Weekly outlook (4-7 March): Global cues to dictate the trend?

Upstox

5 min read • Updated: March 4, 2024, 8:24 AM

Summary

Experts believe that the recovery in the banking sector, especially in the leading private banks, could add to the positive momentum of the BANK NIFTY and help it consolidate its recent gains. However, traders are advised to keep a close eye on global market developments, especially speeches and testimonies by Federal Reserve Chairman Jerome Powell.

Markets closed higher for the third week in the row and closed above its previous all-time high on closing basis. The NIFTY50 advanced 0.7% and closed at 22,378, while the SENSEX gained 0.9% and ended the week at 79,806. The sharp upmove was aided by positive global cues, better than expected third quarter GDP data and upbeat auto sales numbers.

However, the broader markets underperformed there benchmark peers. The NIFTY Midcap 100 lost 0.6% and the Smallcap 100 closed flat.

Sectorally, the NIFTY Metal (+3.6%) and Auto (+1.5%) were the top gainers for the week, while Media (-5.0%) and IT (-1.1%) lost the most.

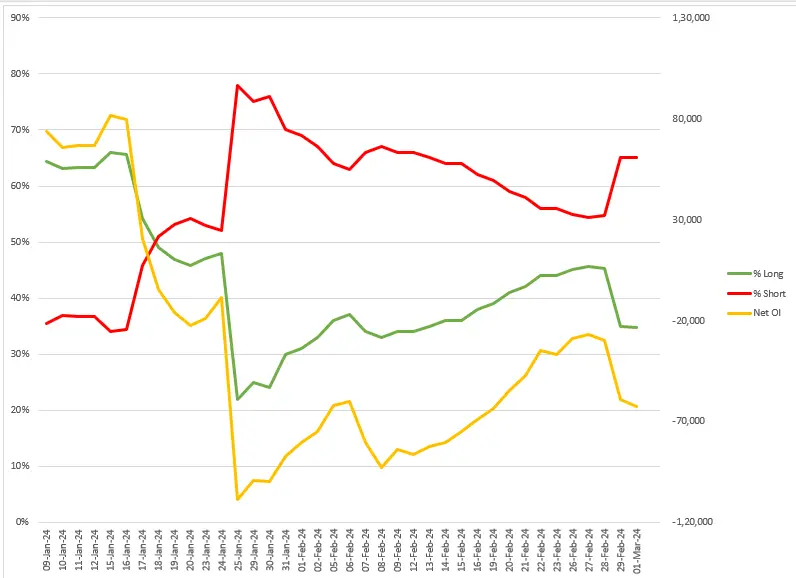

Index breadth- NIFTY50

The NIFTY 50 maintained its positive momentum throughout the week, trading consistently above its 20-day moving average (DMA). While a sharp correction occurred near the monthly expiry, the index found support at its 20 DMA, preventing a sustained downward move.

Currently, 64% of the NIFTY 50 stocks are trading above its 20 DMA, indicating a sustained bullish sentiment. This is an improvement from a brief dip below 50% near the expiry. The breadth indicator tends to hover between 50% and 70%, indicating consolidation. A reading above 70% could signal potential new highs for the index. Traders are advised to monitor the breadth of the NIFTY 50 stocks closely next week to gauge the overall momentum of the market.

FIIs positioning in the index

Foreign Institutional Investors (FIIs) remain net-short in the March series index futures, with the current long-to-short ratio at 34:65 as of March 1. This translates into a net open interest of -62,761 contracts.

It's important to note that FIIs remained net short throughout the February series. While the long-short ratio is informative, a closer look at the unwinding of short contracts provides a clearer picture. As the chart below shows, support-based buying around the 21,700 level coincides with a visible reduction in FII short positions.

With the March series starting with a 64% short position, traders should monitor any further unwinding to gauge the momentum of the trend.

Click here to track open positions of FIIs in the index futures: Login https://pro.upstox.com/

