Market News

Market highlights| NIFTY50 breaks 26,000 barrier, retreats after profit-booking; check details

.png)

3 min read | Updated on September 24, 2024, 18:34 IST

SUMMARY

Options data for the monthly expiry of the NIFTY50 showed significant open interest at the 26,000 call and 25,900 strike, suggesting consolidation within a narrow range. Traders looking to implement directional strategies can keep a close eye on these levels, as a break above or below them on a closing basis could signal the market's next direction.

NIFTY50 breaks 26,000 barrier, retreats after profit-booking

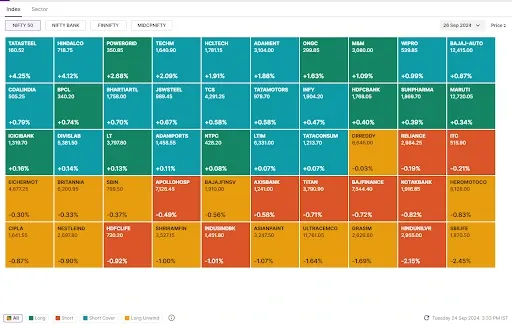

Markets hit a fresh all-time high and traded in a narrow range, ending the Tuesday’s session flat amid volatility. The NIFTY50 index crossed 26,000 mark towards the fag-end of the session but failed to sustain the phsyhcologically crucial level on closing basis.

Sectorally, Metals (+2.9%) and Energy (+0.7%) advanced the most, while PSU Banks (-0.8%) and FMCG (-0.7%) were the top losers.

On the daily chart, the NIFTY50 has formed a doji candlestick pattern, signaling a potential pause in the current trend. After gaining over 2% in the last three sessions, some consolidation around the current levels is likely before the next leg of the rally. Traders should closely monitor the high and low of the doji on a closing basis, as a break above or below these levels could provide further direction for the market.

-

Top gainer and loser in NIFTY50: Tata Steel (+4.3%) and SBI Life (-2.7%)

-

Top gainer and loser in NIFTY Midcap 100: One 97 Communications (+4.0%) and Policy Baazar (-4.1%)

-

Top gainer and loser in NIFTY Smallcap 100: National Aluminum (+6.6%) and Amber Enterprises (-5.0%)

Key highlights of the day

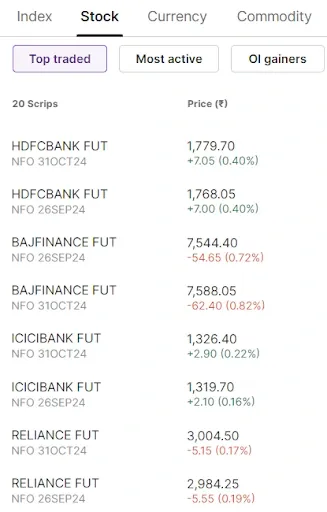

Top traded futures contracts

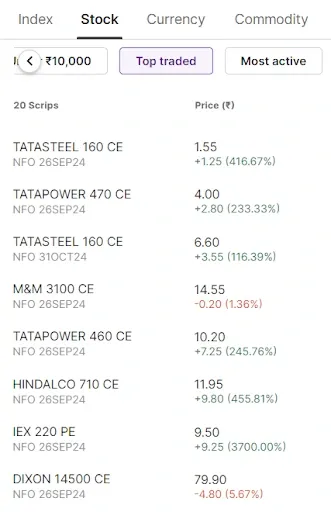

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Policy Baazar, Bank of Maharashtra, Hindustan Unilever, Page Industries and Mazagon Dock Shipbuilders

📈Open=Low (Bull power): Escorts Kubota, Jindal Steel, ABB, Tata Chemicals, Bajaj-Auto and Mahindra & Mahindra

🏗️Fresh 52 week-high: Hindalco Industries, Mankind Pharma, Tata Power, Avenue Supermarts (DMART) and IPCA Laboratories

⚠️Fresh 52-week-low: N/A

See you tomorrow!

Next Story