Market News

Trade setup for 1 April: NIFTY50 holds key DMAs, can the bulls maintain momentum?

4 min read | Updated on April 01, 2024, 08:44 IST

SUMMARY

Market momentum hinges on two key events this week, the RBI policy and the auto sales data. Banking and auto stocks are likely to be in focus.

As per open interest data, the NIFTY50 has a strong call base at he 22,500 and 23,000 strikes for the 4 April expiry.

Asian markets update 7 am

Indian equities are poised for a positive open today, as reflected by the GIFT NIFTY (+0.1%). This comes despite a pullback in Asian markets, with Japan’s Nikkei 225 falling 0.8%. Hong Kong markets remain closed for Easter Monday.

U.S. market update

The U.S. market ended Thursday's session on a mixed note with both the Dow Jones and the S&P 500 gaining 0.1% to close at 39,807 and 5,254 respectively. The Nasdaq Composite fell 0.1% to close at 16,379.

Today the U.S. markets will be reacting to the Federal Reserve's preferred measure of inflation, the Personal Consumption Expenditures (PCE) report. The PCE index rose 0.3% in February and was up 2.5% on a 12-month basis. However, the data was in line with expectations.

NIFTY50

The NIFTY50 extended its gains for a second day, closing Thursday's session 1% higher. While a bullish candle on the daily chart and a close above the previous day's high are bullish signs, selling pressure near the 22,500 level resulted in a long upper shadow.

Going forward, this week's RBI policy decision and auto sales data are the key factors that could influence the market's momentum, with banking and auto stocks in focus. Currently, the NIFTY 50 is trading above all its major daily moving averages (20 and 50) with a new trading range between 21,700 and 22,500.

As per open interest data, the NIFTY50 has a strong call base at he 22,500 and 23,000 strikes for the 4 April expiry. On the other hand, there is a significant put base at the 22,000 and 22,200 strikes. Early options activity suggests that traders expect the NIFTY50 to trade between 21,700 and 22,800 this week.

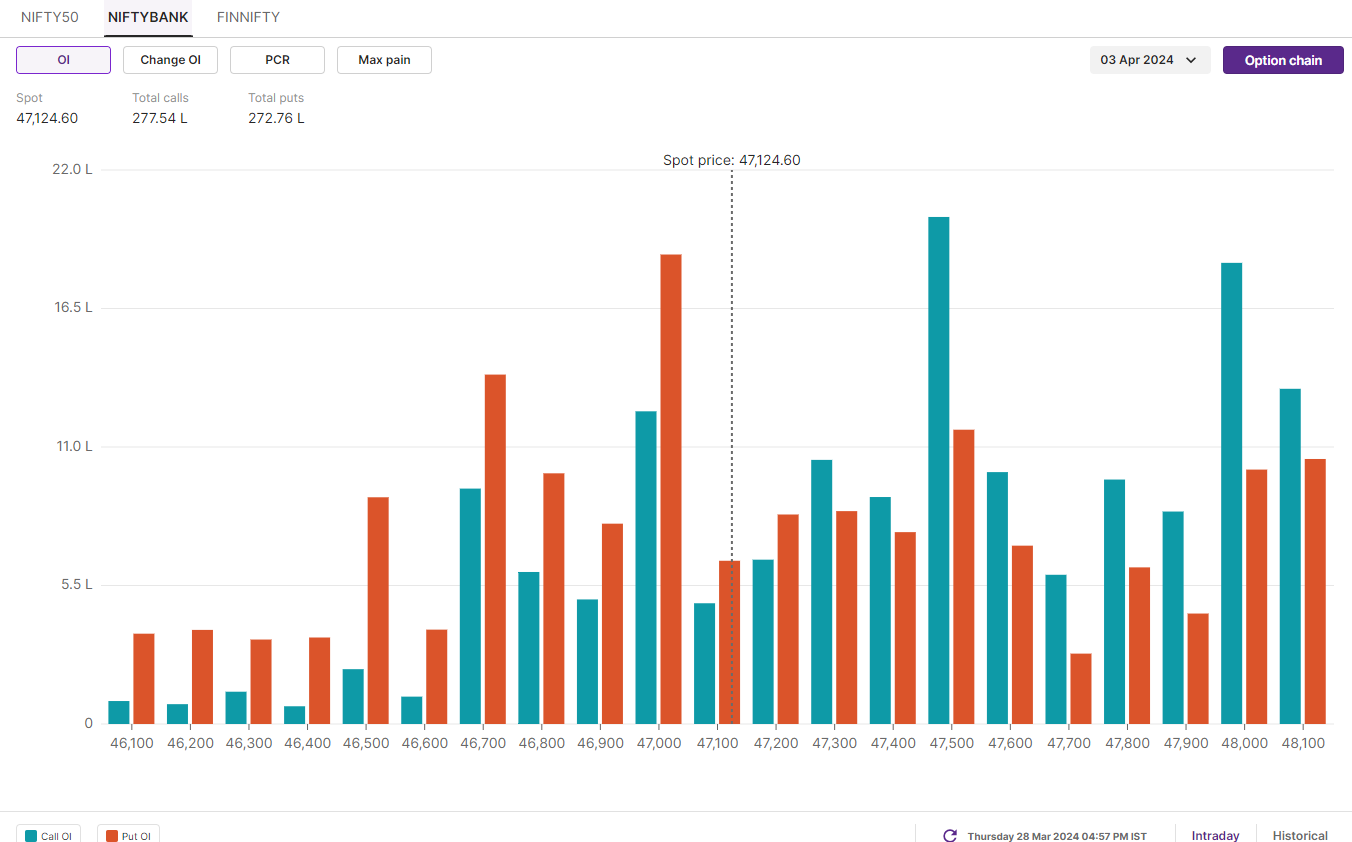

BANK NIFTY

The BANK NIFTY moved out of four days of consolidation and reclaimed the 47,000 mark and its 20-day moving average on the closing basis. The index also formed the bullish candle on the daily chart, closing above previous day’s high.

On the daily chart, the BANK NIFTY has formed a base between 46,300 and 46,500 zone which will act as immediate support for the index. The immediate resistance for the index is at 48,200 mark.

The open interest (OI) for the BANK NIFTY still remains scattered for 3 April expiry, with significant call base at 47,500 and 48,000 strikes. On the other hand, the put base is at 47,000 and 46,700 strikes. As per options data, the traders are expecting BANK NIFTY to trade between 45,800 and 48,200 this week.

FII-DII activity

Stock scanner

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story