Business News

RBI MPC Highlights: Repo rate remains unchanged, growth forecast revised; 5 key takeaways

.png)

3 min read | Updated on June 07, 2024, 11:34 IST

SUMMARY

The RBI has kept the rates steady since February 2023. The policy rate decision has come against the backdrop of the US Federal Reserve not announcing any cut in rates so far this year. The RBI upgraded the growth forecast for FY 2024-25 to 7.2% against its earlier projection of 7% in the previous policy review.

The RBI remained focussed on the withdrawal of the accommodative policy

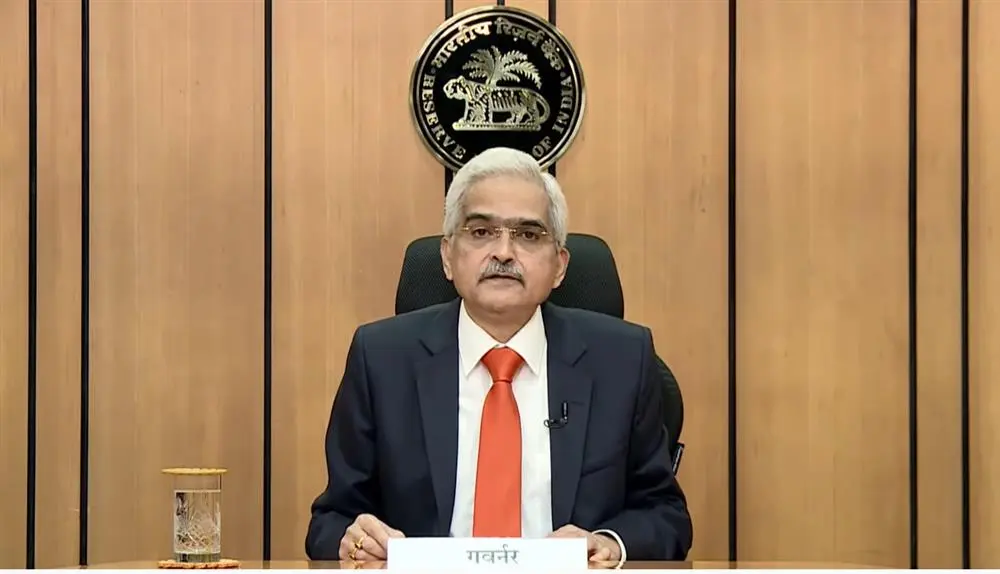

The Reserve Bank of India’s Monetary Policy Committee headed by Governor Shaktikanta Das kept the key policy rates unchanged for the eighth straight time on Friday.

In its second bi-monthly monetary policy of 2024-25 released on June 7, the RBI kept the repo rate or overnight lending rate at 6.5% while observing that the inflation growth balance was moving favourably.

The RBI has kept the rates steady since February 2023. The policy rate decision has come against the backdrop of the US Federal Reserve not announcing any cut in rates so far this year. However, the European Central Bank (ECB) and Bank of Canada have begun cutting the key rates.

The ECB on June 6 slashed its benchmark lending rate by 25 basis points to 3.75% from 4%.

RBI Governor Shaktikanta Das, while announcing the MPC’s decision after three-day deliberations, expressed concerns over elevated food inflation.

Here are five key takeaways from the RBI’s monetary policy announcement.

Policy rates

The RBI has kept the repo rate, or the rate at which it lends to commercial banks, steady at 6.5% since February 2023. Repo rate is the key tool for the RBI to regulate the money supply through this short-term or overnight lending rate. The reverse repo rate is 3.35% while the bank rate is 6.75%. The Cash Reserve Ratio is at 4.50% while SLR is 18%.

Growth projections

The RBI upgraded the growth forecast for FY 2024-25 to 7.2% against its earlier projection of 7% in the previous policy review.

India’s economic growth remains resilient as the GDP rose by 7.8% in the March quarter of 2023-24. The overall economic growth in 2023-24 was 8.2% as per the National Statistical Office data, beating the RBI estimates.

Inflation

The RBI governor stated that the inflation is expected to be 4.5% in the current fiscal with risk evenly balanced. The RBI panel forecast retail inflation for the June quarter of FY25 at 4.9%. It sees CPI inflation at 3.8% in Q2; 4.6 % in Q3 and 4.5% in Q4.

Recent official data showed that retail inflation slipped to an 11-month low of 4.83% in April against 4.85% in March. However, consumer price index-based inflation is still above the RBI’s comfort zone of 4%. The RBI rate-setting panel has been mandated with keeping retail inflation at up to 4% with 2% margin on either side.

Policy stance

The RBI remained focussed on the withdrawal of the accommodative policy. The central bank had also maintained this policy stance in April. Accommodation stance refers to boosting the money supply to support the economy in the face of slowing growth.

Liquidity

The RBI governor stated that the central bank will remain nimble and flexible in liquidity operations.

Also, after transferring a record ₹2.11 lakh crore to the government as dividend for FY24, the RBI central board has decided to increase the risk provisioning to 6.5% of RBI balance sheet.

Das said the increase in contingency risk buffer for FY24 will further improve RBI's balance sheet.

Current Account Deficit

The RBI stated that Current Account Deficit is expected to have moderated in the March quarter of FY24.

It also mentioned that India remains the largest receiving country with 15.2% share in world remittances. Also, gross Foreign Direct Investment remained robust but net FDI moderated in FY24.

The RBI also increased the threshold of bulk deposit in banks to ₹3 crore from ₹2 crore earlier.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story