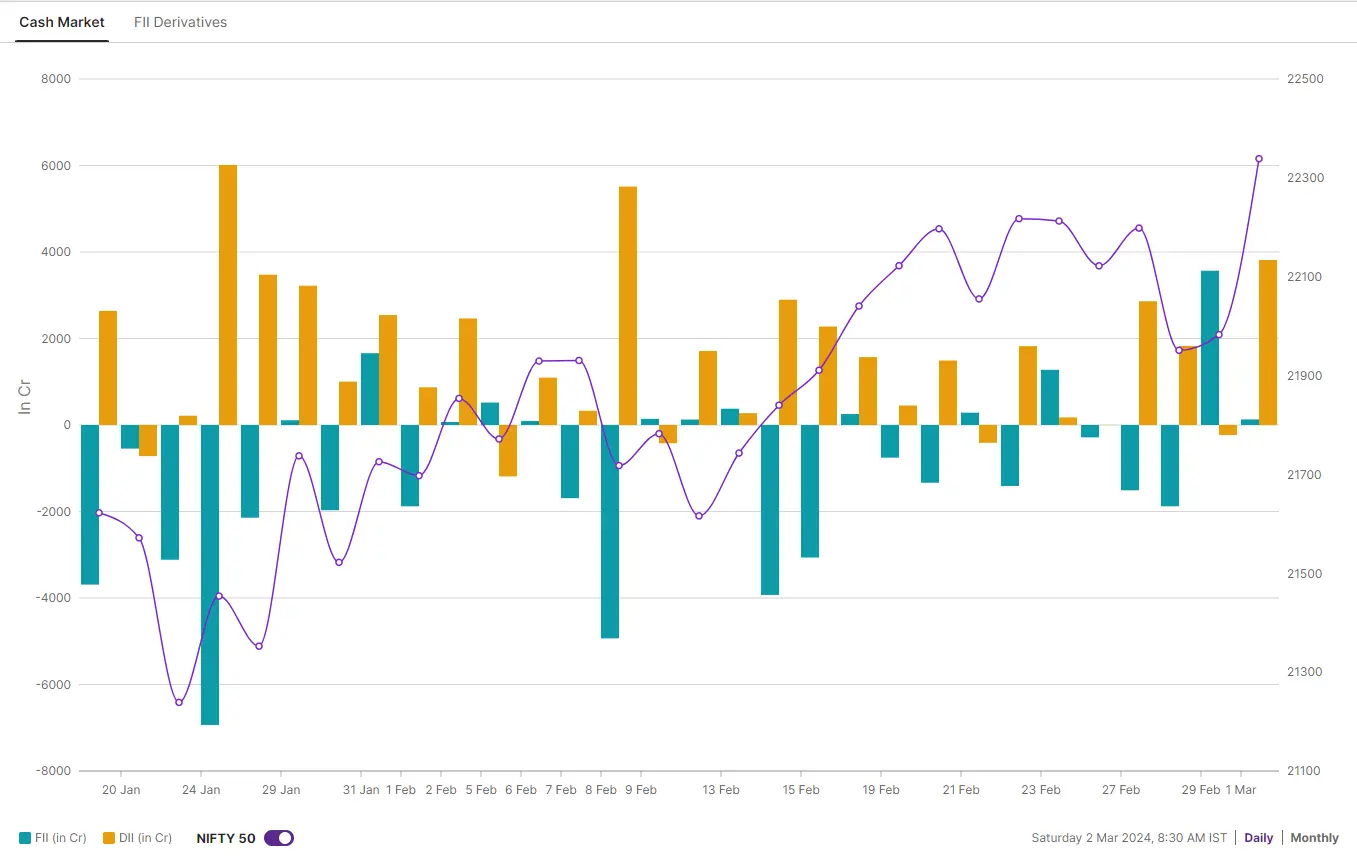

The reduction in bearish bets was again in line with the reduced selling by FIIs in the cash market. As of March 1, the FIIs purchased shares worth ₹23 crore on the net basis, while Domestic Institutional Investors (DIIs) pumped in ₹8,268 crore, resulting in net positive institutional activity of ₹8,291 crore for the week.

(Updated as of 1 March)

(Updated as of 1 March)

