Business News

Budget 2024: Top income tax expectations from Union Budget

3 min read | Updated on January 19, 2024, 17:11 IST

SUMMARY

The Union Budget 2024 will be an interim one and is expected to avoid major populist announcements. Taxpayers anticipate reforms, particularly in personal income tax and the new tax regime. Expectations include increase in the personal income tax rebate under the New Tax Regime, rise in Section 80D deduction limit. Investors and homebuyers expect a more straightforward tax framework, streamlined capital gains taxation, ease in TDS compliance.

Individuals have tax expectations from Union Budget 2024

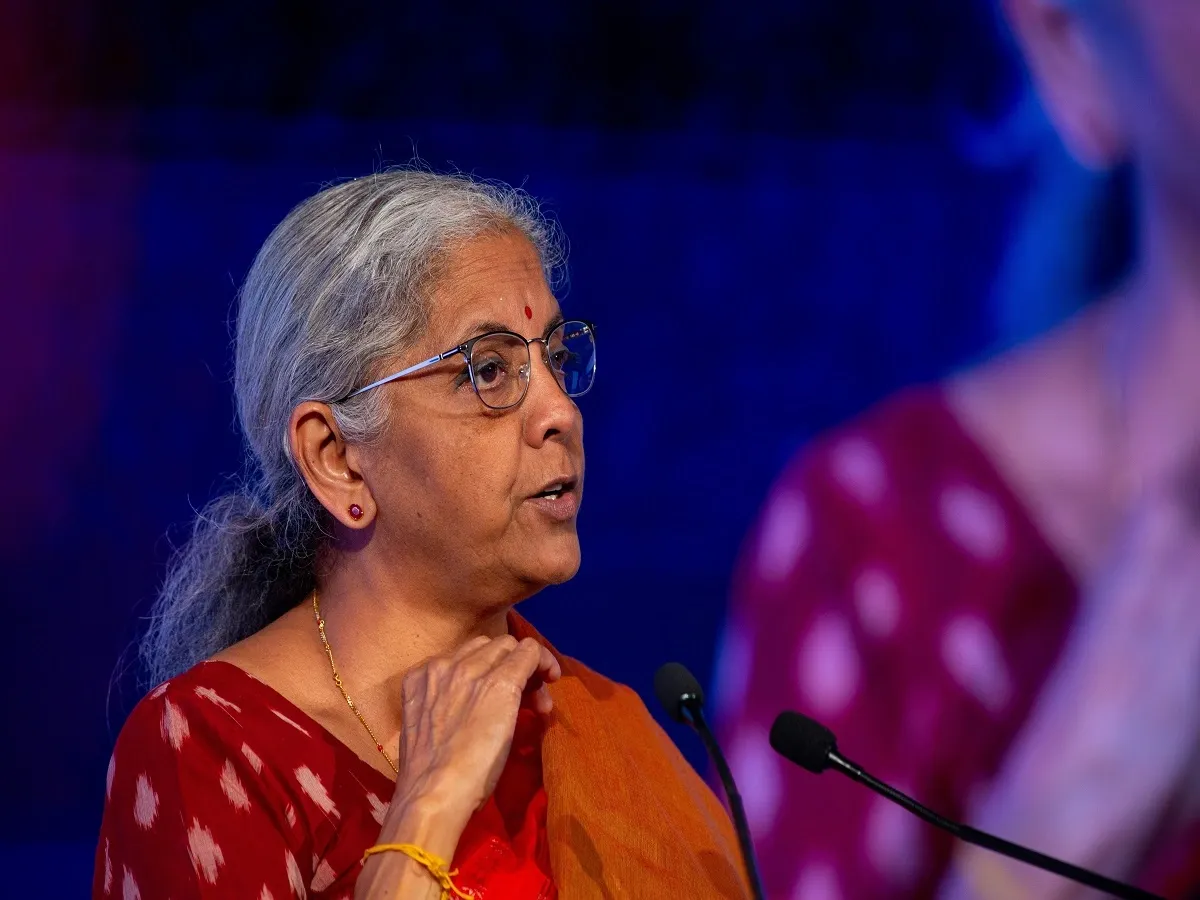

The upcoming Union Budget for the fiscal year 2024-2025, scheduled for presentation on February 1, will be an interim budget ahead of the impending Lok Sabha elections. Hence, the Finance Minister is widely expected to refrain from making any major populist announcements.

Nevertheless, the taxpayer community has heightened expectations, particularly in the realm of income tax reforms. Key anticipations revolve around some relief in personal income tax, with a specific focus on the new tax regime. Additionally, measures to streamline capital gains tax and facilitate greater ease in Tax Deducted at Source (TDS) compliance are also expected in the budget.

Here are some of the top expectations in income tax from Budget 2024:

To enhance clarity and simplicity, there’s a need for streamlining the classification of equity and debt instruments. It would be beneficial to unify the tax treatment for listed and unlisted securities, fostering consistency. Additionally, simplifying the provisions related to indexation, particularly in adjusting purchase prices for inflation, would contribute to a more straightforward and accessible tax framework for investors.

About The Author

Next Story