How should Indian investors read the recent Accenture results

Upstox

3 min read • Updated: March 26, 2024, 7:19 PM

Summary

Accenture PLC reported cuts in guidance in revenues for FY24 from 2-5% to 1-3%. The slash in the guidance impacted Indian IT players which have high exposure to global IT spending.

Accenture (ACN), a global peer of Indian IT companies, downgraded its FY24 forecast sighting weakness in global macro environment translating into cut in IT spends. Consequently, its share price fell ~5.6% while American Depository Receipts (ADRs) of Indian IT companies like Infosys and Wipro fell between 2-4% on March 21st.

As we show below, high global exposure for domestic Indian IT companies, financial weakness, and elevated valuations could translate to fear among investors. As such, we believe investors should remain vigilant and re-assess their investment thesis before making any further decisions. While it is easy to get carried away with all the new AI excitement, we note that AI contribution is currently not a significant revenue driver. For ACN total AI order bookings for H1FY24 were lower than 5% of its total new order bookings.

What are the larger scale implications for investors

Earnings guidance and commentary by global IT companies have a much wider read-through not just for wider economy but also for the Indian IT sector. Below are some of the key highlights

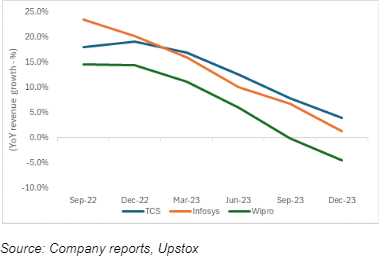

Weakness could trickle -down to Indian IT companies Indian IT companies have a high reliance on global markets – predominantly the USA and Europe

Global uncertainty has already impacted their financial performance – with revenues growth slowing down or even contracting.

Further, as seen in Exhibit 3, this has started to trickle down to earnings, where resilience is weakening.

Weak earnings growth coupled with higher valuations could hamper price performance.

High domestic valuations At current valuations, NIFTY IT is trading at a PE of ~31x, which is higher than its 6-months, 1-, 2- and 5-year median (Exhibit 4), indicating elevated overall IT valuations and limited downside cushion. Persistent weakness could spark worries among investors and lead to a correction in these stocks.

Elevated IT valuations raise concern (Median PE going back discrete time periods)

| Particulars | Current PE* | 6 months | 1Year | 2Years | 3Years |

|---|---|---|---|---|---|

| Price to earnings | 30.8 | 29.1 | 26.3 | 26.4 | 27.5 |

| Premium / (Discount) | 6% | 17% | 17% | 12% |

Discretionary spend expected to be lower While difficult to prove empirically, IT spends are typically the first major cuts companies tend to make when they foresee a challenging economic environment. Consequently, it could be extrapolated into lowering of discretionary expenses by companies, with wider reductions expected to come in other areas – ranging from employee salaries, new project spends. A further worry could be a wide-spread lower discretionary spread across sectors.

Signal towards a weak earnings season Since IT companies are typically some of the first ones to report earnings (in USA and India), this could lead to pessimistic investor expectations for the forthcoming earnings season.

Accenture (ACN) result update

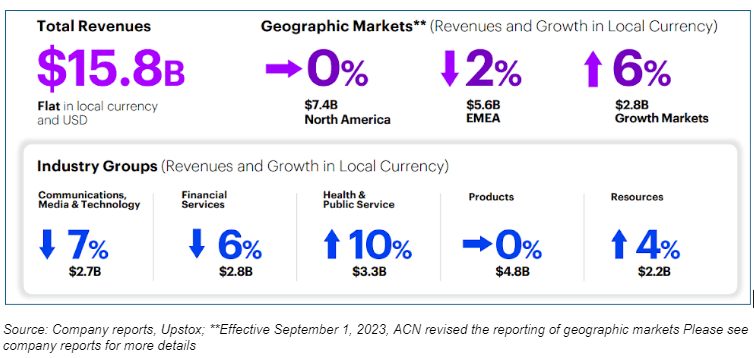

On March 21, ACN announced its Q2FY24 (3 months ended February 29, 2024) result. Key takeaways:

-

Revenue growth continues to cool off, and operating margin remains under pressure

-

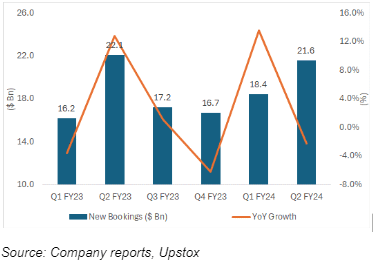

Absolute new order bookings were the second highest ever, though growth remains muted

- Revenue guidance for FY24 lowered as an uncertain economic environment and higher interest rates lead to lower tech spends

| Particulars | Old (Q1 FY24) | New (Q2 FY24) |

|---|---|---|

| FY24 Revenue growth forecast (%) | 2- 5 | 1-3 |

| GAAP Operating Margin (%) | 14.8 - 15.0 | 14.8 |

| GAAP EPS ($ ) | 11.41- 11.76 | 11.41- 11.64 |

Overall quarterly earnings snapshot can be seen in the below