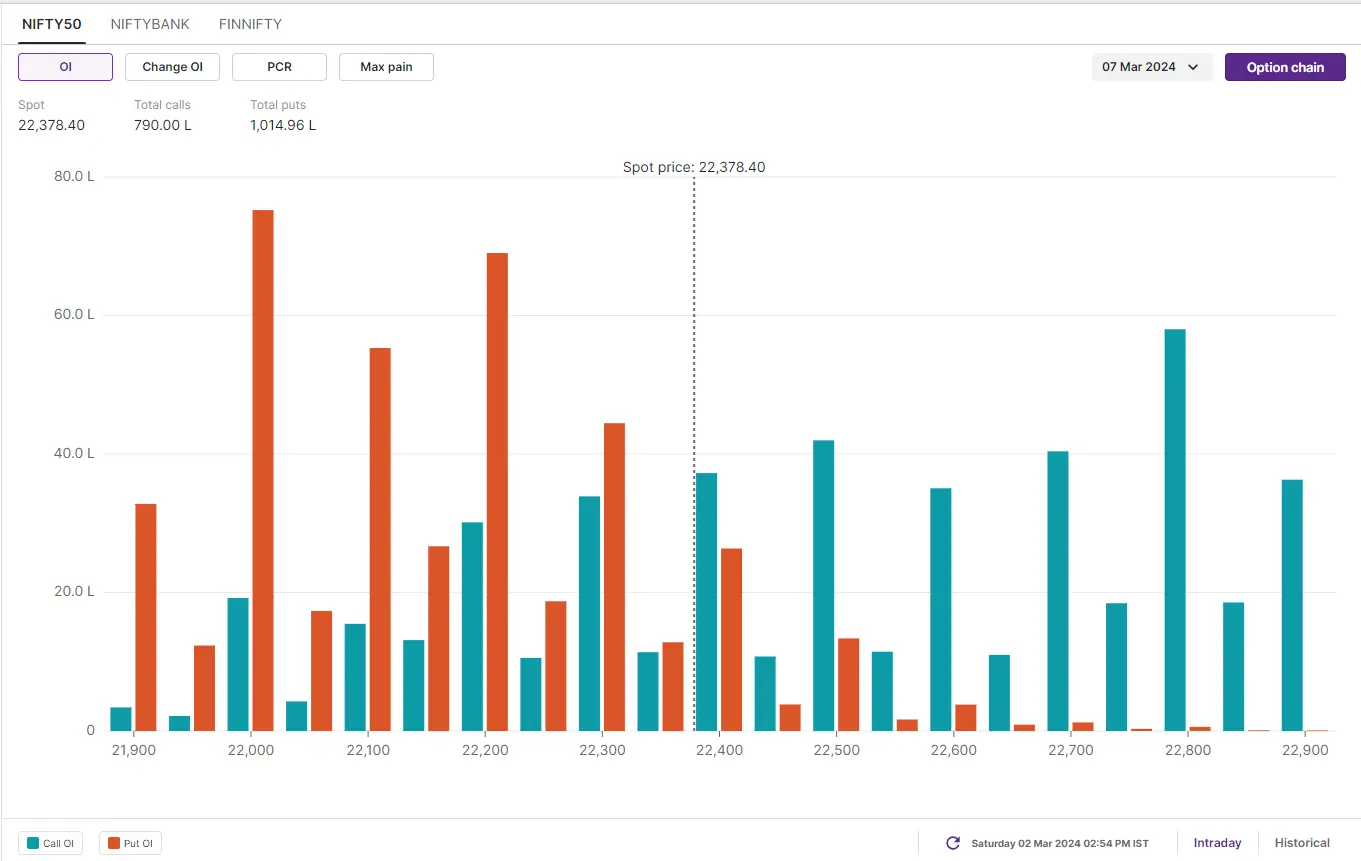

F&O - NIFTY50 outlook

For the 7 March expiry, the initial OI build-up of call writers is concentrated at the 23,000 and 22,800 strikes. The bulls, on the other hand, have established their put base at the 22,000 and 22,000 strikes. Based on options data, the NIFTY50 is expected to trade between 21,600-22,900 in the upcoming week.

According to the experts, the NIFTY50 formed a bullish candle on the weekly chart and closed above the previous week's high, indicating a strong presence of buyers. Going forward, immediate support for the index is at the 20-day moving average (around 22,000).

F&O - BANK NIFTY outlook

For the 6 March expiry, significant call OI of BANK NIFTY was observed at 49,000 and 48,000 strikes, while the maximum put writing occurred at 47,000 and 45,000 strikes. Based on the options data, BANK NIFTY is expected to trade between 45,800 and 48,700 in the upcoming week.

The BANK NIFYY remained under pressure throughout the week and traded sideways till the expiry. However, the index rallied over 2% just one day after the expiry of February F&O contracts and zoomed past the 47,000 mark. On the weekly chart, the BANK NIFTY formed an inverted hammer (marked with black arrow), which is considered as a reversal pattern. After the four weeks, with sharp bouts of volatility the index has closed above the high of the inverted hammer, indicating continuation of the positive momentum.

📅 Events in focus: US Services PMI data, U.S. Federal Reserve Governor Jerome Powell to testify before Joint Economic Committee and Non Farm Payrolls data of February will be the key events which can stir the market next week.

⚡Mark your calendars: Indian markets will be closed on Friday, March 8th for Maha Shivratri.

📊Stocks in focus: As per the open interest and futures prices, IEX, Havells, National Alluminium and SAIL saw long build-up. Similarly, to track the OI losers login https://pro.upstox.com/ ➡️F&O➡️Futures smartlist➡️OI Gainers/OI Losers/Most active.

📓✏️Takeaway: In last week's takeaway we told our readers to keep an eye on HDFC Bank as it could provide some respite to the BANK NIFTY. This week, both HDFC Bank and BANK NIFTY bucked the trend and closed in green.

Experts believe that the recovery in the banking sector, especially in the leading private banks, could add to the positive momentum of the BANK NIFTY and help it consolidate its recent gains. Moreover, the positive impact of banks on the NIFYY50 has pushed the key support level from 21,300 to 21,700. However, traders are advised to keep a close eye on global market developments, especially speeches and testimonies by Federal Reserve Chairman Jerome Powell.

As always, we'll keep you informed of any significant movements and potential opportunities via our morning trade setup blog, available every day before the market opens at 8 am.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.