 0.7%. NIFTY regained the 25,000 level by rising 163 points, or 1.65%, to 25,127.95. SENSEX recovered 592 points to close to the 82,000 level on Monday.

Stock markets witnessed a correction on Tuesday, largely dragged by index major Reliance Industries Limited after weak Q2FY25 results. Reliance Industries, in its Q2 results released after market hours on Monday, reported a 5% drop in the net profit due to weak oil refining and petrochemical business. NIFTY dropped below the 25,100 level, while SENSEX closed at 81,820.12.

SENSEX and NIFTY declined on Wednesday due to a selloff in IT and auto shares. Losses in Asian and European markets also affected investor sentiment in domestic markets.

An increased buying in IT shares, following healthy Q2 results by Wipro, restricted losses. NIFTY closed near a two-month low of 24,749.85, while SENSEX declined 495 points to close at 81,006.61.

SENSEX and NIFTY cut short the three-day decline on Friday on value-buying in banking, metal, and realty shares. Firm global cues also aided the recovery in domestic markets.

NIFTY gained 0.42% to settle at 24,854.05, and SENSEX rose by 0.27% to end the week at 81,224.75 levels.

Auto, Metal & Media shares slide; Bank, Realty cut losses

NIFTY Auto declined the most by 5% this week, dragged by losses in Bajaj Auto, HeromotoCorp and others. Metal, Media, FMCG and Oil & Gas were also among the major losers this week. NIFTY Bank, Realty, and Financial Services advanced 1% each, helping cut losses.

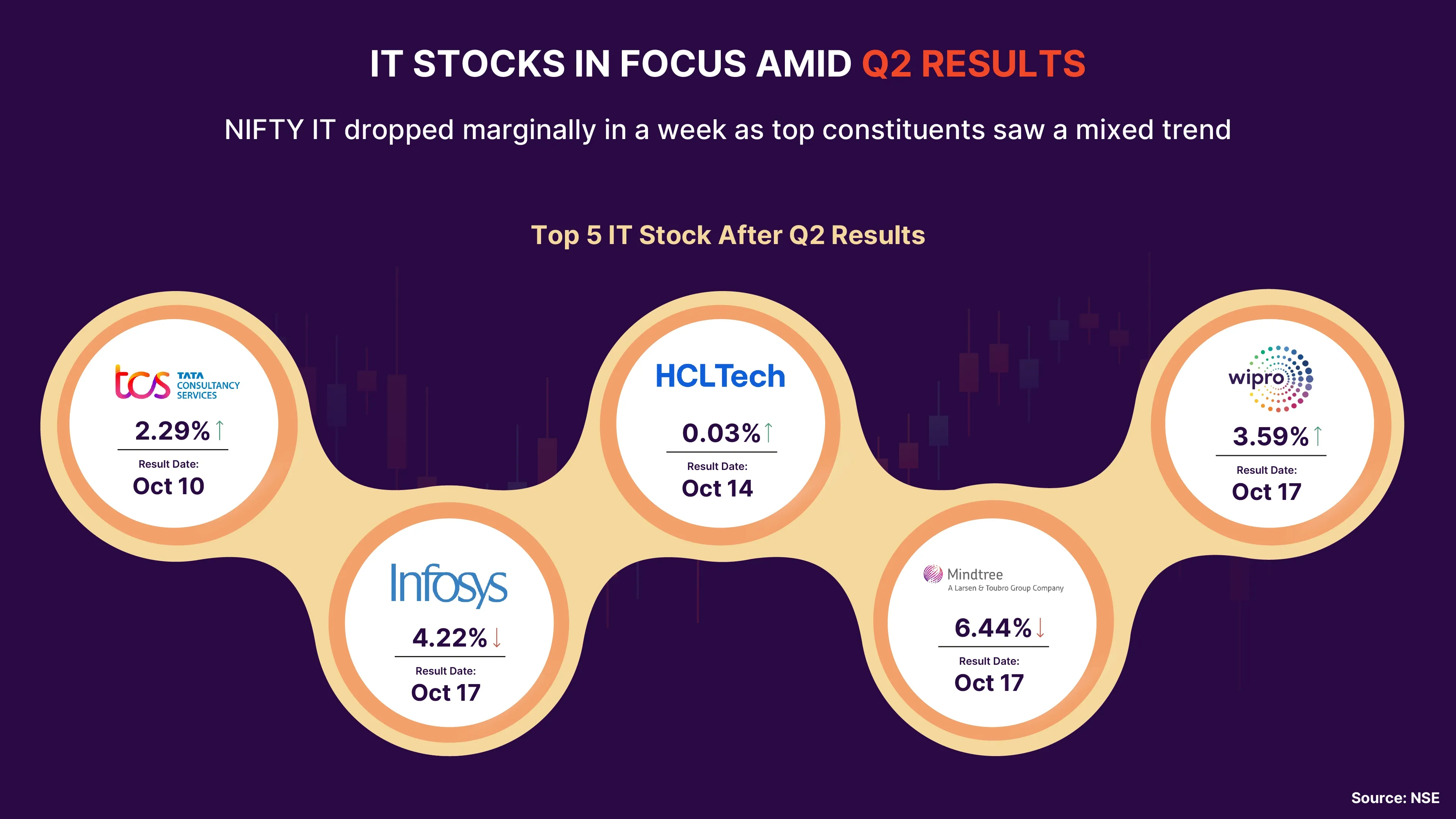

IT shares closed mixed after Q2 numbers

IT stocks closed on a mixed note this week after quarterly financial results. While NIFTY IT declined marginally by 0.54% in a week, the top IT firms have seen a mixed trend since the release of their results. Among the top five IT players, while TCS and Wipro gained since the release of their Q2 results, Infosys and LTIMindree significantly dropped. On the other hand, HCL Technologies shares remained flat after the release of its Q2 results.

FIIs remain net sellers

FIIs emerged as net sellers this week. Foreign investors sold equities worth over ₹16,330 crore on a net basis in the first four trading sessions of this week in the cash segment. FIIs have become net sellers of ₹74,732 crore on a net basis this month. Domestic investors, on the other hand, have lapped up shares, providing support to key indices.

Bajaj Housing Finance shares fall 6%, below its listing price

Newly listed Bajaj Housing Finance shares dropped around 4% this week after a one-month lock-in period for shareholders ended on October 15. On Monday, the stock tanked 6% to slip below the listing price due to selling by shareholders. The stock made a 114% premium at ₹150 per share on September 16 compared to the IPO price of ₹70. Shares hit a high of ₹188 apiece on the NSE, marking a 135% listing day jump, but have retreated since then.

What lies ahead?

Stock markets will likely trade in a range due to headwinds like FII selling, muted Q2 earnings expectations and premium valuations. Stocks will be moved by second-quarter earnings, with index major HDFC Bank, ICICI Bank and Bajaj Finance announcing results over the weekend or next week. Investors are likely to turn more sector and stock-specific. The focus will also be on large caps, and buying on dips will be the strategy.

Next Story