Market News

NIFTY50 consolidates at 24,300, volatility drops 3%

.png)

3 min read | Updated on July 11, 2024, 20:05 IST

SUMMARY

The NIFTY50 and BANK NIFTY are trading in a range, showing mixed signals on the weekly chart. Early indications suggest a formation of doji on the NIFTY50 and a hammer pattern on BANK NIFTY.

Stock list

NIFTY50 consolidates at 24,300, volatility drops 3%

Markets remained volatile throughout the day, trading within the range of the bearish candle formed on 10 July. The NIFTY50 index ended the day flat and formed an inside candle on the daily chart, closing the day at 24,315.

On a sectoral basis, most of the major indices ended the day in the green. Oil & Gas (+1.1%), Consumer Durables (+0.6%) and FMCG (+0.2%) led the way, while Real-Estate (-1.5%), Pharmaceuticals (-0.6%) and Automobiles (-0.1%) saw selling pressure.

The NIFTY50 index formed an inside candle on the daily chart and witnessed buying from the 24,200 zone. It is currently consolidating between 24,100 and 24,400 zones, experiencing sharp intraday volatility. Until the index breaks this range, the price action is likely to remain range-bound.

-

Top gainer and loser in NIFTY50: ONGC (+2.4%) and Tata Consumer Products (-1.7%)

-

Broader markets outperformed the benchmark peers. The NIFTY Midcap 100 index rose 0.4%, while the Smallcap 100 jumped 0.6%.

-

Top gainer and loser in NIFTY Midcap 100: Oil India (+8.2%) and Tube Investments of India (-6.6%)

-

Top gainer and loser in NIFTY Smallcap 100: Great Eastern Shipping (+7.2%) and Amara Raja Energy & Mobility (-1.9%)

Key highlights of the day

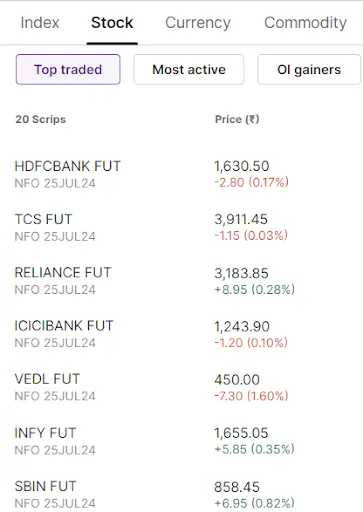

Top traded futures contracts

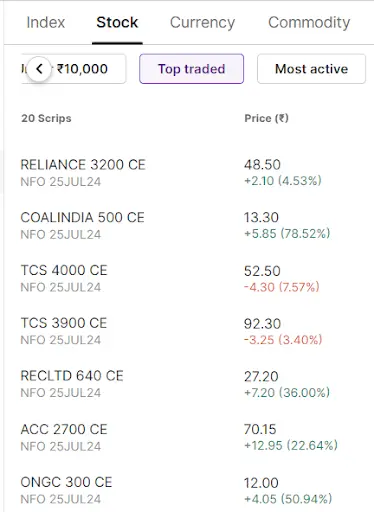

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Tube Investments of India, Coforge, Bajaj Finance, Zydus Lifesciences and Mahindra and Mahindra

📈Open=Low(Bull power): BSE, Indus Towers, One 97 Communications (Paytm), TVS Motor and Trent

🏗️Fresh 52 week-high: Oil India, Sona Blw Precision, Sun Tv, Rail Vikas Nigam and Zomato

⚠️Fresh 52 week-low: N/A

See you tomorrow!

About The Author

Next Story