NIFTY50 finds support at 20-DMA, Midcap and Smallcap tumble

Upstox

2 min read • Updated: February 28, 2024, 6:06 PM

Summary

Amid the sharp sell-off ahead of the monthly expiry, the NIFTY50 briefly dipped below its 20-day moving average (around 21,950) and closed near it. Experts believe that the index is currently trading in a range of 21,850-22,300. If it breaches its 20 DMA, the next important support will be at the 50 DMA, around 21,700.

Markets tumbled over 1% ahead of the monthy expiry of F&O contracts, with the NIFTY50 closing near its day’s low at 21,951 (-1.1%) and the SENSEX settling at 72,304 (-1.0%).

The NIFTY Midcap 100 and Smallcap 100 fell almost 2%, registering their biggest one-day fall since 12 February.

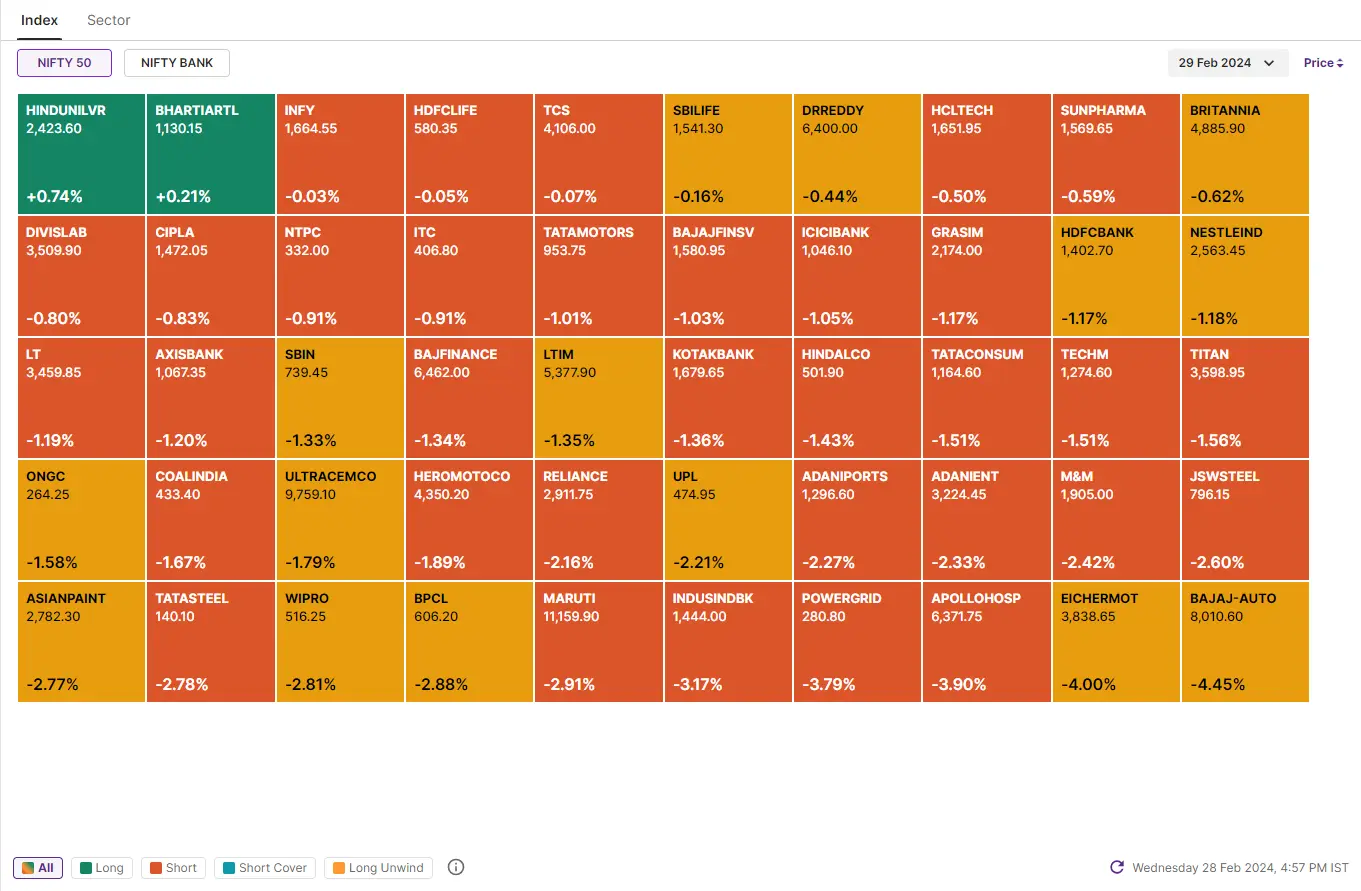

It was a sea of red across sectors today with PSU Bank (-2.3%), Realty (-2.1%), Oil & Gas (-2.0%) and Auto (-2.0%) suffering the biggest losses.

The NIFTY50 has formed a bearish engulfing candle on the daily chart, confirming our morning blog's advice of potentially sharp swings ahead. Despite yesterday's up move, the Volatility Index remained elevated around 16 and today it jumped over 3% to close above 16, further highlighting the potential for increased volatility.

Key highlights of the day:

📱Vodafone-Idea slipped over 13% on concerns that the company’s ₹45,000 crore fundraising might be insufficient to address its financial challenges.

🎨Asian Paints continued its correction, falling over 2% today after a weekly fall of over 6%. Concerns about increased competition from Grasim's entry into the paint market continue to weigh on stock.

📺ZEE Entertainment fell 6% after announcing an internal panel to investigate the SEBI allegations.

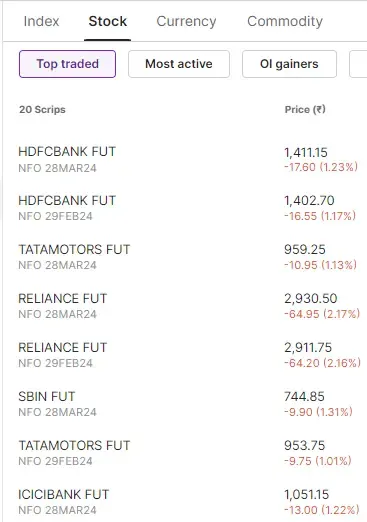

Top traded Futures contracts

Top traded stock options contracts

6 trading insights from NIFTY 200🔍

📉Open = High (Bear power): AU Small Finance Bank, PAYTM, Page Industries, Jubilant FoodWorks and Navin Fluorine

📈Open = Low (Bull power): Coromandel International and Icici Prudential

🏗️Top five fresh 52 week-high: Havells India, PB Fintech, Siemens, ABB and Voltas

⚠️Fresh 52 week-low: Page Industries

⬆️Gap-up open: N/A

⬇️Gap-down open: Union Bank

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!