Markets close at record high, Banks and IT stocks shine ahead of the RBI policy

Upstox

3 min read • Updated: April 4, 2024, 6:24 PM

Summary

It is important to note that the NIFTY50 formed a hanging man candlestick pattern on the daily chart ahead of the RBI policy announcement. The hanging man signals a potential reversal after an uptrend. However, for the pattern to be confirmed, the price of the next candle needs to close below the bearish reversal pattern.

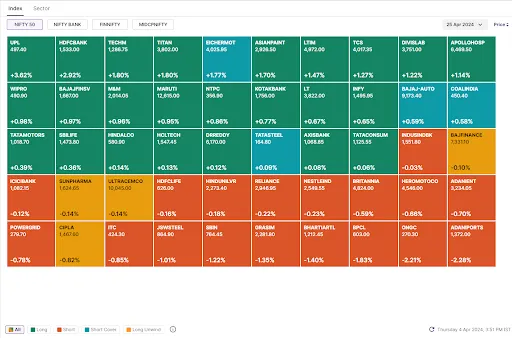

Markets closed at the record high levels today amid high volatility on the day of the weekly expiry of NIFTY50 options contracts. The NIFTY50 index gained 0.3% and ended the session at 22,514, while the SENSEX rose 0.4% and ended the day at 74,227.

-

Top gainer and loser in NIFTY50: HDFC Bank (+3.1%) and ONGC (-2.1%)

-

Broader markets closed higher today. The NIFTY Midcap 100 index reached a fresh all-time high, but closed flat. The NIFTY Smallcap 100 index also gained, advancing 0.4%.

-

Top gainer and loser in NIFTY Midcap 100: Bandhan Bank (+4.2%) and Mahindra and Mahindra Financial (-0.1%)

-

Top gainer and loser in NIFTY Smallcap 100: Ujjivan Financial Services (+6.5%) and Praj Industries (-0.1%)

Despite a positive start, the NIFTY50 index gave up all initial gains and faced selling pressure around 22,500-mark. However, it recovered most of its losses from the support zone (22,300-22,350) and closed higher.

It is important to note that the NIFTY50 formed a hanging man candlestick pattern on the daily chart ahead of the RBI policy announcement. The hanging man signals a potential reversal after an uptrend. However, for the pattern to be confirmed, the price of the next candle needs to close below the bearish reversal pattern.

Key highlights of the day:

- 🏦HDFC Bank (+3%) was in focus after the bank released its fourth quarter update. The company’s gross loans rose 55% YoY to ₹25 Lakh crore in FY24, while the domestic retail loans jumped 109% and deposits grew 26% YoY to ₹23 Lakh crore.

- 🛢️Shares of oil producing companies tumbled after the government raised the windfall tax on domestically produced crude oil by 39% to ₹6,800 per tonne. Shares of ONGC and Oil India fell over 2% each.

- 🥫Dabur India slipped over 4% after company in its business update said that it expects mid-single digit revenue growth in the fourth quarter of FY24.

- 💸AU Small Finance Bank jumped more than 2% on the back of strong loan and deposit growth. In its fourth quarter update, the company said the gross loan rose 28% YoY to ₹82,175 crore, while the deposits jumped 26% to ₹87,182 crore.

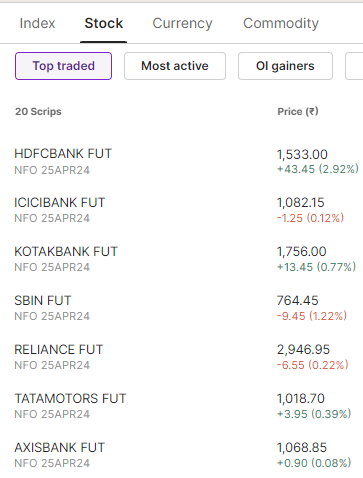

Top traded futures contracts

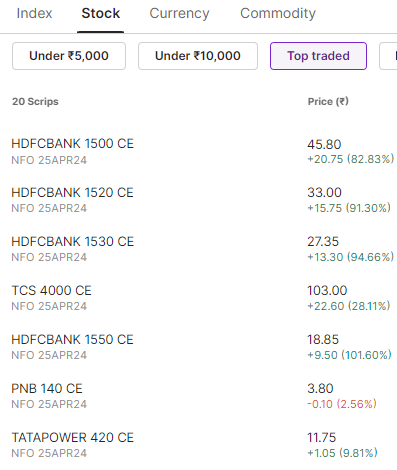

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): ONGC, Adani Ports, Reliance, Nestle India and Shriram Finance

📈Open = Low (Bull power): HDFC Bank, Bandhan Bank, Indian Hotels and Gujarat Fluorochemicals

🏗️Fresh 52 week-high: IPCA Laboratories, Avenue Supermarts (D-Mart), Adani Power, Vedanta, NTPC and Muthoot Finance

⚠️Fresh 52 week-low: Dabur

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!