ICICI Bank Q4 Results Highlights: Net profit up 17% YoY at ₹10,708 crore, NII rises 8%; dividend declared

Upstox

7 min read • Updated: April 27, 2024, 5:12 PM

Summary

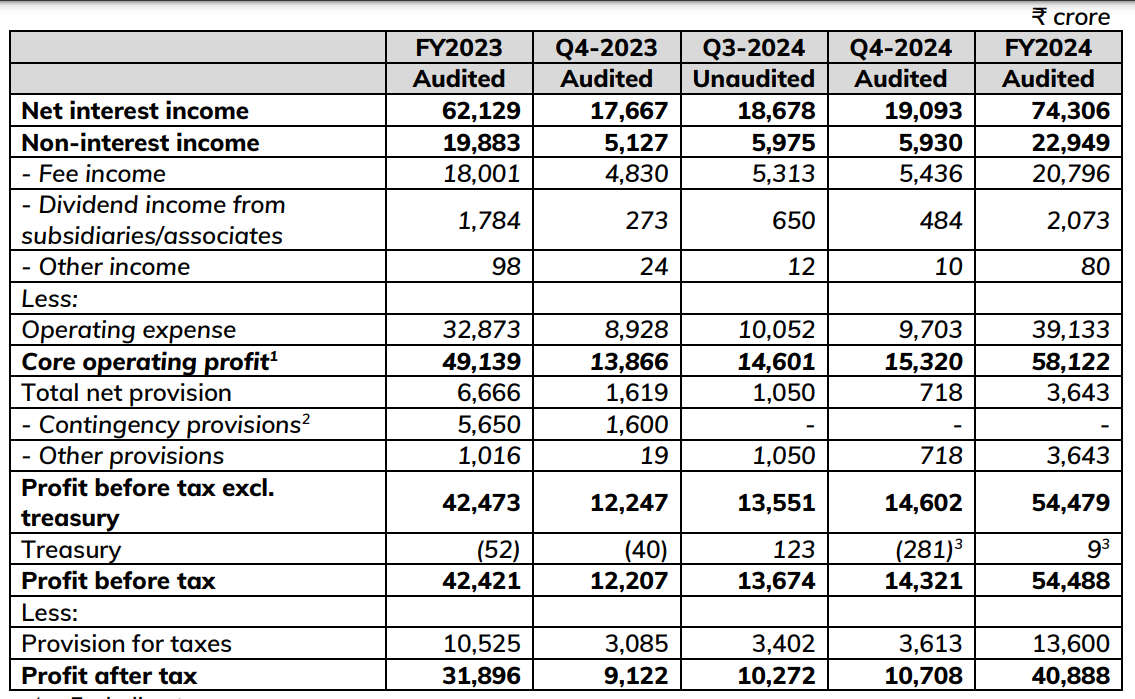

ICICI Bank Q4 Results: The standalone net profit clocked by ICICI Bank has jumped by 17.4% year-on-year to ₹10,708 crore, whereas the net interest income has increased by 8% YoY to ₹19,093 crore. The lender has also declared a dividend of ₹10 per share. Here are the key highlights.

ICICI Bank Q4 Results LIVE Update at 4:45 pm: Key highlights of ICICI Bank's fourth quarter and full-year results

ICICI Bank Q4 Results LIVE Update at 4:41 pm: 623 bank branches added in FY24

- "With the addition of 623 branches in FY2024, the bank had a network of 6,523 branches and 17,190 ATMs and cash recycling machines at March 31, 2024," the release noted.

- The value of the bank’s merchant acquiring transactions through UPI grew by 67.7% year-on-year and 8.7% sequentially in Q4-2024.

- ICICI Bank had a market share of about 30% by value in electronic toll collections through FASTag in Q4FY24, with a 14.5% year-on-year growth in collections in Q4FY24.

ICICI Bank Q4 Results LIVE Update at 4:37 pm: Net profit in FY24 grows 28% YoY to ₹40,888 crore

The standalone net profit for the entire fiscal year ended March 31, 2024 (FY24) grew by 28.2% year-on-year to ₹40,888 crore, ICICI Bank said.

ICICI Bank Q4 Results LIVE Update at 4:35 pm: Total period-end deposits grow 19.6% YoY

- Total period-end deposits increased by 19.6% year-on-year and 6.0% sequentially to ₹14,12,825 crore in Q4 FY24.

- Period-end term deposits increased by 27.7% year-on-year and 1.6% sequentially to ₹8,16,953 crore.

- Average current account deposits increased by 13% year-on-year in Q4.

- Average savings account deposits increased by 4.6% year-on-year in Q4.

ICICI Bank Q4 Results LIVE Update at 4:30 pm: Asset quality improves as net, gross NPA decline

Net non-performing assets (NPA) ratio declined to 0.42% as of March 31, 2024 from 0.44% as of December 31, 2023, ICICI Bank said in a release.

The gross NPA ratio declined to 2.16% in the fourth quarter, as compared to 2.30% in the preceding quarter.

ICICI Bank Q4 Results LIVE Update at 4:25 pm: Lender declares dividend

The board of directors of ICICI Bank have declared a dividend of ₹10 per equity share of face value of ₹2 each. The dividend will be paid after it is approved by the shareholders at the ensuing Annual General Meeting (AGM), the bank said in a regulatory filing.

