Market News

NIFTY50 expiry: Options market considers 24,600 level as crucial for NIFTY50 expiry

.png)

2 min read | Updated on July 19, 2024, 09:25 IST

SUMMARY

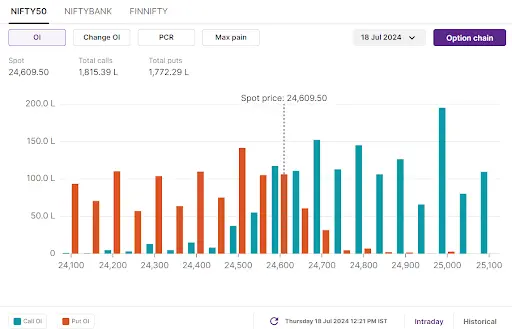

The options market is currently factoring in a resistance at the 24,700 level with the open interest on the call side amounting to 1.75 crore at this strike. On the downside, the market is reflecting immediate support at the 24,500 level with the Put options at this strike having an open interest of 1.3 crore at the time of writing.

Stock list

NIFTY50 Expiry: The options market considers 24,600 level as crucial for NIFTY50 expiry

Equity markets opened lower on Thursday and continued to trade in the red by noon. The benchmark NIFTY50 was trading 0.01% higher while the SENSEX was trading 0.1% higher at 12:20 p.m.

Open interest pulse

The Nifty 50, which has its expiry on Thursday, was trading at 24,600.20 at noon. The options market is currently factoring in a resistance at the 25,000 level with the open interest on the call side amounting to 1.95 crore at this strike. The change in open interest for the strike stood at 84 lakh at 12:20 p.m.

On the downside, the market is reflecting immediate support at the 24,500 level with the Put options at this strike having an open interest of 1.4 crore at the time of writing. The change in open interest stood at 76 lakh.

The max pain of Nifty 50 stood at 24,600 at the time of writing. The max pain theory shows the level at which option sellers are likely to have the least loss on expiry.

Chart check

On a 15-minute chart, the index traded above its 21-period and 50-period exponential moving averages (EMAs).

The index also reflected a put-call ratio (PCR) of 0.82, which indicates a neutral sentiment. PCR is the ratio of the number of puts to the number of calls of an asset. It is noteworthy that in extreme downward and upward market movements, the PCR may hit as low as 0.5 or as high as 1.8, respectively.

India VIX, an index that reflects the anticipated volatility in the market over the next 30 days, rose 1.55% on Thursday to 14.44. Volatility is expected to rise in the run-up to the Union budget.

About The Author

Next Story