Market News

Weekly market wrap: SENSEX scales 80K as benchmark indices climb for 5th straight week

.png)

4 min read | Updated on July 06, 2024, 13:39 IST

SUMMARY

With SENSEX scaling 80,000 levels, premium valuation concerns have deepened which can lead to some consolidation in the market. However, FII buying in the cash market can support the market in the near term.

Stock list

- SENSEX scaled the 80,000 mark for the first time on July 3

- On a weekly basis, SENSEX closed 1.21% higher while NIFTY advanced 1.3%

- ONGC, Coal India, Tata Consumers Products and Wipro were among top gainers this week

Indian benchmark indices extended their bullish run this week registering fifth straight weekly gains. Let’s take a look at all the key actions on the D-Street in an exciting week marked by resilience.

Benchmark SENSEX breached the historic 80,000 mark for the first time this week as easing inflation worries and strengthening rate-cut hopes boosted rate-sensitive stocks. Broader NIFTY also scaled the 24,400 level as FIIs returned to Indian equity markets.

Easing inflation worries and softening bond yields in the US helped revive buying in IT and pharma shares. US Federal Reserve Chairman Jerome Powell's comments were positive news for Indian markets. Powell stated that the US was on a disinflationary path with a core inflation print of 2.6% for May 2024. The comments triggered gains in global equity markets on hopes of a rate cut by the US Fed by September.

A Federal rate cut could also prompt the Reserve Bank of India to reduce domestic rates. Investors were also bullish on the quarterly earnings outlook of Indian corporates, supporting premium valuations.

SENSEX scaled the 80,000 mark for the first time on Wednesday intraday while NIFTY breached the 24,300 level as banking shares advanced. The historic peak of the 30-share index, however, triggered premium valuation concerns among investors. This led to some consolidation in the last two trading sessions of the week.

SENSEX and NIFTY closed flat on Thursday as investors preferred to book profits. The key indices settled on a mixed note on Friday after recovering from the day’s low levels.

SENSEX closed below the 80,000 mark at 79,996.60, down 53 points. NIFTY managed to end in the green at 24,323.85 rebounding from day’s low of 24,168.

On a weekly basis, SENSEX closed 1.21% higher while NIFTY advanced 1.3%.

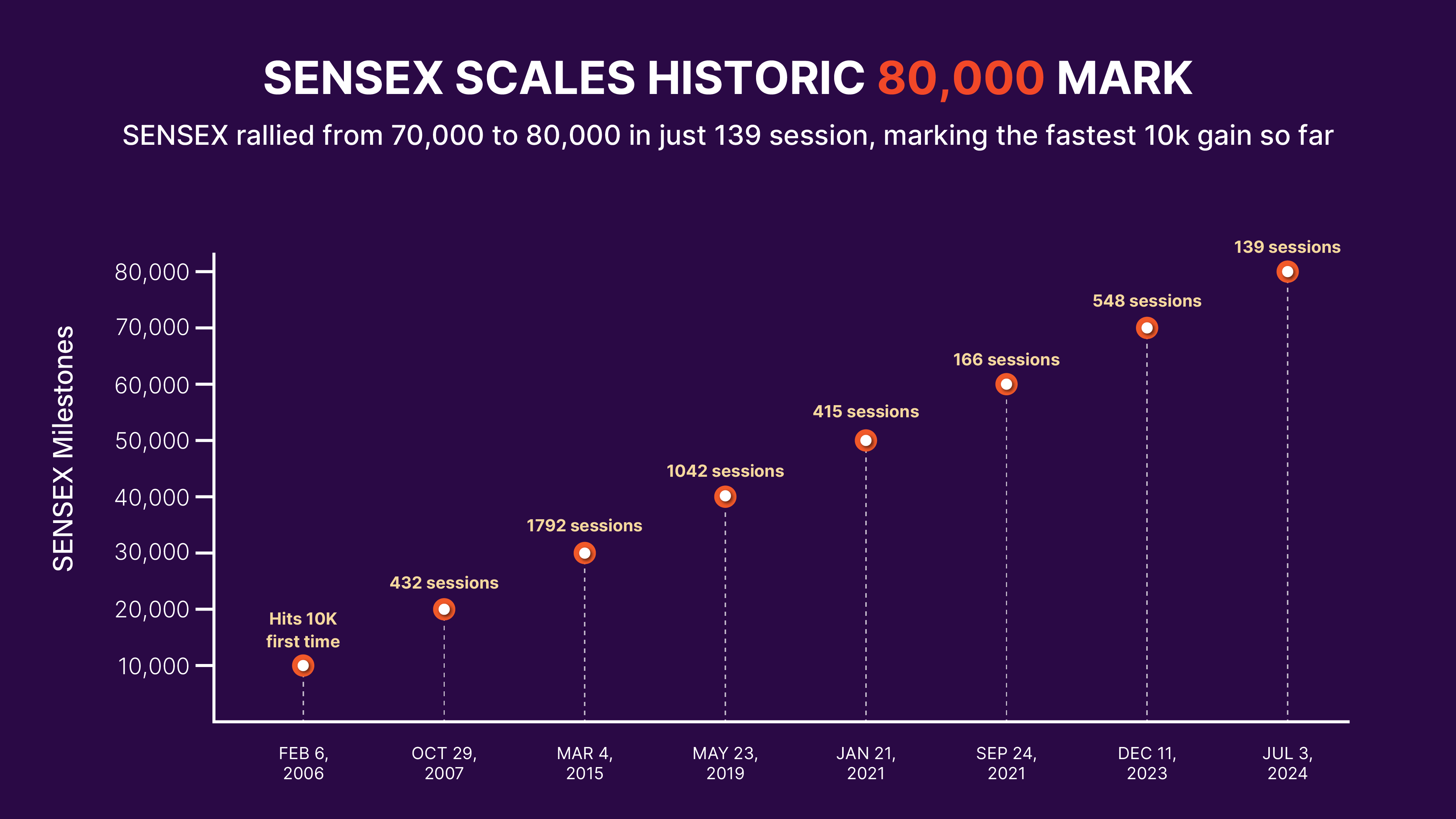

SENSEX vaults from 70K to 80K in just 139 sessions

SENSEX vaulted 10,000 points to breach the 80,000 mark from 70,000 in just 139 days. The key index scaled the historic milestone for the first time on July 3. The index had scaled the 70,000 mark on December 11, 2023. The key stock index managed to rally 10,000 points in the shortest period so far, despite a deep correction on June 4 due to general election results. Interestingly SENSEX piled on more than 2,600 points or 3.6% in just two weeks.

ONGC, Coal India among major gainers this week

ONGC, Coal India, Tata Consumers Products and Wipro were among major movers this week. ONGC rose by around 7%, Coal India by 5% while TCPL and Wipro rose more than 4% this week.

IT, Pharma shares rebound on US rate cut hopes

IT and pharma shares witnessed revival of fortunes this week with the sectoral NIFTY Pharma and IT indices rallying around 4%. The gains were led by easing inflation worries and rate cut hopes in the key US market, which account for a significant contributor to revenue for IT and pharma companies.

What lies ahead?

With SENSEX scaling 80,000 levels, premium valuation concerns have also deepened which can lead to some consolidation in the market. However, FII buying in the cash market can support the market in the near term. While the US rate cut hopes have bolstered, non-farm payroll data to be released on Friday late would gauge the trajectory of the Fed’s potential rate cuts.

Next Story