Market News

NSE slashes lot size for NIFTY50 derivative contracts

3 min read | Updated on April 03, 2024, 08:25 IST

SUMMARY

The new NIFTY50 lot size has been reduced from 50 to 25. For NIFTY50, the revised lot size for the first weekly expiry will be for contracts expiring on 2 May and the first monthly contract with the new lot size will expire on 30 May 2024.

NSE halves lot size for trading derivatives contracts for Nifty50 index.

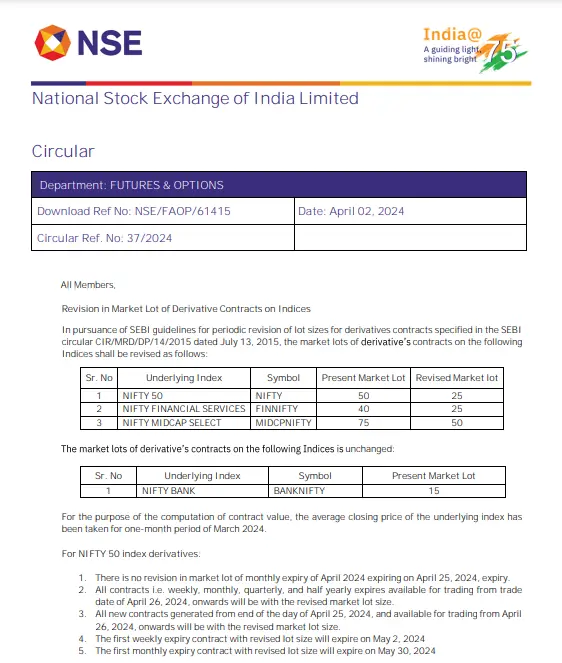

The National Stock Exchange (NSE) on Tuesday announced the revision of the lot size of derivatives contracts of NIFTY50, NIFTY Financial Services (FINNIFTY) and NIFTY Midcap Select (MIDCP NIFTY) indices. The changes in the lot size will be effective from 26 April 2024 onwards.

The new NIFTY50 lot size has been reduced from 50 to 25. The lot size of the NIFTY Financial Services (FINNIFTY) has been reduced from 40 to 25, while the lot size of the NIFTY Midcap Select (MIDCP NIFTY) has been reduced from 75 to 50. However, the lot size of NIFTY BANK will remain at 15.

The revised lot size for the weekly, monthly, quarterly and half-yearly expiries of the NIFTY50 will be effective from 26 April. The exchange added that there will be no revision to the lot size for the monthly expiry of the April 2024 contracts. For NIFTY50, the revised lot size for the first weekly expiry will be for contracts expiring on 2 May and the first monthly contract with the new lot size will expire on 30 May 2024.

For the NIFTY Financial Services (FINNIFTY) and NIFTY Midcap Select (MIDCP NIFTY) indices, there will be no revision to the lot size for existing monthly and weekly expirations for April, May and June 2024 contracts. Monthly contracts in the July series of both FINNIFTY and MIDCP NIFTY will have a revised lot size.

The weekly contracts of FINNIFTY with expiry date up to 23 July 2024 will continue with the old lot size. The revised lot size for FINNIFTY weekly expires will come into effect from 6 August 2024. Similarly, MIDCP NIFTY weekly contracts expiring on or before 22 July 2024 will continue with the old lot size. The revised lot size for weekly contracts on MIDCP NIFTY will take effect from 5 August 2024.

What is lot size in derivatives contracts?

The lot size in a derivatives segment denotes the predetermined quantity of shares in a single unit or group for which contracts are traded. For example, if the lot size is 25, only contracts in multiples of 25 can be traded. These lot sizes are determined based on stock price, liquidity, and risk.

Why did the NSE revise the lot size?

As per experts, NSE’s move to reduce lot size will increase turnover on the NSE platform and boost retail participation as the margin requirement to buy/sell derivative contracts will also be reduced.

At a lot size of 50, the NIFTY50 contract value works out to ₹11.2 lakh. However, when the lot size is reduced to 25, the contract value halves to ₹5.6 lakh, which makes NIFTY50 contracts significantly cheaper than the SENSEX options contracts.

The margin requirement will also reduce from the current ₹1.28 lakh per lot to ₹64,000 per lot. This will increase the liquidity in the derivative markets as traders with lesser capital will also participate as entry barriers are halved.

The revision in lot size also comes amid competition from rival Bombay Stock Exchange (BSE), which has gradually increased its turnover and gained market share in the derivative segment over the last one year.

About The Author

Next Story