Old vs new tax regime: Six things taxpayers should know before making a decision

Upstox

2 min read • Updated: April 10, 2024, 9:58 AM

Summary

The new tax regime has significantly lower tax rates, but the benefits of deductions and exemptions (other than ₹50,000 standard deduction from salary and ₹15,000 from the family pension) are not available.

The new financial year (FY 2024-25) began on April 1, and salaried taxpayers must choose between the old and the new tax regimes.

The new tax regime is the default option, but taxpayers can still select the old regime if it is more beneficial for them. Before choosing the tax regime, here are key points you should note.

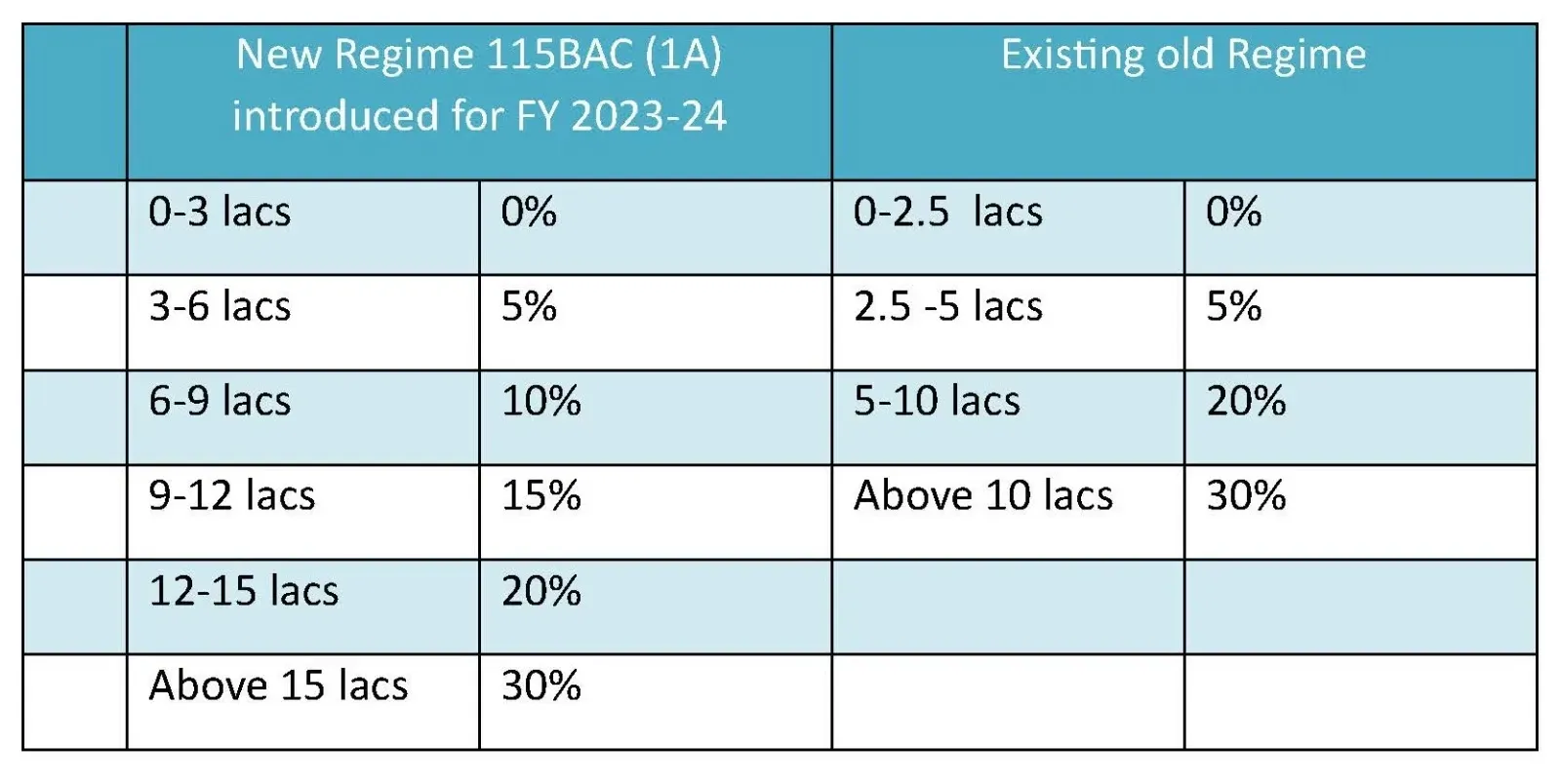

New tax regime vs old tax regime

-

The new tax regime has significantly lower tax rates, but the benefits of deductions and exemptions (other than ₹50,000 standard deduction from salary and ₹15,000 from the family pension) are unavailable.

-

The old regime offers various exemptions and deductions such as Sections 80C (expenses, investments) and 80D (medical costs), leave travel allowance (LTA) and house rent allowance (HRA).

-

However, the old tax regime has a complex structure with higher tax rates in some brackets.

-

Those earning between ₹3 and ₹5 lakh would be taxed at 5% under both the regimes. Under the new taxation regime, taxpayers earning from ₹6-₹9 lakh will be taxed at 10%, compared to 20% under the old regime. For those earning above ₹10 lakh, the tax rate is 30% under the old regime, while the new regime taxes individuals earning from ₹9-12 lakh at 15%, those in ₹12-₹15 lakh bracket at 20%, and those earning more than ₹15 lakh at 30%.

-

The new tax regime offers a full rebate on an income up to ₹7 lakh. At the same time, this limit for the old tax regime is on income up to ₹5 lakh. It means taxpayers earning up to ₹7 lakh will not pay tax under the new regime.

-

For example, if your salary is ₹8,00,000, then the old tax regime would be beneficial if deductions are more than ₹1,38,500. Similarly, if you earn ₹15,00,000, your deduction needs to be ₹3,58,000 under the old tax regime to break even with the new tax regime.