Market News

Q1 earnings, Powell speech, WPI Inflation and Union Budget updates – key market triggers this week

.png)

7 min read | Updated on July 15, 2024, 10:01 IST

SUMMARY

The broader trend for the NIFTY50 remains positive. However, the index may witness volatility this week due to earnings releases from heavyweight companies such as Reliance Industries, Infosys and HDFC Bank. Additionally, with the Union Budget due to be announced next week, traders should remain vigilant for any potential profit-booking at all-time highs.

Stock list

After experiencing partial profit-booking on 10 and 11 July, NIFTY50 has resumed its uptrend.

Markets ended in the green for the sixth consecutive week after remaining range-bound for majority part of the week. The benchmark indices NIFTY50 and SENSEX broke the seven day consolidation zone on Friday 12 July, ending the week in a positive territory.

The sharp gains in the NIFTY50 was led by gains in heavyweight FMCG (+3.5%), IT (+3.4%) and Oil & Gas (+2.4%) sectors. Meanwhile, Metals (-2.6%), Reality (-2.3%) and Banks (-0.7%) were the laggards.

The broader markets remained subdued throughout the week, impacted by the recent NSE circular that removed 1,000 stocks from the collateral list available for margin funding. The NIFTY Midcap 100 and Smallcap 100 index both experienced nearly a 3% intraday decline on 10 July but subsequently recovered all their losses, finishing the week on a flat note.

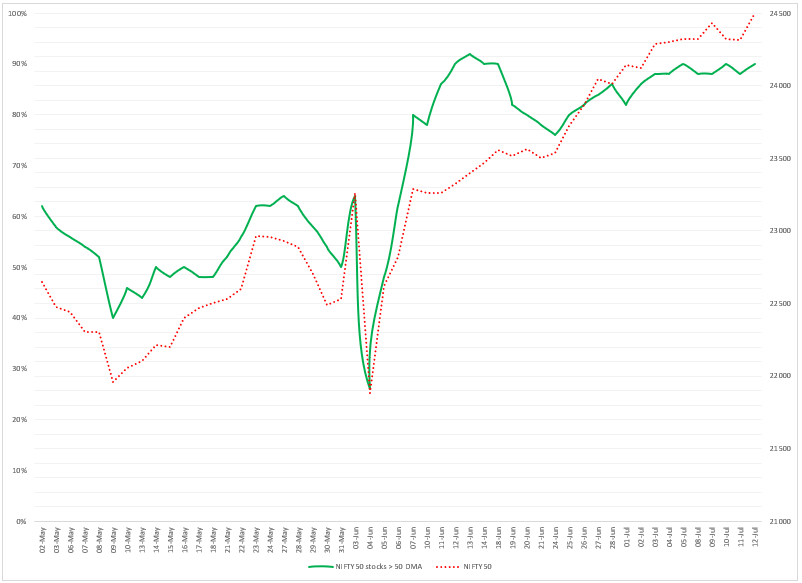

Index breadth- NIFTY50

The NIFTY50 extended the last week’s bullish momentum, with an average 89% of NIFTY50 stocks trading above their 50-day moving average (DMA). In our previous analysis, we noted that the breadth indicator, which measure NIFTY50 stocks trading above their 50-DMA, was approaching the previous peak of 92%, advising traders to be cautious of profit-booking at higher levels.

After experiencing partial profit-booking on 10 and 11 July, the index has resumed its uptrend. The current reading of the breadth indicator shows that 90% of NIFTY50 stocks are trading above their 50-DMA, nearing the previous peak of 92%. While the broader trend remains bullish, traders should be wary of sharp intraday movements that could lead to profit booking at higher levels.

