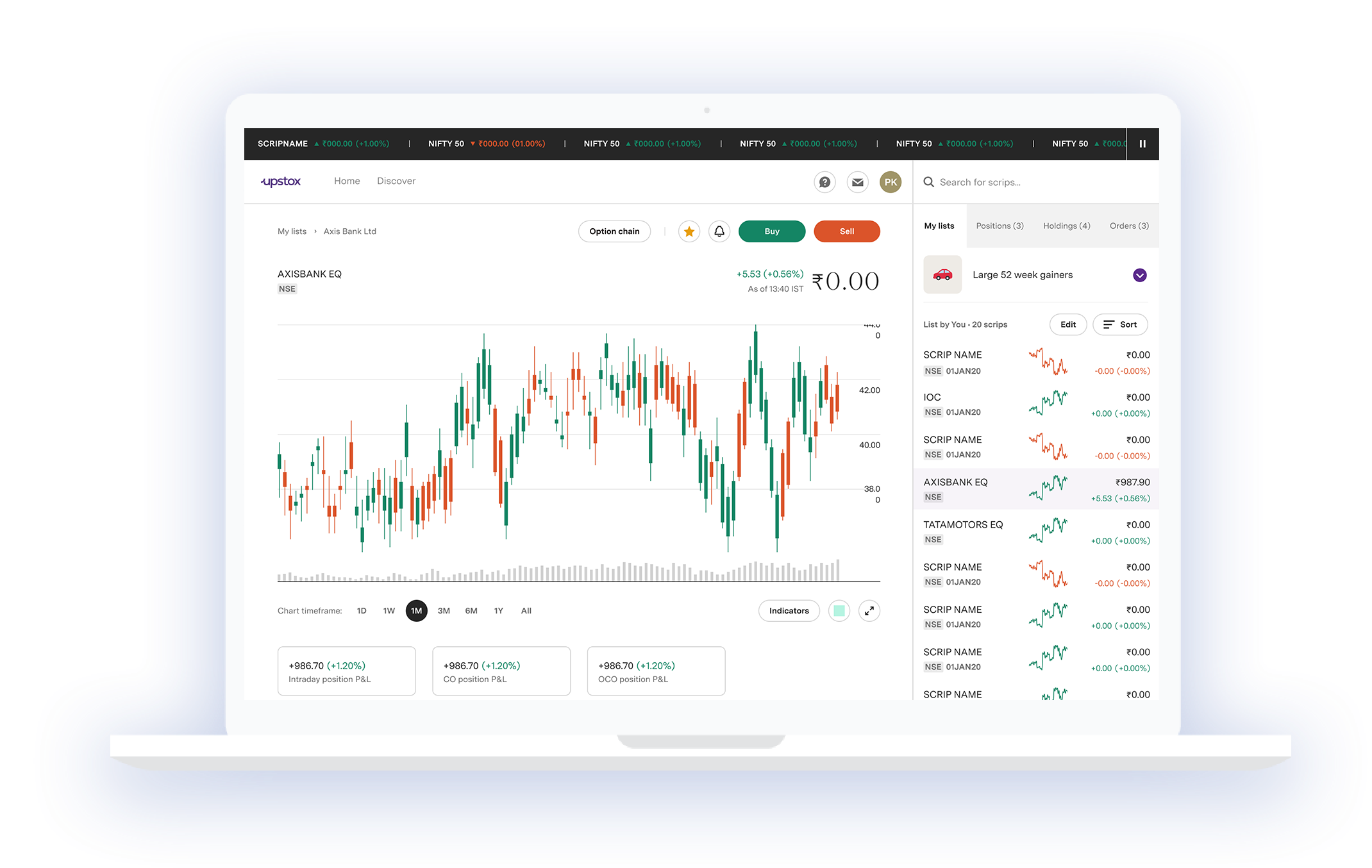

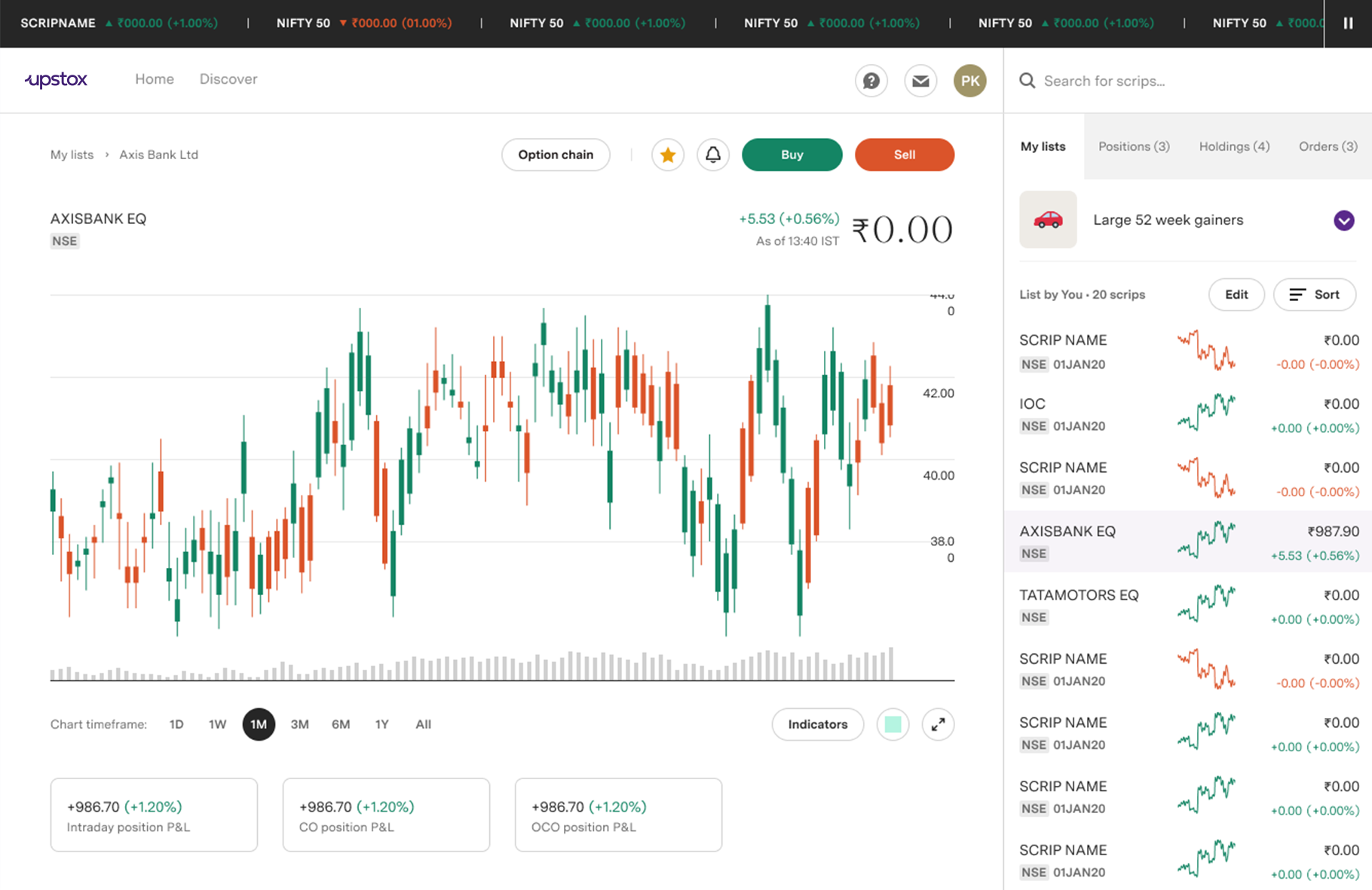

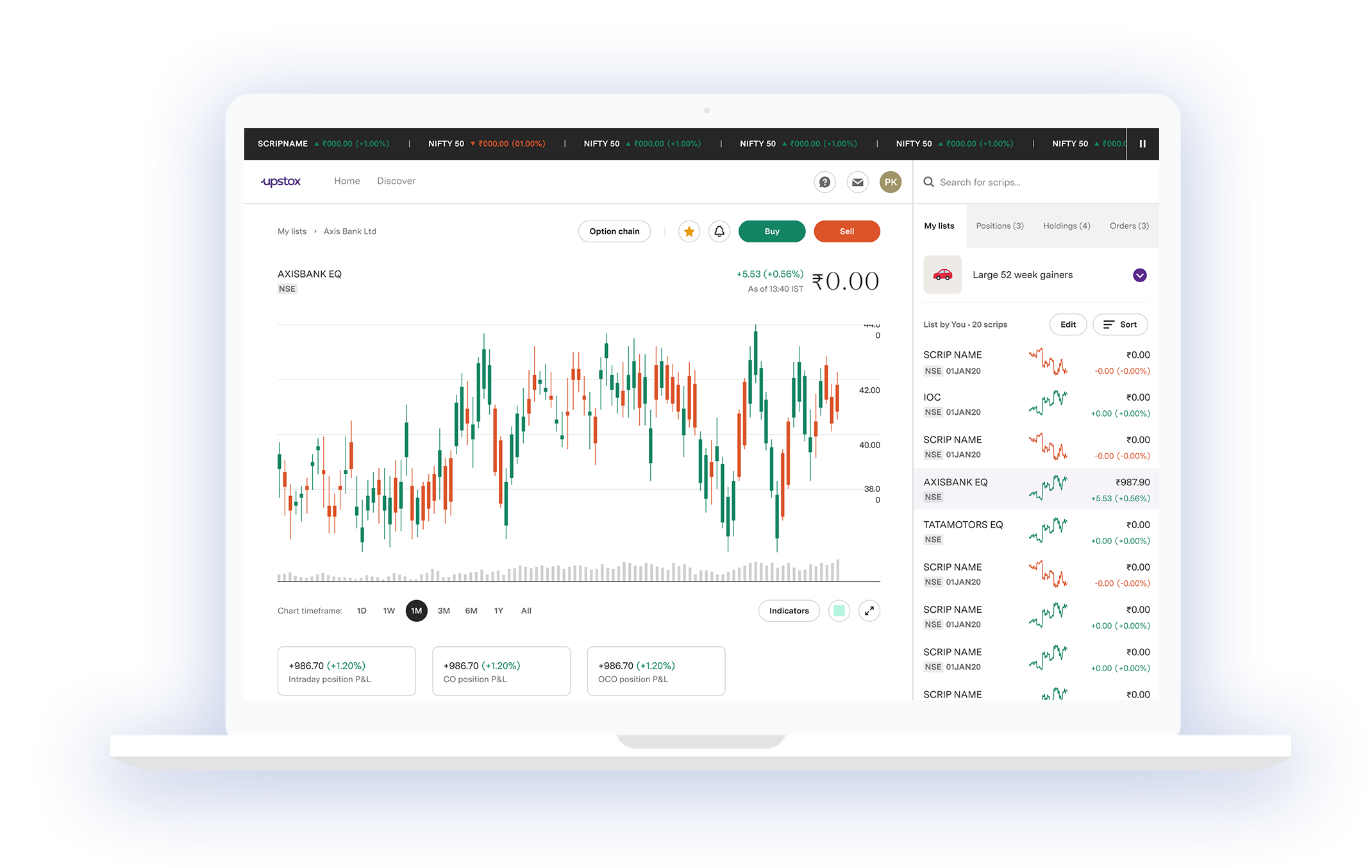

Analyse Markets Smartly

POWERFUL CHARTS

We give you the best charting

tools to spot market

trends and make informed decisions.

100+ INDICATORS

You can customize your charts

with 100+ indicators and become a truly pro trader.

Buy & Sell Quickly

Place Pro Orders

Placing cover orders &

bracket orders just became more simple.

Delightful Experience

Stay Organized

Set up your workspaces the way you want! Neatly shuffle around your trading systems.

Personalize

Make the platform work for you in your unique trading style with the widgets features.

Join the Upstox family today!