Business News

Budget 2024: Here’s how markets reacted during past 5 Budgets

4 min read | Updated on January 19, 2024, 18:01 IST

SUMMARY

Despite the volatility, it has been seen in the past that equity indices usually end the budget day with only modest gains or losses.

Markets usually react sharply during Budget announcements

It is generally said that stock markets on a budget day can be a traders’ paradise. Equities usually become extremely volatile and sensitive to Union Budget announcements made by the Finance Minister in the Parliament. And traders cash in on these opportunities by trying to make money during the price swings.

Despite the volatility, it has been seen that equity indices usually end the budget day with only modest gains or losses. Much of the action happens in later months as markets slowly analyse and digest the broader repercussions of the announcements made during the Budget presentation.

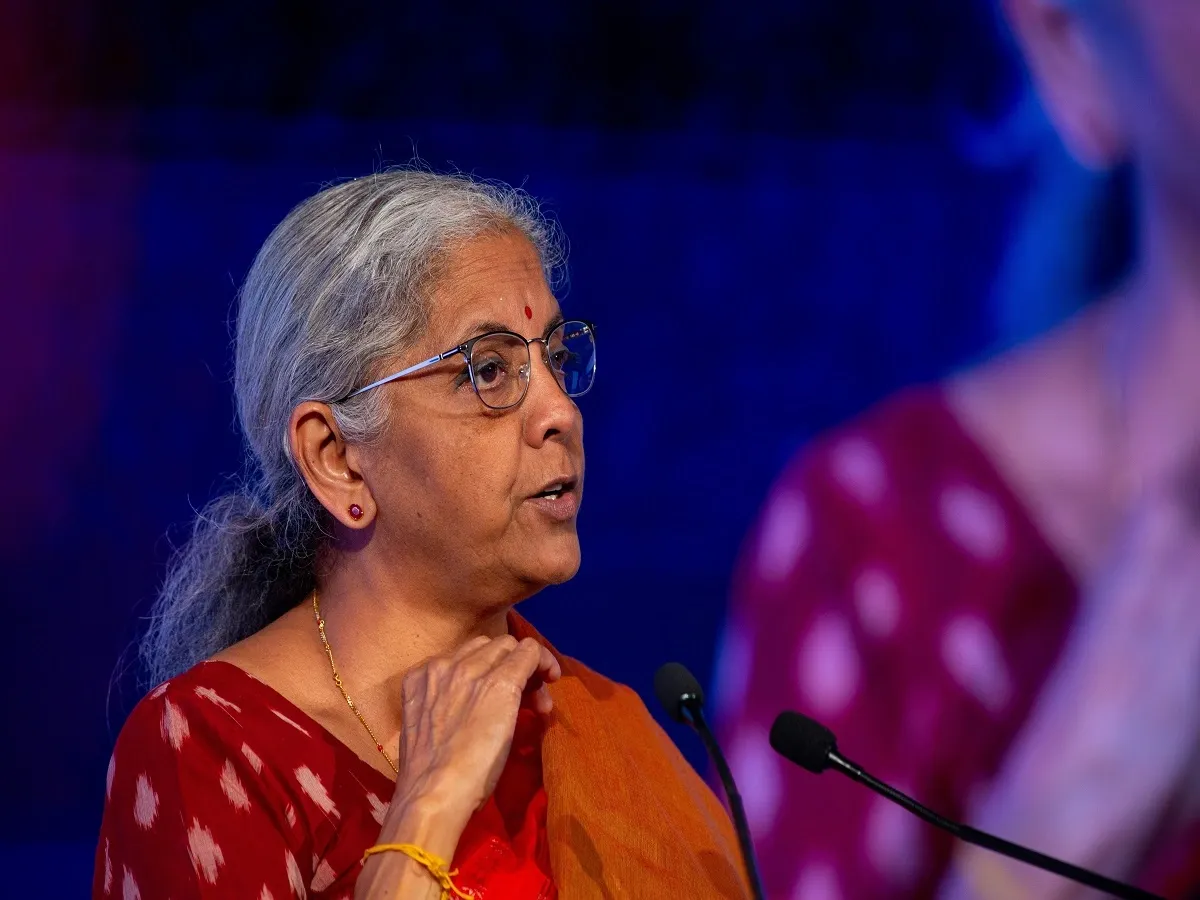

Finance Minister Nirmala Sitharaman will present the Interim Budget on 1 February as this is an election year. The full Budget is expected to be presented by the new government in July after the Lok Sabha elections.

The Finance Minister has already indicated that no ‘spectacular announcement’ is expected in the Interim Budget. The market observers will keep a keen watch on the Finance Minister to see the direction the government takes in an election year. Here’s a look at how the stock markets reacted to the Union Budget in the last five years:

The Union Budget 2019 was Finance Minister Nirmala Sitharaman’s maiden budget after the Narendra Modi-led government won its second term. It was presented on 5 July 2019. Before that, the Interim Budget 2019 was presented by acting Finance Minister Piyush Goyal on 1 February 2019.

On 5 July 2019, the equity market indices had fallen around 1.1%, with the Sensex down 394 points and the Nifty slipping 135 points.

This was after Sitharaman talked about the government’s target of making India a $5-trillion economy. Income tax slabs and rates were left unchanged, but a surcharge was introduced on income tax for individuals earning more than ₹2 crore a year.

On 1 February 2020, Sitharaman delivered the longest budget speech ever when she presented the Union Budget 2020.

Stock markets took a hit that day, falling 2.5%, as the Finance Minister introduced the new income tax regime and abolished dividend distribution tax. The Sensex had tumbled 988 points, while the Nifty dropped 300 points that day as the Modi government’s attempts to simplify taxation drew mixed reactions.

This was a significant Budget as it came after the lockdown induced by the Coronavirus pandemic wreaked havoc on the economy like never before. However, Sitharaman managed to lift spirits with her speech that focussed majorly on increasing spending on the infrastructure, health and agriculture sectors, without tinkering too much with tax rates.

On 1 February 2021, the market gained a healthy 4.7%. The Sensex jumped 2,315 points in a single session, while the Nifty added 647 points.

This was the Budget that saw a sharp hike in capital expenditure, with no changes in income tax. Sitharaman’s major focus was on roads, railways, urbanisation and clean mobility when she presented her fourth budget speech on 1 February 2022. Despite the absence of any big-bang announcements or major tinkering in schemes, the budget impressed the markets with its long-term vision for the country. The stock market indices that day rose around 1.4%, with the Sensex jumping 848 points and the Nifty gaining 237 points.

The Union Budget 2023 was termed the first budget in ‘Amrit Kaal’ after India completed 75 years of Independence.

The Finance Minister announced an increase in exemption limit up to ₹7 lakh per annum under the new tax regime, with rebate under Section 87A of the Income Tax Act, 1961. Earlier, the rebate was only available for taxable income up to ₹5 lakh under the new tax regime. She also announced a cut in surcharge from 37% to 25% for individuals with income above ₹2 crore.

Capex was raised almost 33% compared with the previous year to a record high in order to spur economic growth.

The stock markets seemed a bit confused and settled mixed after a day of extreme volatility. On 1 February 2023, the Sensex managed to close in the green, rising 158 points. However, the Nifty stayed in the red, losing around 45 points.

About The Author

Next Story