NIFTY50 holds fort at 20-DMA, Mid and Small Caps tumble

Upstox

2 min read • Updated: February 9, 2024, 5:48 PM

Summary

As highlighted in our morning trade setup blog, the NIFTY50 is currently trading in a range with a slight downward bias, having found support at its 20 DMA. If the index closes below this level, the next key support is around 21,500, which also coincides with the 50 DMA.

_67754.png)

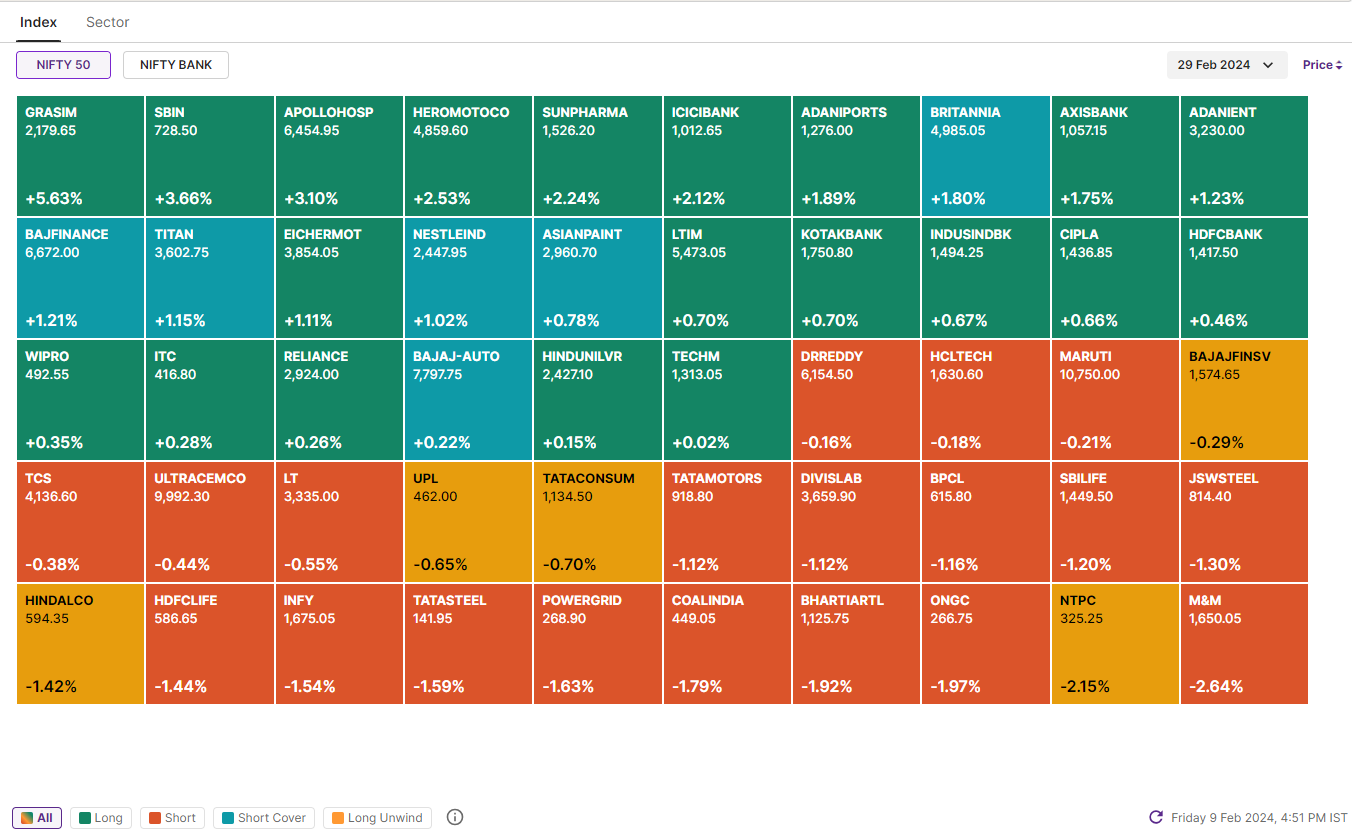

The NIFTY50 index had a rollercoaster ride on Friday, trading in a narrow range throughout the choppy session. Despite the volatility, the index managed to close higher at 21,782 (+0.3%), finding crucial support at its 20-day moving average (DMA). It attempted to reclaim the 21,800 level, but ultimately fell short.