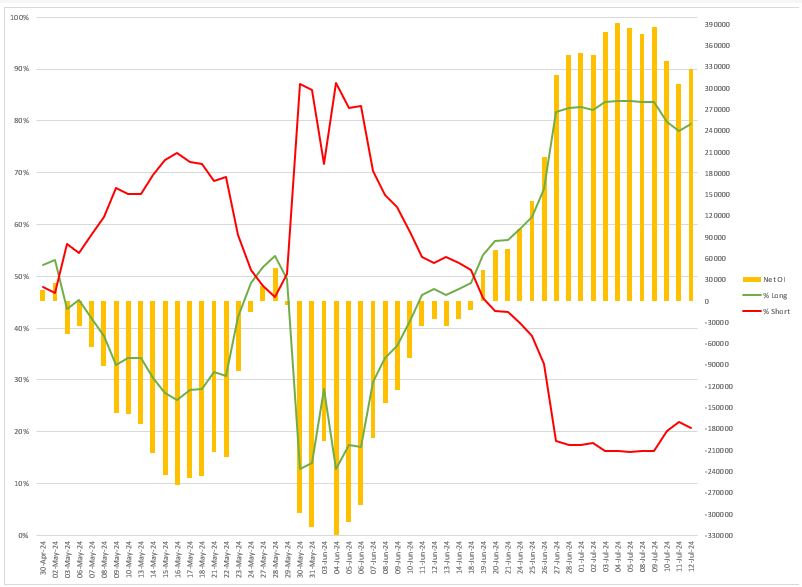

FIIs positioning in the index

The Foreign Institutional Investors (FIIs) sustained their net long open interest (OI) in the index futures for the fourth week in a row. They reduced their net OI to 3.27 lakh contracts, marking a 15% decrease from the previous week. As of last week, the long-to-short ratio of FIIs in the index futures OI stands at 79:21.

Meanwhile, the FIIs remained net buyers in the cash market for the fifth week in a row and purchased shares worth ₹3,591 crore. The Domestic Institutional Investors also bought shares worth ₹4,288 crore, taking net institutional inflow to ₹7,880 crore.

