Market News

NIFTY50 closes flat amid volatility; All eyes on RBI policy and weekly expiry

2 min read | Updated on February 07, 2024, 17:47 IST

SUMMARY

The BANK NIFTY continues its consolidation near its budget day low (around 45,600), as mentioned in our morning trade setup blog. The index has still not managed to close above its immediate resistance level of 46,000. With the crucial RBI policy decision looming tomorrow, traders are advised to remain cautious and closely monitor price action near these levels.

.jpg)

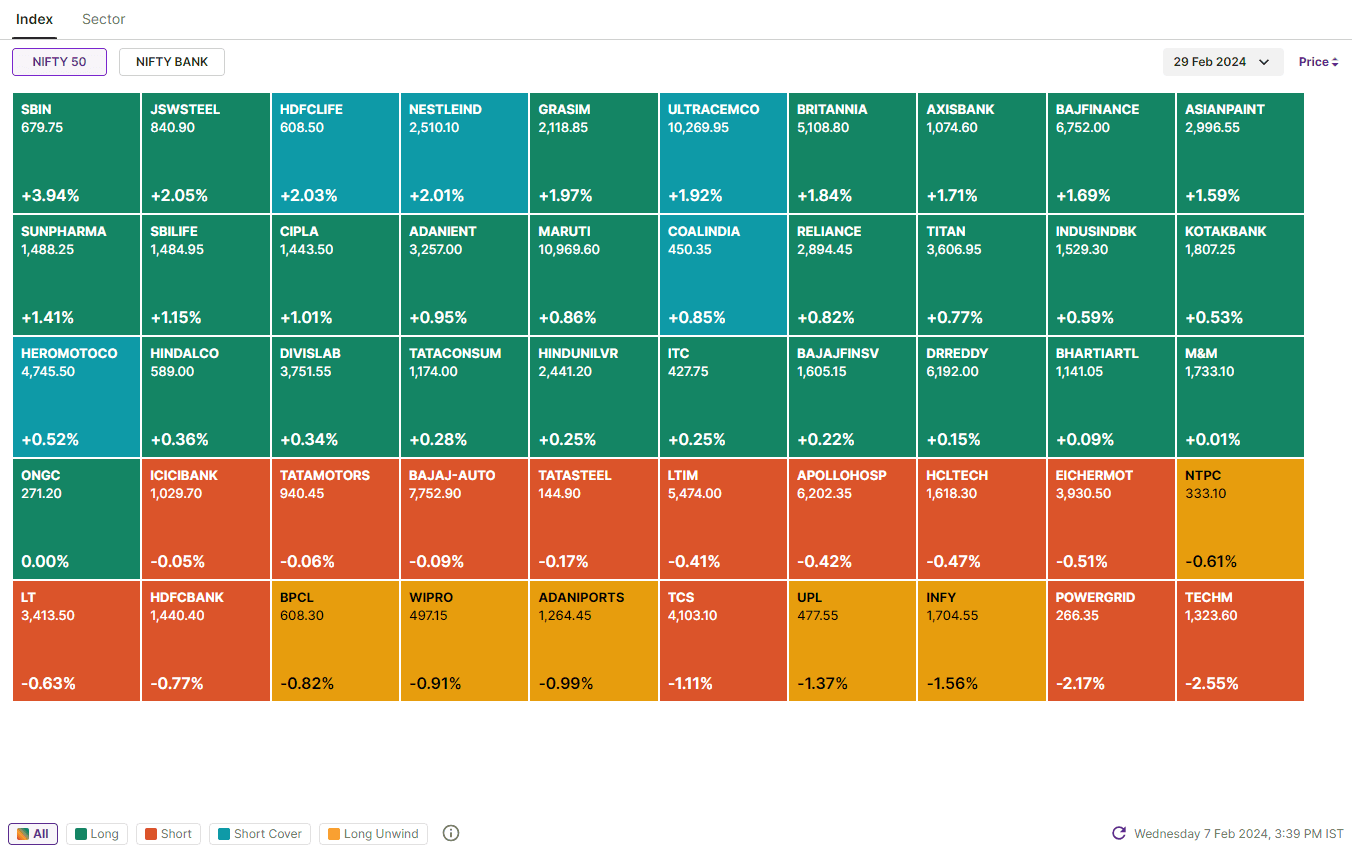

The NIFTY50 index ended balanced with 27 gainers and 23 losers.

The benchmark indices relinquished morning gains to conclude the volatile session flat. The NIFTY50 (+0.01%) struggled to surpass the 22,000 mark and consolidated in a range. All eyes are now on the RBI's monetary policy decision tomorrow, 8 February, which coincides with the weekly expiry of NIFTY50 options contracts and could add to market volatility.

While the NIFTY50 itself ended balanced with 27 gainers and 23 losers, all the major sectoral indices except IT (-1.2%) closed in the green. PSU Bank (+2.8%), Realty (+1.8%) and Media (+1.2%) led the gains.

Meanwhile, BANK NIFTY continues its consolidation near its budget day low (around 45,600), as mentioned in our morning trade setup blog. The index has still not managed to close above its immediate resistance level of 46,000. With the crucial RBI policy decision looming tomorrow, traders are advised to remain cautious and closely monitor price action near these levels.

Key highlights of the day:

🔌IEX drops 5% after CERC approves market coupling pilot program for India's power exchanges.

🏦Canara Bank jumped over 7% following the bank’s announcement of stock split.

💊Lupin (+1.4%) hit a 52-week high after the USFDA approved its cataract drug.

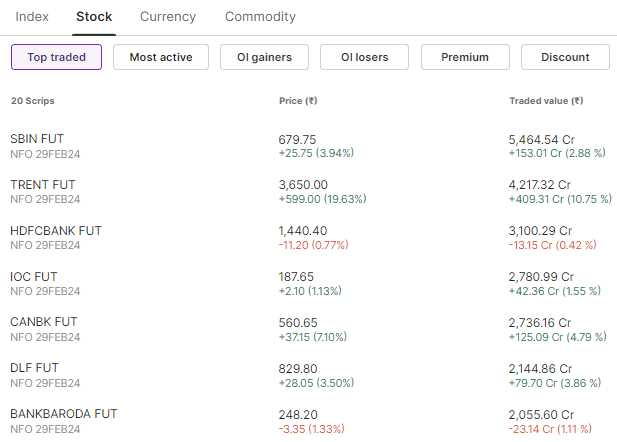

👕Tata Group-owned retail giant Trent (+19.4%) reported a 39% YoY rise in Q3 net profit to ₹370 crore, driven by robust festive season demand.

Top traded Futures contracts on Upstox

Top traded stock options contracts on Upstox

Trading insights NIFTY 200🔍

📉Open = High (Bear power): Infosys, Biocon, Petronet LNG, Bata India and Bank of Baroda.

📈Open = Low (Bull power): Indian Hotels, DLF, Zee Entertainment, Power Finance Corporation and Macrotech Developers.

🏗️Top five 52 week-high: Trent, Yes Bank, Adani Green, Canara Bank and State Bank of India.

⚠️52 week-low: Navin Fluorine

⬆️Gap-up open: Adani Green, Yes Bank, Canara Bank, ABB, DLF, Max Financial Services, Pidilite Industries, JSW Steel, SBI Cards, HDFC Life, Ultratech Cement and Sun Pharma.

⬆️ Gap-down open: N/A

See you tomorrow!

About The Author

Next Story