While the benchmark NIFTY50 managed to close higher, broader market indices painted a different picture. Both the NIFTY Midcap 100 and NIFTY Smallcap 100 fell, slipping 0.8% and 1.4% respectively.

Sectoral performance was mixed. Private Banks (+1.0%), PSU Banks (+0.9%), and Pharma (+0.5%) advanced the most. Metal (-1.5%), Oil & Gas (-1.3%), and IT (-0.4%) were the top losers.

As highlighted in our morning trade setup blog, the NIFTY50 is currently trading in a range with a slight downward bias, having found support at its 20 DMA. If the index closes below this level, the next key support is around 21,500, which also coincides with the 50 DMA.

Key highlights of the day:

🔥Grasim Industries' (+5%) Q3 profit surged 48% YoY to ₹1,514 crore, driven by strong cement demand and lower raw material costs.

💊Alkem Laboratories' (+0.5%) Q3 net profit jumped 30% YoY to ₹595 crore, fueled by lower raw material costs, improved margins, and a robust biosimilars business.

📱Airtel shares fell 2% after the government gave the go-ahead for spectrum auctions in eight bands, fuelling concerns about mounting financial liabilities from previous purchases.

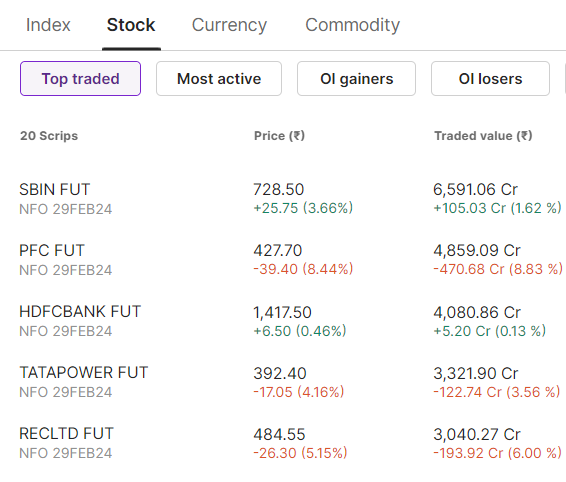

Top traded Futures contracts on Upstox

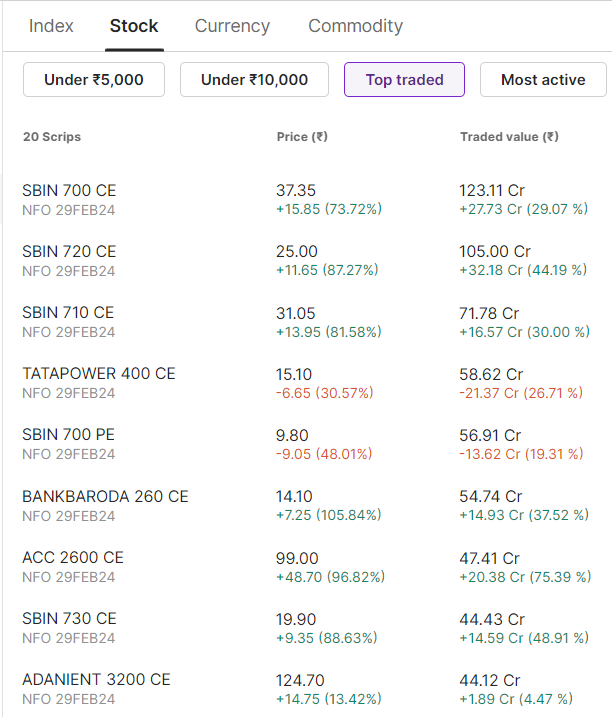

Top traded stock options contracts on Upstox

Trading insights NIFTY 200🔍

📉Open = High (Bear power): Power Finance Corporation, Ramco Cements, Escorts, UPL and Tata Power.

📈Open = Low (Bull power): Lupin and Jubilant FoodWorks.

🏗️Top five 52 week-high: ACC, Yes Bank, Bank of Baroda, Zomato and State Bank of India.

⚠️52 week-low: UPL and Navin Fluorine.

⬆️Gap-up open: N/A

⬆️ Gap-down open: PFC, Rail Vikas Nigam, Ramco Cements, Apollo Tyres and Patanjali.

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you on Monday!