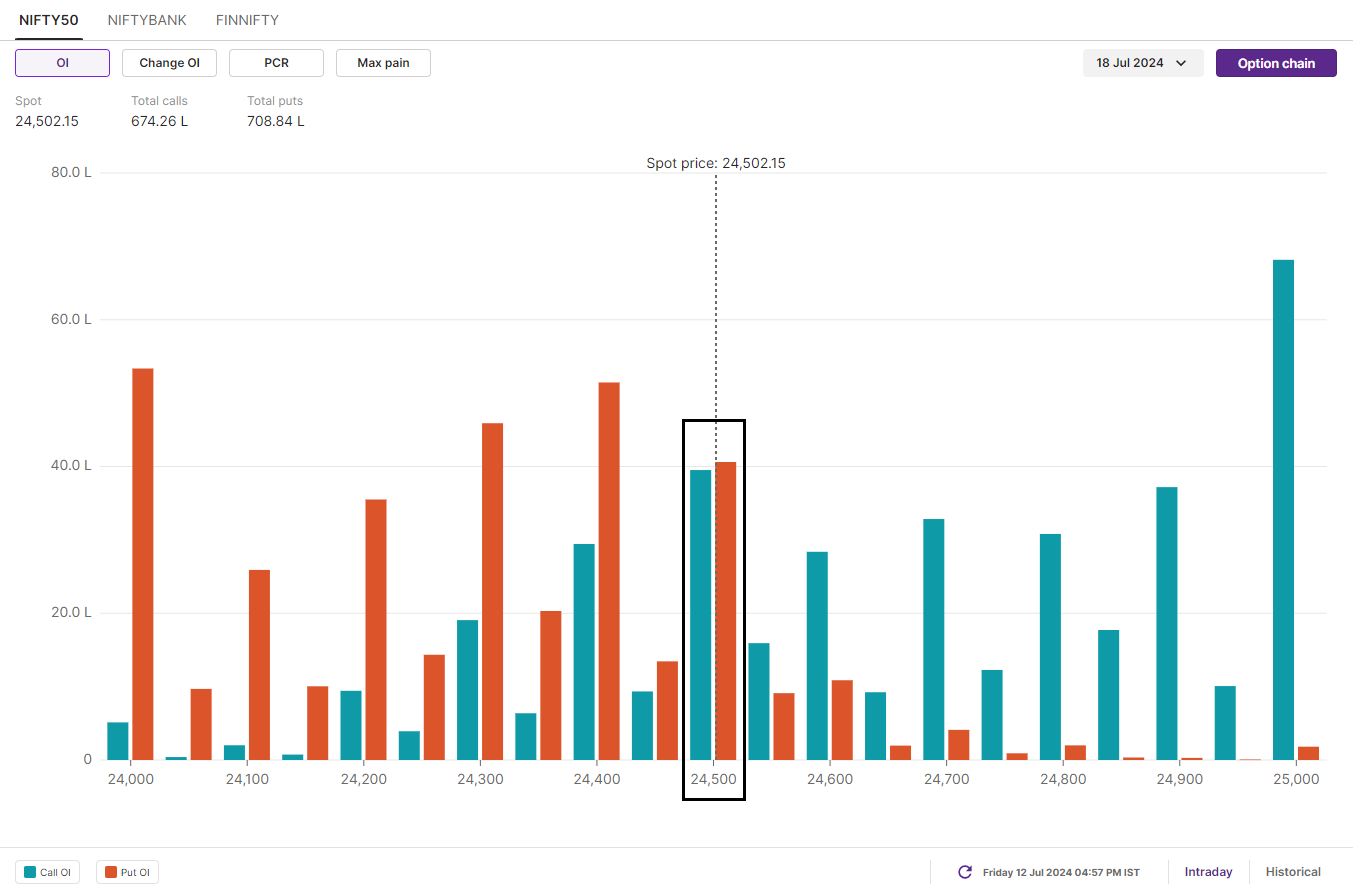

F&O - NIFTY50 outlook

The open interest data for the 18 July expiry shows some interesting trends at key strike prices. There's a heavy concentration of call options at the 25,000 level, suggesting that traders see this as a resistance point. On the other hand, the 24,000 level has a significant number of put options, marking it as a strong support zone. Interestingly, the 24,500 strike shows significant open interest in both call and put options, suggesting a likelihood of range-bound movement around this price.

However, the technical structure of the NIFTY50 index remains bullish. The index negated early signs of a doji candlestick pattern on the weekly chart and closed above the previous week's high. The rally in the last session of the week was led by IT bellwether TCS's Q1 FY25 results, which signalled early signs of recovery. For the coming sessions, the index has no resistance on the charts, while immediate support lies between 24,150 and 24,200 zones. Until the index breaches this support on the daily chart, the broader trend is expected to remain bullish.

