Weekly wrap 26 to 28 March: NIFTY, SENSEX rally for two sessions to end FY24 on a high

Upstox

4 min read • Updated: March 30, 2024, 9:56 AM

Summary

As the new financial year begins on April 1, the market observers and investors will keep a watch on a series of global and domestic factors. The US unemployment data, expected to be out in the first week of April, is likely to affect investor sentiments.

- Key indices NIFTY and SENSEX posted gains in two of three sessions

- NIFTY, SENSEX closed FY24 with gains up to 28%

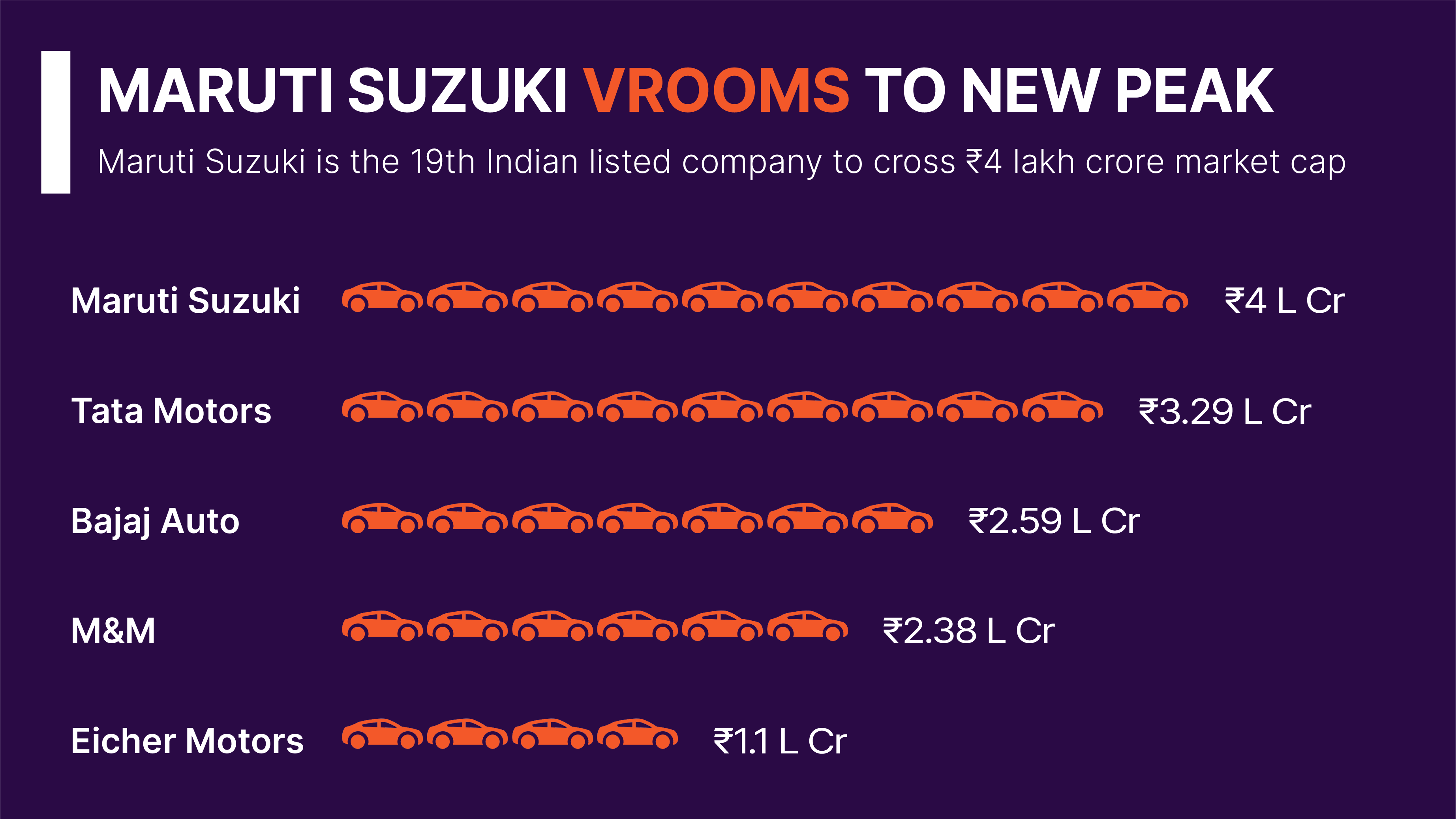

- Maruti Suzuki shares hit an all-time high of ₹12,726.8 apiece on Wednesday on the NSE

- Maruti Suzuki became the 19th Indian listed company to surpass ₹4 lakh crore market capitalisation

Hey there! We are back with a quick recap of the markets in the last week of FY24.

