Ruchi Soya FPO — Everything You Need to Know

Founded in 1986, Ruchi Soya Industries Ltd is among the leading manufacturers in the edible oil and soya foods sector of India. Swami Ramdev founded-Patanjali Ayurved Group acquired Ruchi Soya in 2019, is the main promoter of the follow-on public offer (FPO) of ₹4,300 crore. The Securities and Exchange Board of India (SEBI) gave its formal approval in August 2021.

They claim to be the pioneers and most prominent manufacturers of soya foods that served their brand ‘Nutrela’ in becoming a household name in India. The company owns 22 manufacturing units and has a refining capacity of more than 11,000 tonnes, a packaging capacity of 10,000 tonnes, and a seed crushing capacity of 11,000 tonnes per day.

While the date of the FPO has not been announced, the company has filed all the requisite materials with the market regulator and is set to launch soon.

Here’s everything you need to know about the Ruchi Soya FPO:

Offer Details

-

FPO Size: ₹4,300 crore

-

Face Value: ₹2 Per Equity Share

-

Dates: Expected in September 2021

-

Price Band: Not Announced

-

Lot Size: Not Announced

-

Listed on: BSE and NSE

As per the Draft Red Herring Prospectus (DRHP), the listed company will finalise its offer price, lot size, and exact time of launch soon.

Objectives of the FPO

The Indore-based FMCG company has the following objectives for launching the FPO:

-

Financing incremental working capital requirements of our Company

-

To use around 60% of the capital for paring down the company’s debts, with a goal of becoming debt-free in the next two or three years.

-

To use about 15% as working capital and balance for general corporate purposes.

Company Fundamentals

Ruchi Soya’s current shareholding pattern is as follows:

-

Patanjali Group (Promoters)

-

98.9%

-

Central Government

-

0%

-

Others

-

0.17%

-

General Public

-

0.93%

-

Financial Institutions

-

0%

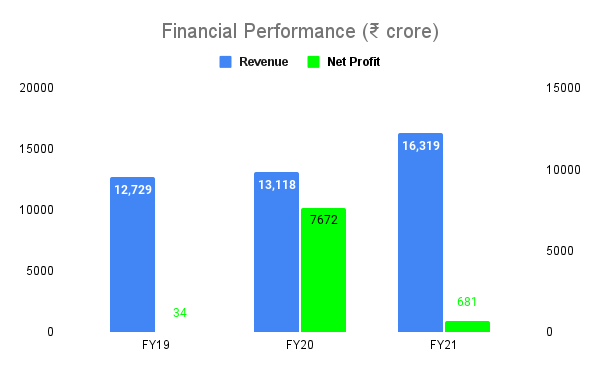

Financial Information

Overview of Business

Since its incorporation in 1986, Ruchi Soya Industries Ltd has emerged as a leader in the edible oil and soya foods manufacturing business. It follows a farm-to-fork model and has secured access to palm oil plantations around India. As one of the top FMCG brands in the market today, the company’s brands include Ruchi Gold Oil, Mahakosh Oil, Sunrich Oil, Nutrela Soya Foods and so on.

They are also one of the largest exporters of oil meals, which they deliver to countries like Japan, Indonesia, Vietnam, Malaysia, South Korea, the Middle East, and Europe.

The company filed for corporate insolvency in December 2017 due to its total debt of around ₹12,000 crore. Two years later, it was acquired by Patanjali Ayurved for ₹4,350 crore.

Industry Outlook

Ruchi Soya’s soya chunks brand Nutrela enjoys a strong foothold as one of the pioneers of soya chunks three decades ago, and has a share of 40% of the branded soya chunks market. Many of its flagship products have evolved into the leaders of their category, such as Ruchi No. 1.

However, Ruchi Soya’s net profits declined from ₹7,715 crore in 2019-2020 to ₹366 crore by the end of December 2021, even as the total income increased from ₹13,117 crore to ₹11,480 crore in the same period. Over the last five years, the company has demonstrated a profit growth of 21.43% CAGR.

Strengths

-

Operating across the value chain in the edible oil segment

-

Strong brand recognition in the Indian market e.g Nutrela and Ruchi Gold

-

Strong, established and extensive distribution network with its products available in over 4.5 lakh retail outlets in addition to modern trade and e-commerce platforms

-

Increased association with the Patanjali brand resulting in a wider array of product offerings

Opportunities

-

Growing demand for health-related FMCG products and nutraceuticals, especially in the aftermath of the pandemic

-

Expanded presence in global markets and premium segments

Threats and Risks

-

Cut-throat competition from domestic and international players such as Hindustan Unilever, Agro Tech Foods Ltd, Sanwaria Agro Oils Ltd, and other players

-

High revenue dependence on edible oil segment

-

nearly 80% of revenues

-

Almost entirely dependent on third party suppliers for raw materials

-

Demand fluctuation due to the pandemic might slow down growth

-

Involved in certain litigation proceedings

-

Have experienced negative cash flows in the recent past

With a growing demand for health-related consumer products and nutraceuticals, Ruchi Soya is looking to attract new investors to further expand into new markets. Watch out for the IPO date and analyse the potential before investing.