Business News

Amul to sell fresh milk in the US: Here are the challenges it could face

6 min read | Updated on July 19, 2024, 21:04 IST

SUMMARY

Gujarat Cooperative Milk Marketing Federation (GCMMF), which owns the Amul brand, has launched its fresh milk products in the US markets. Amul has been exporting dairy products for many decades. However, it will be the first time for the company to export fresh milk outside India. But there are multiple challenges that lie ahead for Amul in the US market.

Amul could face challenges as it aims to sell fresh milk in the US market.

Challenges in the US dairy market

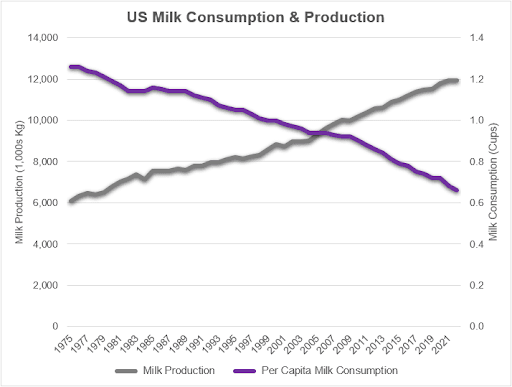

While Amul’s entrance into the US market to deliver fresh milk products for the first time is an exciting development, there are certain risks with this business decision. They will be fighting headwinds that are a result of multiple trends that have started to compound over the last several decades. To illustrate this, from 1975 to 2023, US milk production has increased 96% but milk consumption has decreased by 47%.

Source: US Department of Agriculture

Source: US Department of AgricultureWith an increase in supply and decrease in demand, you would expect prices to fall. According to the St. Louis Federal Reserve that tracks commodity price data, US milk prices fell 1% in 2023 while food prices rose by 3% counter to general inflation trends. Commodity products like milk typically have limited pricing power in markets so unless Amul is able to sufficiently differentiate themselves, their product’s prices could be caught in a downward trend.

Why are dairy farmers continuing to produce?

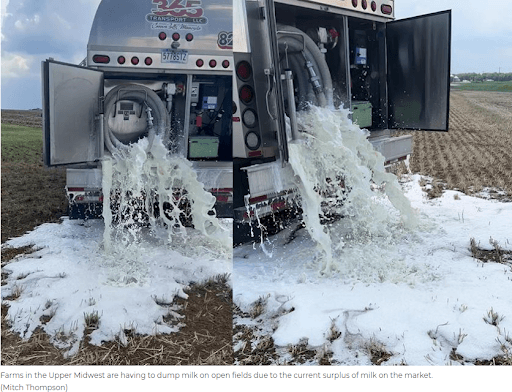

Unlike factories that can respond to changing market trends, dairy farmers don’t have that luxury. Cows have to be milked and if they aren’t, they could become sick or possibly die. Once the milk is produced, it needs to be transported to processing facilities to be pasteurized and homogenized. Even though the milk is being produced, there are limited processing plants, limited storage at the processing plants, and there needs to be enough manual labourers to do this work. Since the COVID-19 pandemic, these processing facilities have struggled to adequately staff leading to a glut of unprocessed milk. This milk has a limited lifespan and farmers have had to dump this unprocessed milk that cannot be sold.

In the US, government subsidies incentivize farmers, not just dairy farmers, to keep producing despite falling prices. In addition, government regulation as well as economies of scale have made it more attractive for consolidation across the dairy industry. Small farms with a few hundred cows cannot compete with larger farms or corporations with tens of thousands of cows. The benefit of scale means that it can be arbitrarily more expensive to produce more. While margins are crunched, large farms and corporations are still profitable. Lastly, dairy farmers are producing more with less leading to the “milk produced” and “milk processed” imbalance as well as the “milk supplied” and “milk demanded” imbalance. This increase in yield is driven by technological advancements that use automation to milk cows efficiently and feed them appropriately while using data to optimize.

Why has demand been falling?