ICICI Bank Q4 Results LIVE Update at 4:20 pm: Net profit, NII surpasses Street estimates

The standalone net profit and NII logged by ICICI Bank has surpassed the street estimates. The NII, at ₹19,093 crore, is higher as compared to the estimate of ₹18,958 crore, as calculated on the basis of projections shared by seven brokerages.

The net profit, at ₹10,708 crore, has marginally exceeded the average estimate of ₹10,331 crore.

ICICI Bank Q4 Results LIVE Update at 4:15 pm: Net profit up 17% YoY at ₹10,708 crore, NII up 8%

-

The standalone net profit clocked by ICICI Bank has jumped by 17.4% year-on-year to ₹10,708 crore, whereas the net interest income has increased by 8% YoY to ₹19,093 crore.

-

In the fourth quarter of FY23, the net profit and NII clocked by the bank stood at ₹9,122 crore and ₹17,667 crore, respectively.

-

The net interest margin in Q4FY24 came in at 4.40%, lower as compared to 4.43% in the preceding December 2023 quarter and 4.9% in the year-ago quarter of March 2023.

ICICI Bank Q4 Results LIVE Update at 3:30 pm: Net profit, NII keenly watched as lender is set to post earnings shortly

The NII and net profit of ICICI Bank will remain keenly watched, as it is set to post the earnings scorecard for the March 2024 quarter shortly. The estimates indicate that the lender's performance is likely to remain flat sequentially.

ICICI Bank Q4 Results LIVE Update at 2:45 pm: Fourth quarter earnings to be released shortly

ICICI Bank is expected to shortly released the results for the fourth quarter of financial year 2023-24. Ahead of the results, estimates projected a flattish quarter for the lender, with the net profit seen to be rising only 0.6% sequentially and NII seen up by 1.7% quarter-on-quarter.

ICICI Bank Q4 Results LIVE Update at 2:00 pm: A look at the lender's NII in the preceding three quarters

- The net interest income climbed by 13.4% YoY to ₹18,678 crore in the December 2023 quarter.

- The bank reported 23.8% YoY growth in NII at ₹18,308 crore in the September 2024 quarter.

- In the first quarter, the NII stood at ₹18,227 crore.

ICICI Bank Q4 Results LIVE Update at 1:15 pm: A look at the lender's net profit in the preceding three quarters

- The bank’s net profit in Q3 FY24 surged by 23.6% YoY to ₹10,272 crore.

- In the September quarter the lender’s net profit stood at ₹10,261 crore.

- In the June quarter, ICICI Bank reported a net profit of ₹9,648 crore, up 39.7% YoY.

ICICI Bank Q4 Results LIVE Update at 12:30 pm: How the shares have performed?

Ahead of the release of Q4 results, ICICI Bank shares settled in the red. The stock closed at ₹1,107.9 apiece on the NSE, down 0.5% as against the previous day's close. Year-to-date, the shares have rallied by 11.1%, and the surge has been sharper at 19.5% in the last one year.

ICICI Bank Q4 Results LIVE Update at 11:45 am: A look at NPA ratio in the preceding quarter

The net non-performing assets ratio stood at 0.44% in Q3 FY24, almost same as compared to 0.43% in the preceding September 2023 quarter. The gross NPA, however, had improved to 2.3% from 2.48% in Q2 FY24.

ICICI Bank Q4 Results LIVE Update at 11:00 am: What are the NII estimates?

As per the average of estimates shared by seven brokerakes, ICICI Bank's net interest income is seen at ₹18,958 crore, which would mark a marginal 1.7% growth as compared to Q3 FY24.

ICICI Bank Q4 Results LIVE Update at 10:00 am: What are the net profit estimates

The estimates indicate a subdued fourth quarter quarter for ICICI Bank. The net profit is projected at ₹10,331 crore, up only 0.6% quarter-on-quarter, as per the median of estimates shared by seven brokerages.

ICICI Bank Q4 Results LIVE: ICICI Bank, India’s second largest private lender, is set to declare the results of the fourth quarter of financial year 2023-24 (Q4 FY24) on Saturday, April 27. Along with the quarterly scorecard, the bank would also release the earnings report for the full fiscal year ended March 31, 2024. Stay tuned here for the latest updates.

Ahead of the release of Q4 results, ICICI Bank’s stock settled in the red at the end of the trading session on April 26. The shares closed at ₹1,107 apiece on the NSE, down 0.5% as against the previous day’s close.

ICICI Bank Q4 results preview

The results preview projects a flattish quarter for ICICI Bank. The net profit is seen at ₹10,331 crore, up only 0.6% quarter-on-quarter, as per the median of estimates shared by seven brokerages.

The net interest income (NII) – the difference between interest earned on loans and advances and paid on deposits – is estimated at ₹18,958 crore, higher by 1.7% as compared to the preceding December 2023 quarter.

The pre-provisions operating profit (PPoP) is also projected to grow marginally by 0.6% sequentially to ₹14,806 crore.

How ICICI Bank performed in Q3 FY24?

In the October-December period of this fiscal, ICICI Bank had logged a net profit of ₹10,272 crore, higher by 23.6% as against the year-ago period. The NII during the quarter came in at ₹18,678 crore, marking a 13.4% year-on-year surge.

The net non-performing assets ratio grew marginally to 0.44% in Q3 FY24, from 0.43% in the preceding September 2023 quarter. The gross NPA, however, had improved to 2.3% from 2.48% in Q2 FY24.