Overview of tax deductions for the self-employed in 2024

Upstox

3 min read • Updated: February 21, 2024, 1:30 AM

Summary

In the post-Covid era, self-employment has witnessed a considerable rise in recent years. As per a study conducted by the Centre For Monitoring Indian Economy (CMIE), self-employment increased by a staggering 55% between 2016 and 2023.

In post-Covid India, self-employment has witnessed a considerable rise in recent years. As per a study conducted by the Centre For Monitoring Indian Economy (CMIE), self-employment increased by a staggering 55% between 2016 and 2023.

This increase has also resulted in a rise in individuals subject to income tax as independently employed. Self-employed taxation is calculated differently compared to salaried individuals because the income sources vary.

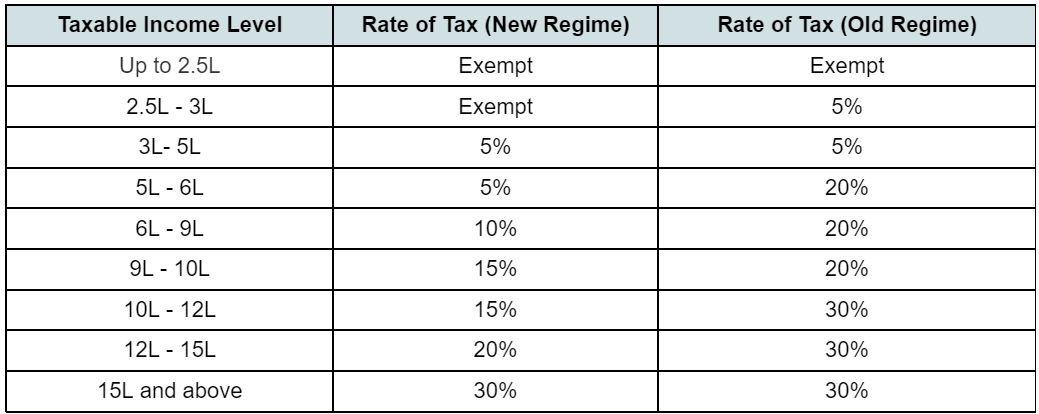

Here’s a brief overview of income tax for self-employed individuals

Who is self-employed?

A self-employed taxpayer is a person who does not receive a salary or fixed wage from a company. The person is either in an occupation of trade, commerce, manufacturing, or similar operations. Or they offer services to other companies and individuals without having a long-term contract. Furthermore, if a person chooses to follow a career in which they are skilled, such as medicine, law, architecture, etc., they are referred to as self-employed professionals.

Self-employed individuals have two ways to figure out their taxable income. First, they pay taxes under the presumptive taxation structure using ITR Form 4 under Section 44ADA. The second alternative is to utilise ITR Form 3, which either a Hindu United Family (HUF) or an individual may use.

Tax deductions

To assist self-employed people in lowering their tax obligations, the Indian government permits a number of income tax deductions. The Income Tax Act provides self-employed taxpayers with the following standard tax deductions under different provisions.

Expense claims

There are several costs associated with operating a business or pursuing self-employment. To lower your taxable income, you can deduct certain costs that are specified in the Income Tax Act. To be eligible for a deduction, though, you will need to present valid documentation of these expenses. These may include travelling expenses, purchasing office supplies, utility bills, professional charges incurred, etc.

Business loan interest

You are eligible to deduct the interest paid on any business loans you have taken out in order to build or extend your business. The interest you pay on your business loan is considered as a cost of your business.

Section 87A

A further deduction of ₹ 12,500 is available to self-employed taxpayers if they have chosen to submit their ITR under the new income tax system. This deduction, however, is only accessible to taxpayers who, after deducting everything under other provisions, have an annual taxable income of less than ₹ 7 lakh.

Section 80C

Investments made in specific tax-saving instruments are eligible for a tax deduction of up to ₹ 1.5 lakh under Section 80C. Usually with predetermined lock-in periods, these are long-term savings products that can save up a healthy sum in taxes.

If you haven't already made tax-saving investments that are eligible for deductions under section 80C, Equity Linked Saving Schemes are a great option for you to consider.

ELSS

Equity Linked Saving Schemes, as the name suggests, are investment options that are related to equity. ELSS helps investors maximise their returns while reducing income-tax liabilities.

With a maximum lock-in term of just three years, ELSS invests your money primarily in stocks or comparable products that yield better returns over a longer period of time. Furthermore, under section 80C of the Income Tax Act, ELSS investments can get a deduction of up to Rs 1.5 lakh per year.

Conclusion

Self-employed individuals have the freedom to control how they handle their taxes. If you are independently employed and looking for an end-of-year tax-saving investment to make, consider options like ELSS, PPF, National Pension Scheme, and ULIPs.