NIFTY50 shrugs off global volatility, IT and Banks shine ahead of the RBI policy

Upstox

2 min read • Updated: April 3, 2024, 5:46 PM

Summary

The NIFTY50 has been consolidating in a narrow range since the beginning of April, protecting its 1 April low on the closing basis (22,427). For the 4 April expiry, options data suggest that traders expect the NIFTY 50 to trade between 22,200 and 22,700.

Despite weak global cues, the domestic markets displayed resilience and staged a sharp recovery from lower levels to end Wednesday’s session flat. Both the NIFTY50 and SENSEX closed marginal lower, settling at 22,434 and 73,876 respectively. Shriram Finance (+3.6%) was the NIFTY50 top gainer, while Nestle India (-2.6%) was top loser.

The broader market continued its outperformance relative to the benchmark indices this week. The NIFTY Midcap 100 index advanced 0.5% and has recovered all its losses incurred in March 2024 (down 9%) and is hovering near its all-time high. The NIFTY Smallcap 100 index, which plunged over 15% in March 2024, has recouped the majority of losses and sits just 3% shy of its all-time high.

-

Top gainer and loser in NIFTY Midcap 100: Mazagon Dock Shipbuilders (+11.9%) and Tata Chemicals (-0.1%)

-

Top gainer in NIFTY Smallcap 100: Cochin Shipyard (+8.3%)

The NIFTY50 is consolidating in a narrow range since the beginning of April, protecting its 1 April low on the closing basis (22,427). The wait-and-watch approach comes ahead of the two key events: the RBI policy on Friday and the Fed Chairman Jerome Powell’s speech later today. Stronger-than-expected U.S. jobs and manufacturing data has prompted traders to reduce bets on a June rate cut by the Federal Reserve.

Key highlights of the day:

🔥National Aluminium jumped 4% after the company reported its highest ever-cast metal production at 4.63 metric tonnes in FY24.

📱Vodafon Idea (+1%) was in focus after the shareholders approved the fundraise of ₹20,000 crore.

💻HCL Technologies (+0.4%) expanded its alliance with Google Cloud to create industry solutions and business value with Gemini AI.

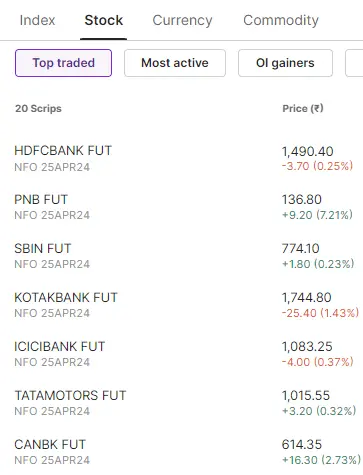

Top traded futures contracts

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Bajaj-Auto, DLF, TVS Motor, Torrent Pharma and Godrej Consumer Products

📈Open = Low (Bull power): TCS, Tech Mahindra, Aurobindo Pharma, Siemens and REC

🏗️Fresh 52 week-high: Laurus Labs, Muthoot Finance, Punjab National Bank, L&T Technology Services and Oil India

⚠️Fresh 52 week-low: N/A

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!