Market News

How do major indices react to Union Budget? A historical view

7 min read | Updated on July 19, 2024, 20:54 IST

SUMMARY

Prior to an event like budget day, there could be speculation in the markets which could make prices drift directionally or prices could become more volatile.

A call option is a straight-forward strategy that gives you the right to buy the underlying asset at a specific price.

Interested in trading around budget day but don’t know where to start? Navigating the trading opportunities around significant events like budget days can require a different approach than typical day-to-day trading. This is because the financial markets will react dynamically to various events whether it is the unveiling of a national budget, new data points on consumer spending or inflation, changes in commodities prices, favorable earnings announcements, or news about an upcoming merger. For example, increased government spending can drive revenues, leading to higher stock prices for select industries. Similarly, an uptick in inflation or commodities prices can have varying impacts on different industries. Certain companies may find themselves more susceptible to increased costs, potentially affecting their stock prices.

Prior to an event like budget day, there could be speculation in the markets which could make prices drift directionally or prices could become more volatile. Once the event occurs, there will likely be additional price action. If the market believes that the information released during the event is bullish and the pre-event activity doesn’t fully account for this, then impacted stocks or broader indices could keep rising. Alternatively, if the information is favorable but the pre-event activity was exceptionally bullish and drove prices too high, then the impacted stocks or indices could reverse downward.

While predicting stock or index movements with absolute certainty is impossible, understanding past market behavioral patterns can offer valuable context. Here are some insights into how the Nifty and Bank Nifty have historically responded to Union Budget Days to help traders make more informed decisions.

Nifty50 Historical Price Movements

As part of our analysis, we looked at the returns on the actual budget day as well as on the surrounding days. For the budget day, we examined the closing price on that day and the closing price on the day prior. This close-to-close return would be the ‘budget day’ return. Similarly, we looked at the returns one-day prior and one-day after. We also expanded this to show the total returns of the 3-day period both before and after the budget day.

The median return is the 50th percentile or most likely return for that particular period. The 3rd and 1st quartile represent that 75th and 25th percentiles of returns. So, on budget day, the 3rd quartile return is 0.81% which means that 25% of the returns on budget day for the last 20 years have been above that and 75% have been below that.

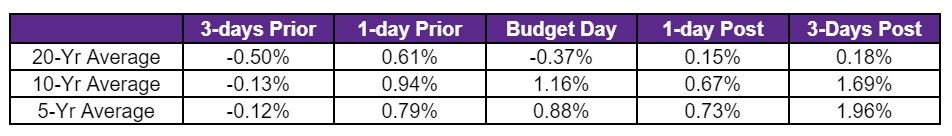

Below is that average returns per period for the last 20 years (2004 – 2023), 10 years (2014 – 2023) and 5 years (2019 – 2023). While past performance isn’t a predictor of the future, the average returns for 1-day post and 3-days post have been positive across various time frames ranging from 5-years to 20-years.

Over the last 20 years, the Nifty has moved up on

-

Day Prior to Budget Day: 16 of 24 (67%)

-

Budget Day: 11 of 24 (46%)

-

Day Post Budget Day: 15 of 24 (63%)

-

Day Prior to Budget Day (excluding interim): 13 of 20 (65%)

-

Budget Day (excluding interim): 8 of 20 (40%)

-

Day Post Budget Day (excluding interim): 13 of 20 (65%)

Bank Nifty Historical Price Movements

We looked at the data for the Bank Nifty returns as well. On budget day, the 3rd quartile return is 1.25% which means that 25% of the returns on budget day for the last 20 years have been above that and 75% have been below that.

Similar to the Nifty50, the average returns for the Bank Nifty for 1-day post and 3-days post have been positive across various time frames ranging from 5-years to 20-years. The caveat is that this is backward-looking and isn’t representative of what could happen in the future.

Over the last 20 years, the Bank Nifty has moved up on

-

Day Prior to Budget Day: 17 of 24 (71%)

-

Budget Day: 12 of 24 (50%)

-

Day Post Budget Day: 16 of 24 (67%)

-

Day Prior to Budget Day (excluding interim): 14 of 20 (70%)

-

Budget Day (excluding interim): 10 of 20 (50%)

-

Day Post Budget Day (excluding interim): 13 of 20 (65%)

Bullish or Bearish Option Strategies

If you were interested in making a directional trade on the Nifty or Bank Nifty, how would you do so using options? Let’s start with bullish strategies. If you believe that the Nifty or Bank Nifty will rise in price in the near future, you could either buy a call option or enter into a bull call spread.

A call option is a straight-forward strategy that gives you the right to buy the underlying asset at a specific price. This specific price is the strike price that you select when placing the trade. If the underlying moves up in price by more than the amount you paid to enter into the call option, you could start turning a profit. A bull call spread starts with purchasing a call option but has a second step that involves selling (shorting) another call option. This call option that you sell will have a higher strike price than the call option that you bought. The benefit to using a bull call spread is that it has a lower cost to enter into a bullish trade due to the short call option.

Now what if you are bearish about the Nifty or Bank Nifty? You can execute very similar strategies but instead of using call options, you would use put options. A put option gives you the right to sell the underlying asset at a specific price. This specific price is the strike price that you choose whenever you enter into the trade. A put option will have a favorable payoff if the underlying moves down far enough to cover the cost to buy the option. An alternative to the put option is a bear put spread. With this strategy, you start by buying a put option and then you also sell a corresponding put option but with a lower strike price than the bought put option. Similar to bull call spreads, the bear put spread will have a lower cost to enter compared to a simple put option.

Summary

While you can never predict how the market will react to news, understanding how it has reacted in the past could at least help you prepare by knowing what is possible. In addition, if you were considering speculating on potential event-based market movements, it is best to be armed with data so that you can properly assess the risk and reward opportunities.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing._

About The Author

Next Story