NIFTY50 struggles at 20-DMA, Reliance and HDFC Bank provide support

Upstox

2 min read • Updated: March 27, 2024, 6:25 PM

Summary

Options data shows strong open interest build-up in the NIFTY50 at the 22,000 put option level, suggesting support for the 28 March expiry. On the other hand, immediate resistance is at the 22,200 level. With the monthly close and the expiration of the NIFTY50's F&O contracts, experts advise caution and to monitor the breach of the trading range between the 20 and 50 DMAs.

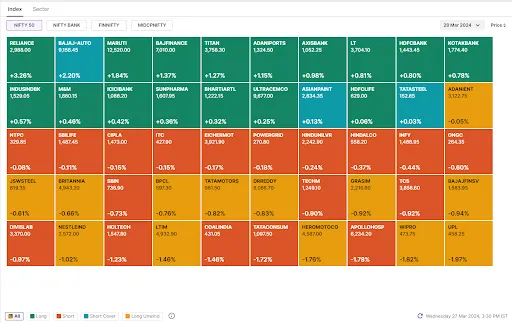

Diverging from global peers, Indian markets started Wednesday's session on a positive note and closed higher led by gains in Reliance Industries, select banking and auto stocks. The NIFTY50 gained 0.5% to close at 22,123 while the SENSEX gained 0.7% to close at 72,996.

Broader markets also extended their winning streak, with the NIFTY Midcap 100 closing flat and the Smallcap 100 index gaining almost 1%.

-

Supporting sectors: Real-Estate (+0.8%), Private Banks (+0.6%) and Automobiles (+0.5%) were the top gainers.

-

Selling pressure: PSU Banks (-0.9%), IT (-0.6%) and Media (-0.5%) were the top laggards.

After a gap-up start, the NIFTY50 gradually moved higher and inched closer to the immediate hurdle of 22,200-mark. The index traded above 22,150-mark for most part of the day but witnessed selling pressure towards the fag-end of the session. This follows a recent four-day consolidation period between its 20 and 50-day moving averages. Experts believe a breakout or breakdown of this range will signal the index’s next move.

Key highlights of the day:

🚘Maruti Suzuki (+2.5%) hit a fresh 52-week high and crossed the ₹4 lakh crore market capitalisation mark. The auto major has gained over 23% in 2024, while the auto index has gained 14% in the same period.

🏗️Larsen & Toubro (+1%) was in focus after the company's construction arm won multiple international and domestic orders in the range of ₹2,500 crore to ₹5,000 crore.

✈️Indigo (+1.2%) extended its gains for the second day in a row after its CEO said the airline plans to double in size by 2030.

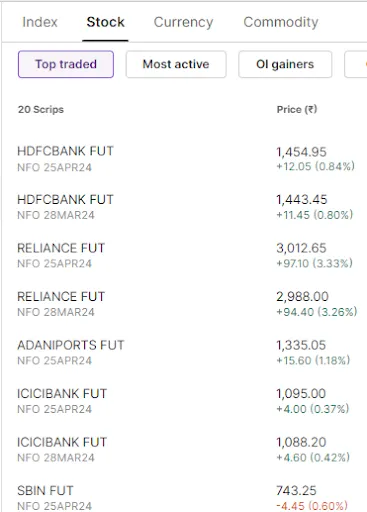

Top traded futures contracts

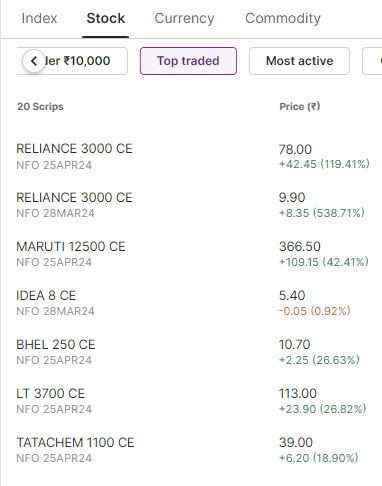

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Dr Reddy's Laboratories, Coal India, Jubilant FoodWorks, Zydus Lifesciences and Voltas

📈Open = Low (Bull power): Bharti Airtel, Dixon Technologies, Steel Authority of India (SAIL), Sun TV and L&T Finance Holdings

🏗️Fresh 52 week-high: ABB, Mankind Pharma, Siemens, Bajaj-Auto, Dixon Technologies, Maruti Suzuki and Interglobe Aviation (Indigo)

⚠️Fresh 52 week-low: N/A

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!