RBI keeps the key rate steady at 6.5%; LIVE Updates

Upstox

5 mins • Updated: December 8, 2023, 3:50 PM

Summary

The Indian central bank has maintained the status quo by keeping the rates unchanged at 6.5%. It is in line with the street expectations. This comes at a time when the retail inflation continues to be above the RBI’s target of 4%.

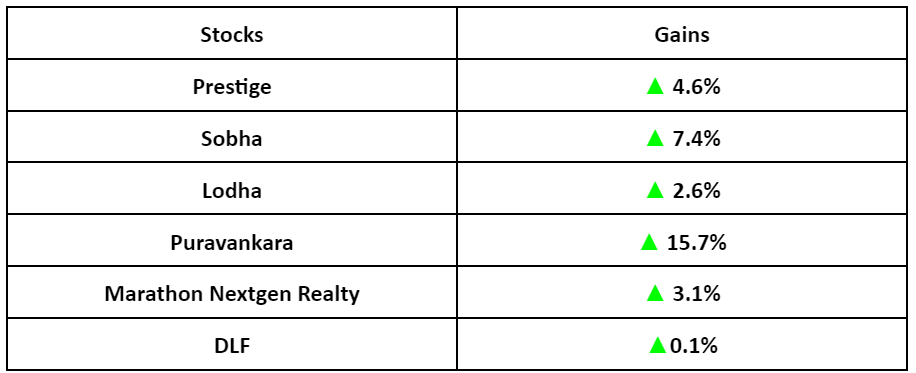

Realty stocks close higher as RBI keeps rates unchanged; Stock Market LIVE Updates

Shares of real estate developers are trading higher after the Indian central bank kept the rates steady at 6.5%. Note that steady rates are beneficial for realty players as it could lead to increase in demand for housing loans.

December 8, 2023 3:50 PM

RBI keeps repo rate unchanged at 6.50 per cent; Stock Market LIVE Updates

The Indian central bank has maintained the status quo by keeping the rates unchanged at 6.5%. Besides policy statements, RBI set out various developmental and regulatory policy measures relating to Financial Markets, Regulations and Payment Systems and Fintech. Here are the complete details

- Review of the regulatory framework for hedging of foreign exchange risks

The central bank has reviewed the regulatory framework governing the hedging of foreign exchange risks. The framework has been refined to enhance operational efficiency and ease access to foreign exchange derivatives, especially for users with small exposures. This will ensure that a broader set of customers with the necessary risk management expertise are given the flexibility to manage their exposures efficiently. The Master Direction will be issued separately.

December 8, 2023 2:30 PM

RBI on India’s robust GDP growth; LIVE Updates

The RBI says that 7.6% GDP growth in Q2FY24, underpinned by robust investment and government consumption. “Continued strengthening of manufacturing activity, buoyancy in construction, and gradual recovery in the rural sector are expected to brighten the prospects of household consumption,” adds the RBI.

It also states that healthy balance sheets of banks and corporates, supply chain normalisation, improving business optimism, and rise in public and private capex should bolster investment going forward.

December 8, 2023 11:45 AM

RBI keeps inflation estimates unchanged; LIVE Updates

The Indian central bank keeps its FY24 inflation forecast unchanged at 5.4%.

December 8, 2023 10:36 AM

RBI on retail loan measures; LIVE Updates

The RBI says that it can’t wait for the house to catch fire and then take steps to curb retail loan growth.

December 8, 2023 10:32 AM

Battle against inflation; LIVE Updates

The RBI governor says that headline inflation continues to remain volatile. The inflation target of 4% is yet to be reached, says Shaktikanta Das.

December 8, 2023 10:27 AM

RBI raises India’s GDP growth forecast; LIVE Updates

The Indian central bank raised its GDP growth estimate to 7% from 6.5% for FY24.

December 8, 2023 10:21 AM

RBI flags off inflation risk; Stock Market LIVE Updates

RBI Governor Shaktikanta Das said that uptick in food inflation may lead to increase in inflation numbers.

December 8, 2023 10:18 AM