Market News

Weekly wrap 13 to 17 May: NIFTY, SENSEX advance nearly 2% on positive Q4 results, easing inflation

.png)

4 min read | Updated on May 18, 2024, 11:02 IST

SUMMARY

Key indices advanced this week on positive global cues and rotational participation from index heavyweights. Positive quarterly results are expected to boost the market. Volatility is expected to remain high as general polls enter the fifth phase on May 20, which will be a market holiday.

saxwds72.png

- BSE MidCap index touched a lifetime high; smallcap index traded near record high this week.

- NIFTY gained 1.6% and SENSEX rose 1.7% on a weekly basis.

- DIIs invested over ₹13,000 crore, taking their overall inflow to ₹32,416 crore, so far in May, while FIIs remained net sellers.

This week markets made a strong recovery after a brief phase of volatility backed by Q4 results and easing inflation. Here’s a quick recap.

Benchmark indices NIFTY and SENSEX advanced nearly 2% despite the uncertainties over the ongoing Lok Sabha elections. Stock markets reversed last week’s losses mainly on the back of domestic fundamentals and strong quarterly results by some bluechips.

Easing inflation numbers, both on the home front and in the United States, boosted the market sentiment. US inflation falling to 3.4% year-on-year also indicated positive global cues.

Broader market indices midcap and smallcap also saw increased buying on dips by domestic institutional investors (DIIs). BSE MidCap touched a lifetime high while smallcap traded near record high levels despite the prevailing volatility.

Volatility prevailed on the D-Street as stock markets gyrated between losses and gains in most sessions. India VIX, the volatility gauge for Indian stocks, breached the 20 points mark this week as the general polls entered the fourth phase.

Stock markets started the week on a positive note with benchmark NIFTY and SENSEX closing marginally higher. NIFTY closed at 22,104.05 on Monday after finding major support at 21,800 level. The indices moved further 0.5% on Tuesday on the back of India’s moderating consumer inflation and favourable signals from Asian peers. NIFTY regained the 22,200 mark.

Though markets saw some correction on Wednesday due to profit taking by investors after recent gains, broader midcap and smallcap indices managed to post gains ranging from 0.5% to 1%.

SENSEX and NIFTY staged a dramatic recovery on Thursday due to buying in the last leg of trade, closing nearly 1% higher. NIFTY closed above the 22,400 mark.

The indices continued to rise on Friday on the back of gains in bluechips despite adverse global cues. NIFTY hit 22,500 level intra-day on the back of gains on Mahindra and Mahindra, Grasim, JSW Steel and Ultratech Cement.

The gains were led by the outperformance of the broader market and positive March quarter earnings. NIFTY closed the week at 22,466.1, up by 362 points or 1.6% on a weekly basis. SENSEX closed at 73,917.03, gaining around 1252 points, or 1.7%, this week.

Among sectoral measures, consumer durables, auto, realty and metal indices advanced while IT dropped.