Indian stock markets closed with healthy gains in the holiday truncated week. Several stocks made remarkable recovery as benchmark NIFTY, SENSEX ended the current fiscal in positive territory with gains up to 28%.

Buying by foreign institutional investors and US stocks hitting record high levels boosted the market sentiment. A strong macro forecast by the Reserve Bank of India (RBI) also aided this week's rally. Though the markets opened for three sessions, volatility prevailed due to the monthly expiry of the derivatives contracts.

In two of three sessions, NIFTY and SENSEX posted gains as foreign investors turned net buyers in Indian equities. Stock markets opened on a weak note on Tuesday after remaining closed for Holi on Monday.

NIFTY dropped by nearly 0.5% to 22,000 level and SENSEX by 0.64% on Tuesday, cutting short their three-day winning run. Key indices dropped mainly due to losses in index heavyweights Reliance Industries, HDFC Bank, TCS and Infosys. The broader market showed resilience, with midcap indices gaining over 1%.

SENSEX and NIFTY rebounded on Wednesday, March 27, as a healthy growth forecast for India by global rating agencies gave a boost to auto, banking and oil shares. NIFTY reclaimed the 22,100 level and SENSEX jumped 0.73%.

The key indices continued their winning march on the last trading day of FY24 despite monthly expiry in the F&O segment. Across-the-board buying by domestic and foreign investors helped NIFTY rise nearly 1% and settle above the 22,300 mark.

The indices inched towards their record levels in intra-day trade, with NIFTY crossing 22,500 and SENSEX reclaiming 74,000. However, the indices trimmed gains in the fag-end. NIFTY closed the week at 22,326.90 and SENSEX at 73,651.35.

On a weekly basis, NIFTY rose by 1.04% while SENSEX advanced by 1.12%.

Among sectoral indices, realty, consumer durables, healthcare, oil & gas, PSU banks, and auto were the major gainers this week. NIFTY Media dropped around 3%, while the IT index declined up to 1% this week.

NIFTY and SENSEX closed FY24 with total gains of 28.6% and 24.8% respectively. Investor wealth zoomed around ₹128 trillion in the fiscal ending on March 31, 2024.

Maruti breaches ₹4 lakh crore market cap

Maruti Suzuki shares hit an all-time high of ₹12,726.8 apiece on Wednesday on the NSE, helping its market cap to surpass ₹4 lakh crore. In the last session of the week on Thursday, Maruti shares settled at ₹12,600.35 apiece, bringing down the valuation of the company to ₹3.96 lakh crore.

Besides being a leader in the Indian passenger vehicle market, Maruti's focus on exports and utility vehicles has driven growth. The auto giant hit the ₹2 lakh crore valuation mark in May 2017 and ₹3 lakh crore milestone in July 2023.

25 stocks start T+0 settlement cycle journey on NSE, BSE

As many as 25 stocks, including SBI, Bajaj Auto, JSW Steel, Nestle, Vedanta, Hindalco Industries, Cipla, BPCL, MRF, Trent, Tata Communications, ONGC and Ambuja Cements, started the T+0 trade settlement cycle on NSE and BSE on Thursday.

Settle settlements will be done on the same day under the T+0 system introduced by the Securities and Exchange Board of India (SEBI). This would bring cost and time efficiency for investors and brokerage firms while ensuring transparency in charges.

The week ahead

As the new financial year begins on April 1, the market observers and investors will keep a watch on a series of global and domestic factors. The US unemployment data, expected to be out in the first week of April, is likely to affect investor sentiments. The policy rate signals by RBI and the Q4FY24 forecasts may change the momentum in the broader market.