NIFTY50 finds support at 50-DMA, IT and Oil & Gas stocks shine

Upstox

2 min read • Updated: March 14, 2024, 7:49 PM

Summary

The NIFTY50 found support at its 50-day moving average and swing low of 21,860. A close below both these levels could indicate further weakness, but experts say the index is stuck in a trading range between the 20 and 50 DMAs for now.

Markets recouped some of yesterday's losses amid broad-based buying across sectors to reclaim the psychologically important 22,000-mark. The NIFTY50 gained 0.6% to close at 22,146 while the SENSEX gained 0.4% to close at 73,097.

Broader markets also took a breather, ending a three-day losing streak. The NIFTY Midcap 100 gained 2% and the Smallcap 100 was up over 3%.

-

Supporting sectors: Oil & Gas (+2.3%), Metals (+1.9%) and IT (+1.9%) pushed the index higher.

-

Selling pressure: Private Banks (-0.4%) and Financial Services (-0.1%) were the laggards.

On the daily chart, the NIFTY50 has seen support based buying from its 50-day moving average (DMA). As highlighted in today's morning blog, the index has strong support at its swing low of 21,860 and 50-DMA, and in order to extend the previous day's decline, a close below both (swing low and 50 DMA) could signal further weakness. However, experts believe that the index is now stuck between the 20 and 50 DMAs and a close above or below these levels will provide further clarity.

Key highlights of the day:

📺Reliance Industries was in focus after it announced the acquisition of Paramount Global's 13.01% stake in Viacom 18 Media for ₹4,286 crore, increasing its stake to 70.49%.

💳Federal Bank fell over 5% intraday after the bank stopped issuing co-branded credit cards following RBI's directive. However, the stock recovered most of the losses to close 1.6% lower.

🔥Hindustan Copper gained 11% after copper prices rose 3% in the international market yesterday and closed above an eight-month high.

⛽GAIL jumped 4% after it announced a ₹650 crore plan to build LNG stations along major highways in India.

💉Zydus Lifesciences gained over 2% after the USFDA approved its edaravone injection for ALS, a fatal neurodegenerative disease.

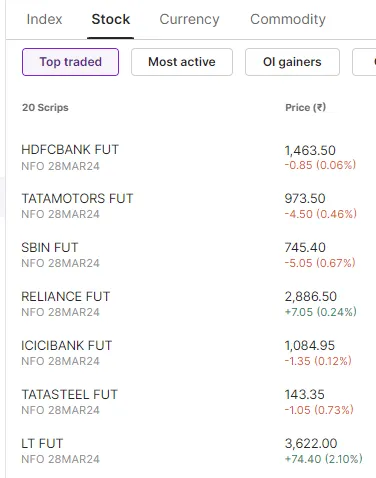

Top traded Futures contracts

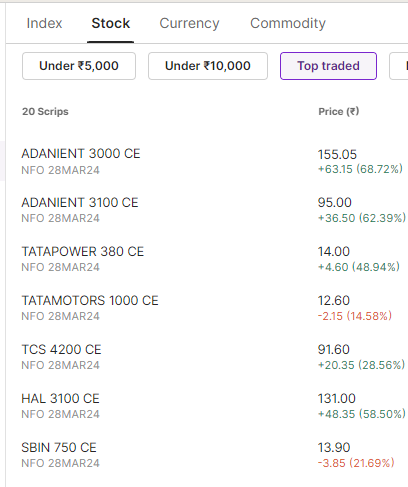

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): N/A

📈Open = Low (Bull power): Hero Motocorp, Adani Power and Tata Consumer

🏗️Fresh 52 week-high: Colgate-Palmolive

⚠️Fresh 52 week-low: Bata India, Bandhan Bank, Hindustan Unilever, Page Industries and UPL

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!