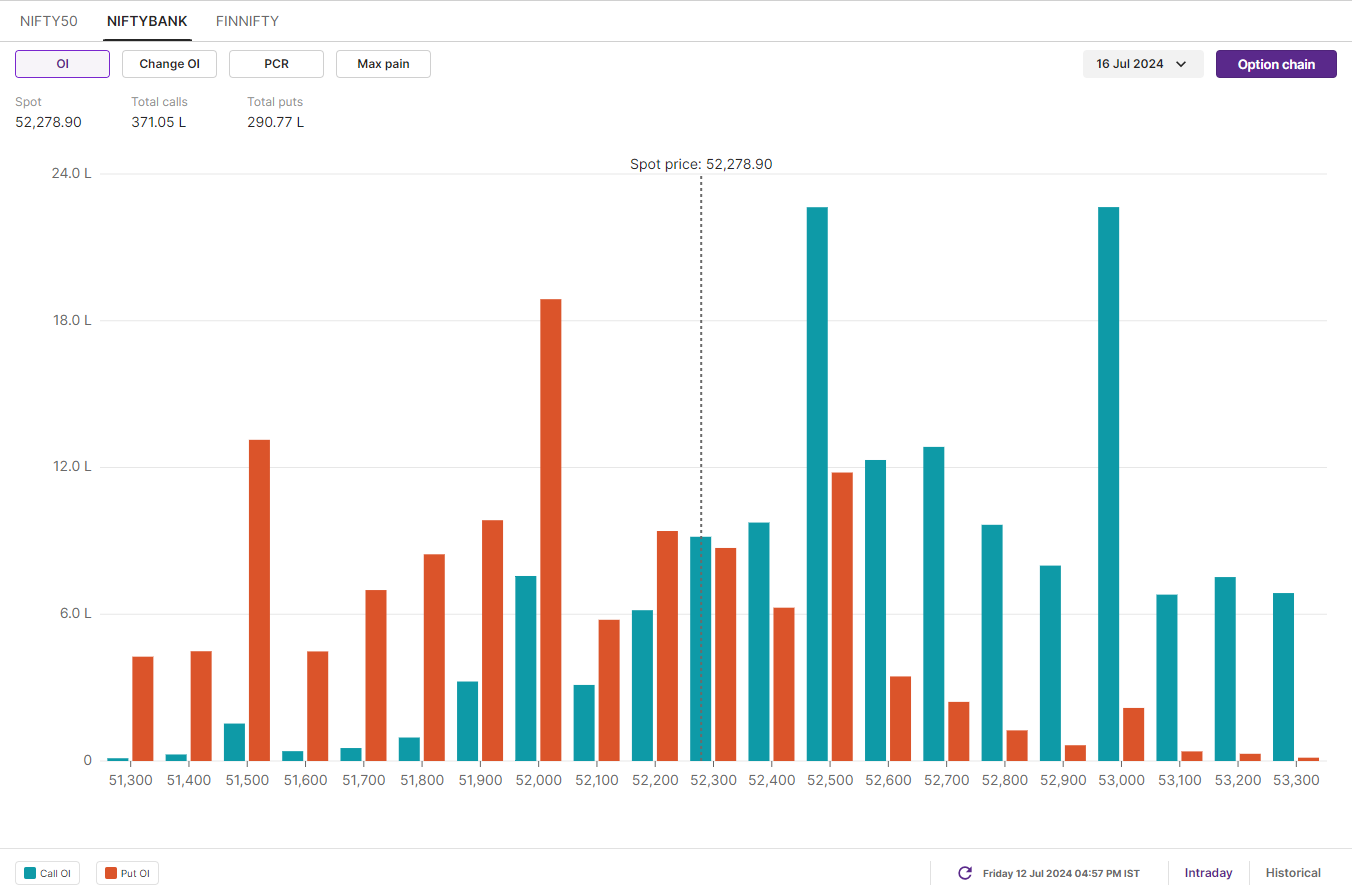

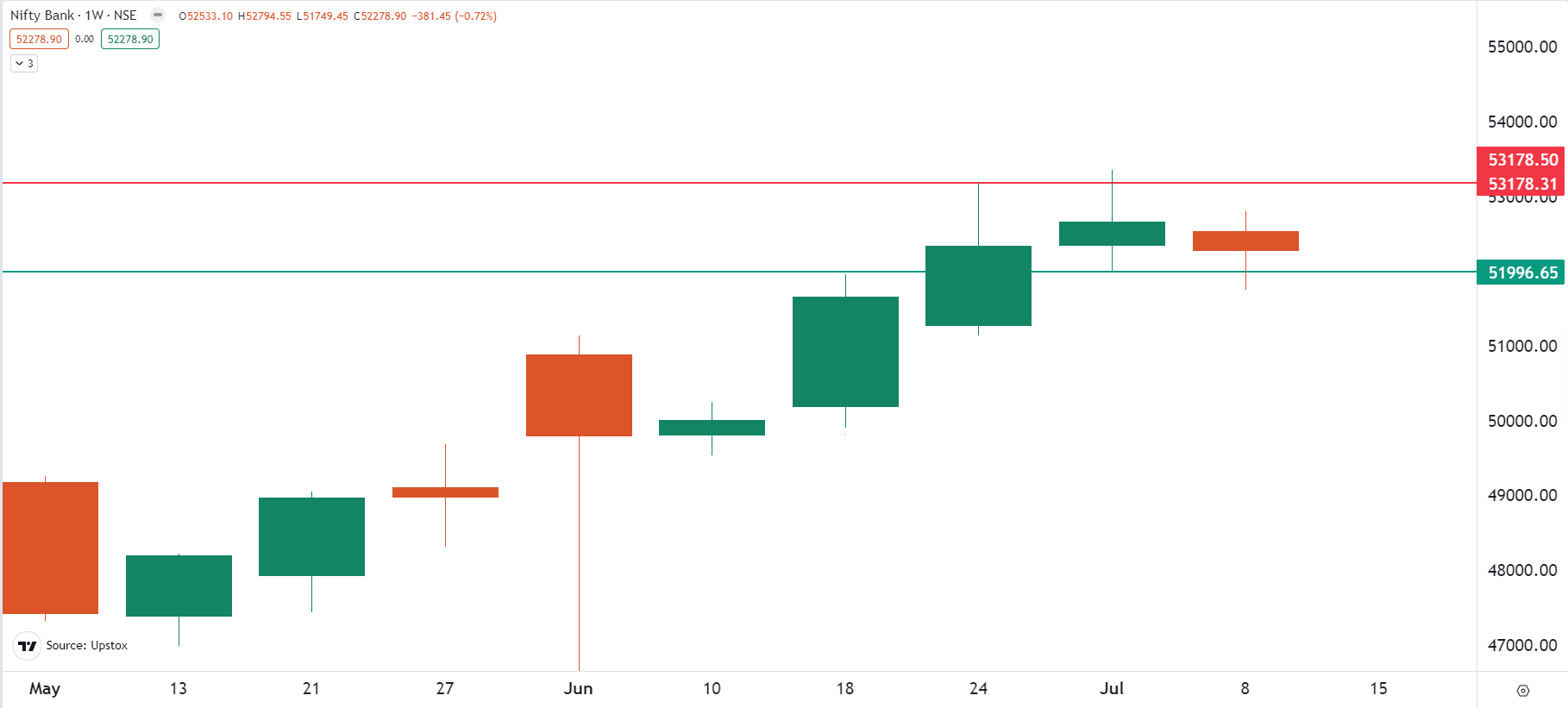

F&O - BANK NIFTY outlook

The open interest (OI) data for the 16 July BANK NIFTY expiry shows the highest call OI at the 52,500 and 53,000 strikes, indicating resistance around these levels. Meanwhile, put OI is highest at the 52,000 and 51,000 strikes, suggesting support around these levels.

After forming the doji candlestick pattern last week, the BANK NIFTY slipped below the previous week's low and closed lower. However, the index experienced significant volatility and saw buying momentum from the immediate support zone of 52,000. Going into the holiday-shortened week, the BANK NIFTY is likely to remain volatile and range-bound. For directional clues, traders can keep an eye on the 52,800 and 52,000 levels. A break of this range will provide traders with further directional clues.

In the US, second-quarter earnings will also be in focus. Key companies that will report their earnings include Blackrock, Goldman Sachs, Bank of America, Morgan Stanley, Netflix and American Express.

🗓️Key events in focus: Finance Minister Nirmala Sitharaman will present the Union Budget on 23 July, 2024. This will be the first budget presented by the PM-Modi-led government after its re-election for a record third term in June. Additionally, investors will keep an eye on the Wholesale Inflation data, which will be released on 15 July after market hours.

On the global front, investors will be watching the UK inflation reading and the European Central Bank’s interest rate decision. Moreover, U.S. Federal Reserve Governor Jerome Powell will participate in a discussion at Economic Club of Washington. This will be his first address since the release of June’s CPI reading, which came in lower-than expected,marking the first month-on-month decline since May 2020.

