Market News

Market highlights | NIFTY50 negates bearish engulfing pattern, protects September month low

.png)

3 min read | Updated on October 18, 2024, 18:13 IST

SUMMARY

The options data of the 24 October expiry saw highest build-up of call options at 25,000 strike, indicating resistance around this zone. Conversely, the put base was seen at 24,500 and 24,800 strike, suggesting support for the index around these levels.

Stock list

NIFTY50 negates bearish engulfing pattern, protects September month low

Markets staged a strong recovery after a morning sell-off, snapping a three day losing streak. The NIFTY50 index dipped toward the 24,500 zone in the opening session but rebounded sharply, gaining over 1% from the day’s low to close at 24,850.

The rebound was broad-based with significant gains in sectors such as Private Banks (+1.9%) and Metals (+1.5%), while IT (-1.4%), FMCG (-0.5%) and Oil & Gas (-0.2%) remained weak.

On the daily chart, the NIFTY50 negated the bearish engulfing pattern from the 17 October and formed a bullish piercing pattern. This two-candles reversal signal shows the potential for further upside as the second candle closes above the mid-point of the previous bearish candle.

In the coming sessions, traders will want to monitor the high of the bullish piercing pattern. A close above this high would confirm the rebound, while a negative close could invalidate the bullish signal.

-

Top gainer and loser in NIFTY50: Axis Bank (+5.7%) and Infosys (-4.2%)

-

Top gainer and loser in NIFTY Midcap 100: Mazagon Dock Shipbuilders (+7.3%) and Supreme Industries (-3.2%)

-

Top gainer and loser in NIFTY Smallcap 100: Aditya Birla Real Estate (+6.4%) and Mahanagar Gas (-9.9%)

Key highlights of the day

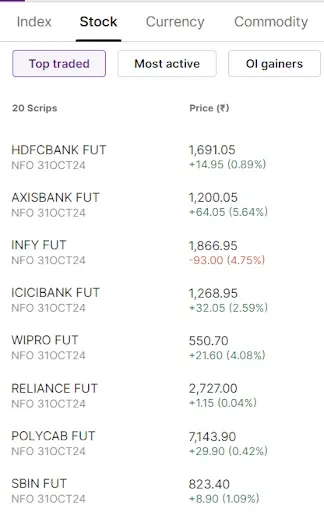

Top traded futures contracts

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): LTIMindtree, Bharat Dynamics, JSW Infrastructure, NHPC and ICICI Lombard

📈Open=Low (Bull power): Alkem Laboratories and Pidilite Industries

🏗️Fresh 52 week-high: Torrent Power

⚠️Fresh 52-week-low: N/A

See you on Monday!

Next Story