US consumers drink milk as a standalone beverage, in cereal, and with coffee or tea. Fluid milk consumption in the US has been falling at a rate of 1% annually since the 2000s and has accelerated to over 2% during the 2010s. Some of this can be explained through lifestyle trends, consumer choices, and demographic changes. In the 1980s, a focus on low fat diets as a way to drive weight loss can explain shifts in types of milk being consumed. From 1979 to 2019, whole milk consumption of a percent of total fluid milk fell from 62% to 35%. Alternatively, milk with lower fat content including skim, 1% plain, and 2% plain rose from 32% to 54% of total fluid milk consumption.

US public schools historically have been large consumers of milk as meal programs would provide milk cartons for breakfast and lunches. Beginning in 2012, students participating in free and subsidized meal programs were required to be provided with a healthier mix of food and beverages. This FDA requirement meant that schools could only offer low-fat (1%) or skim milk. Due to the less flavorful taste, kids are opting out of drinking meal resulting in lower current consumption in public schools. More concerning for the industry in the future is that there is also research* showing a correlation between lower milk consumption in childhood leading to lower milk consumption throughout the rest of your life.

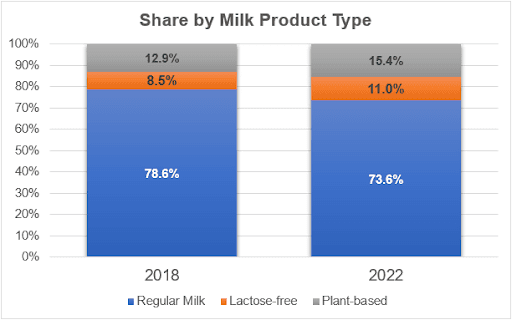

In recent years, there have also been shifts away from regular milk to milk alternatives including plant-based and lactose-free milk. While regular milk still commands a large percentage of the total consumed (at 73.6% as of 2022), there is still a distinct shift occurring. From 2018 – 2022, lactose-free milk sales grew 45% and plant-based sales grew 18%. Alternatively, regular milk sales fell 12%. This trend to plant- or vegan alternatives is due to the perception of them being more healthy and environmental concerns associated with methane emissions of the cattle and dairy industries. Plant-based milks include almond milk, oat milk, coconut milk, and soy milk.

Source: Purdue University, 2023

Source: Purdue University, 2023Another significant factor in continued lower consumption of milk in the US is cereal becoming less prevalent. As cereal is typically a pre-work or pre-school breakfast meal that is usually eaten with milk, it cannot be taken “on the go”. US consumers have opted for breakfast / grain-based bars as a breakfast substitute that can be consumed more easily. With less people opting for cereal, there is less of a need to purchase milk.

There is also a current social media-driven boycott of Kellogg’s – one of the three largest cereal manufacturers in the US who make popular cereals including Frosted Flakes, Fruit Loops, and Rice Krispies. Cereals have become more expensive over time but are still relatively cost-effective meals. While typically eaten as a meal, a common issue is that they don’t provide a balanced nutritional diet and many cereals have high sugar content. In February 2024, the CEO of Kellogg’s, Gary Pilnick, appeared on CNBC and encouraged cash-strapped consumers to eat cereal for dinner. While Kellogg’s has been running a “cereal for dinner” since 2022, the CEO’s message along with price increases for Kellogg’s products was received poorly by US consumers. On TikTok, hashtags of #letthemeatcereal and #boycottkelloggs have trended with one video amassing 4 million views and over 500k likes. Millennial consumers have proposed boycotting the major cereal brand through the end of June.

Conclusion

When put together, Amul is entering into a market that has been collapsing for decades due to a number of different factors. While an affinity for milk is clearly falling, Americans are still willing to pay for beverages – and in many cases, pay a premium. Plant-based milk products command a premium price per ounce compared to regular milk. Coconut milk, Oat Milk, Soy Milk, and Almond Milk are 213%, 157%, 77%, and 67% more expensive than regular milk yet their market share is growing. In addition, Americans are demanding more local and organically sourced products, including milk, versus ones that are more mass produced. The opportunity for Amul to counter this trend is to position itself as a premium and non-commoditized alternative to regular milk such that it is within the choice set of consumers looking for regular milk substitutes.

About The Author

Next Story