DIIs increase stake in domestic equities powered by retail investors

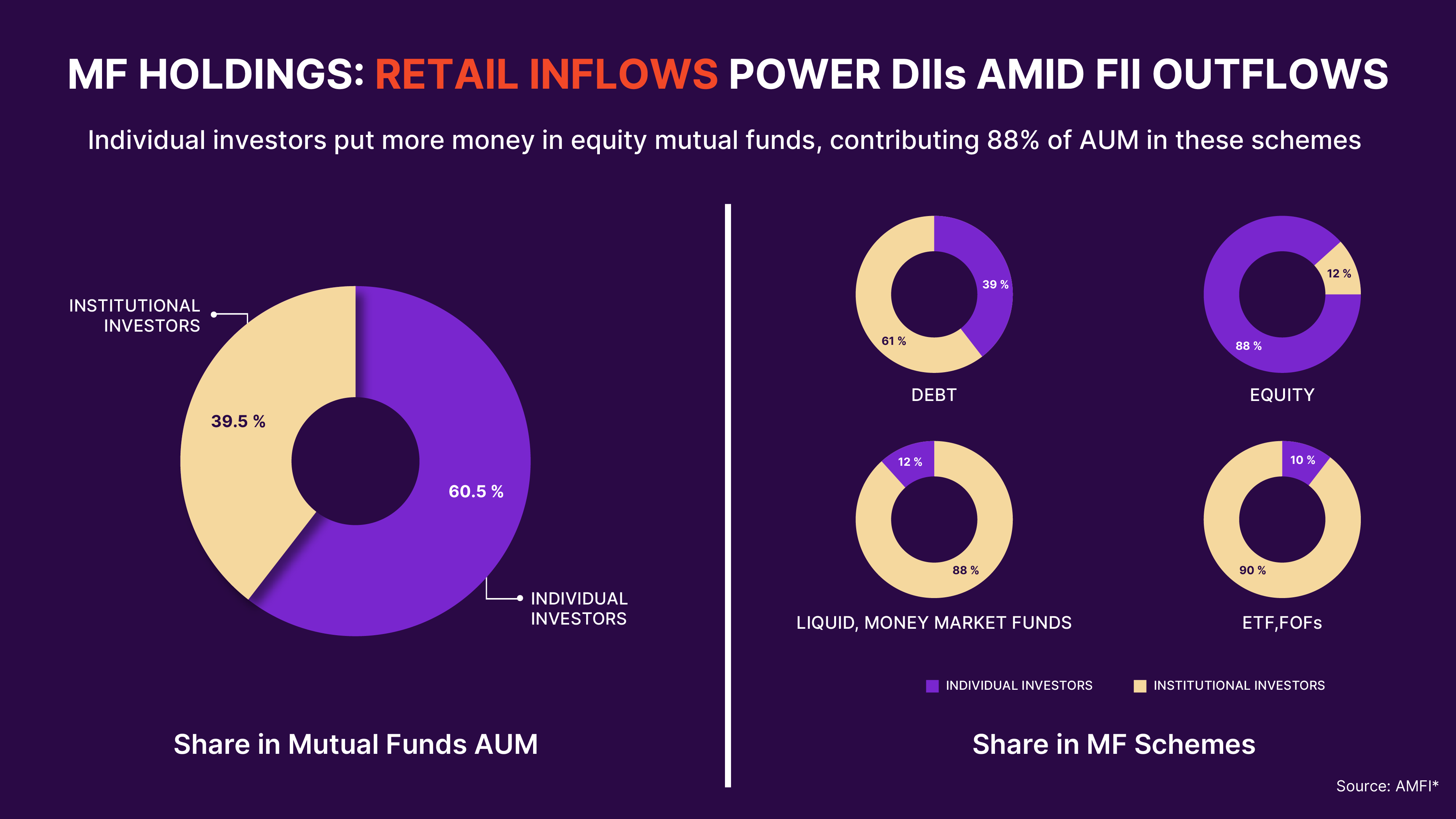

The Association of Mutual Funds in India (AMFI) data showed that investment in mutual funds has continued to grow in recent months with equity fund schemes witnessing a steady rise in takers. Assets held by individual investors were worth ₹34.52 lakh crore in April 2024, up by 44% compared to ₹23.92 lakh crore in April 2023.

Individual investors held around 60% of total assets in the MF industry against nearly 40% by institutional investors. Reflecting rising clout of domestic institutional investors (DIIs), another set of data showed that the gap between DIIs and FIIs in holdings in Indian companies has narrowed.

FII continue to be sellers in Indian equities

The Foreign Institutional Investors (FIIs) remained net sellers in the equity markets this month so far. FIIs have sold shares worth ₹37,149.26 crore in May. This week till Thursday FIIs were net sellers of shares worth ₹12,170 crore. DIIs on the other hand have been key supporters of Indian markets. Domestic investors purchased shares worth over ₹13,000 crore, taking their overall investment to ₹32,416 crore in May.

Mahindra & Mahindra hits year high after Q4 results, joins top NIFTY gainers

Mahindra and Mahindra shares jumped the most since August 2022 on Friday, rising nearly 8% to hit a 52-week high after its March quarter financial results. M&M was among top NIFTY gainers this week spurting nearly 15%. While revenue and margins beat estimates, its investment on EVs was also welcomed by investors.

What lies ahead?

Key indices advanced this week on positive global cues and rotational participation from index heavyweights. Positive quarterly results are expected to boost the market. Volatility is expected to remain high as general polls enter the fifth phase on May 20, which will be a market holiday. Selective buying in key frontline, mid and small-cap stocks is likely to persist.

Next Story