⚡Mark your calendars: Indian markets will remain closed on 17 July due to Moharram. Due to this, the weekly contracts of BANK NIFTY will expire on Tuesday, 16 July along with FIN NIFTY.

🔦Spotlight: U.S. inflation eased substantially in June, with consumer price index dropping to 3% year-on-year. The inflation reading cooled from May’s 3.3% rise and was below the expectation of 3.1%. Owing to this development and the recent testimony of the Fed Chair before Congress, interest-rate futures are now pricing in a 90% probability of a 25 basis point cut in the federal funds rate.

📊Stocks in focus: Based on the price and open interest, the stocks which saw long build-up on Friday were Mannappuram Finance, Mphasis, Persistent Systems and Dalmia Bharat. Similarly, to track the OI losers login to Upstox ➡️F&O➡️Futures smartlist ➡️OI gainers/losers/most active.

📓✏️Takeaway: In last week's analysis, we informed our readers about the mixed signals on the NIFTY50 and BANK NIFTY. We highlighted that a close above 24,400 on the NIFTY50 would signal the resumption of the uptrend.

Currently, both indices are again sending mixed signals. The outlook for the NIFTY50 remains positive, but traders may witness volatility and bouts of profit-booking as we head into a very eventful week. The Union Budget and earnings from index heavyweights like Reliance Industries, HDFC Bank and Infosys are set to give direction to the market.

In the holiday-shortened week, prices may remain range-bound and consolidate at current levels until the expiry of the week’s contracts. However, traders should keep a close eye on the formation of weekly candle and plan the trades accordingly.

To stay updated on any changes in these levels and all intraday developments, be sure to check out our daily morning trade setup blog, available before the market opens at 8 am.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story