Weekly outlook (11-15 March): Inflation, BANK NIFTY nears all-time high, F&O cues to watch

Upstox

5 min read • Updated: March 11, 2024, 8:55 AM

Summary

Last week's positive momentum in the banking sector lifted both the BANK NIFTY and the NIFTY50. All eyes will now be on this week's inflation data. With the BANK NIFTY nearing its peak, traders will be watching its price action closely for further clues.

The markets extended their winning streak for the fourth consecutive week and hit a new all-time high. The NIFTY50 gained 0.5% to close at 22,493 while the SENSEX gained 0.4% to end the week at 74,119.

The border markets continued their under performance. The NIFTY Midcap 100 and Smallcap 100 lost 0.3% and 2.8% respectively.

Sector-wise, PSU Banks (+3.1%) and Pharma (+1.5%) were the top gainers, while Media (-3.2%) and IT (-1.5%) extended their losing streak and were the top losers.

Index breadth- NIFTY50

Consolidation with minor gains at higher levels was also in line with our breadth indicator, which shows that more than 50% of the NIFTY50 stocks are trading above their 20-day moving average (DMA). Currently, 66% of the NIFTY50 stocks are trading above their 20 DMA.

As highlighted earlier, the breadth indicator tends to hover between 50% and 70%, indicating consolidation with a positive bias. Traders are advised to monitor the breadth of the NIFTY 50 stocks closely next week to gauge the exhaustion and overall momentum of the market.

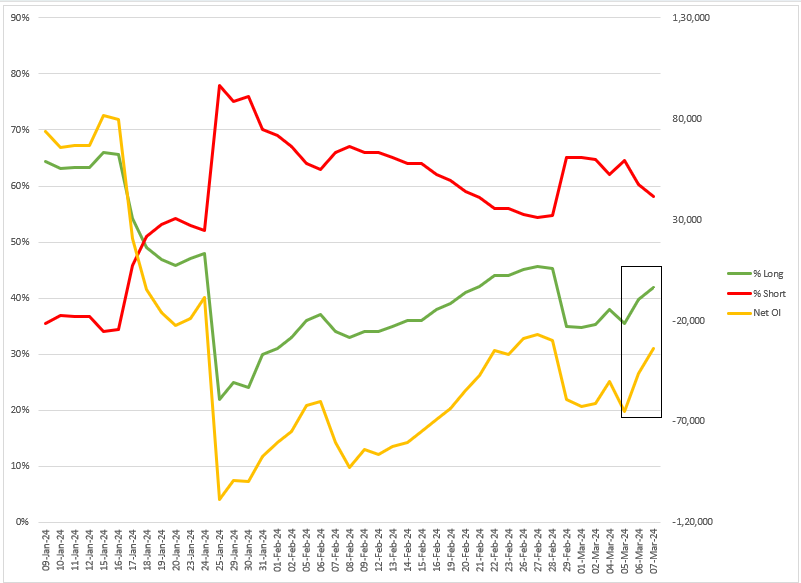

FIIs positioning in the index

After starting the March series with a long-short ratio of 34:65, the Foreign Institutional Investors (FIIs) continued to reduce their shorts in the index futures throughout the week. Currently, FIIs open interest (OI) in the index futures is 58% short. This translates into a net OI of -33,795, down 46% from the previous week's peak.

As mentioned in our blog last week, FIIs open interest in the index futures was net short for the entire February series. We told our readers to keep a close eye on the unwinding or adding of short contracts to get a clear understanding of the ongoing trend. As you can see in the chart below, the open interest of shorts has been reduced again from the 65% peak seen at the start of the March series.

Click here to track open positions of FIIs in the index futures: Login https://pro.upstox.com/

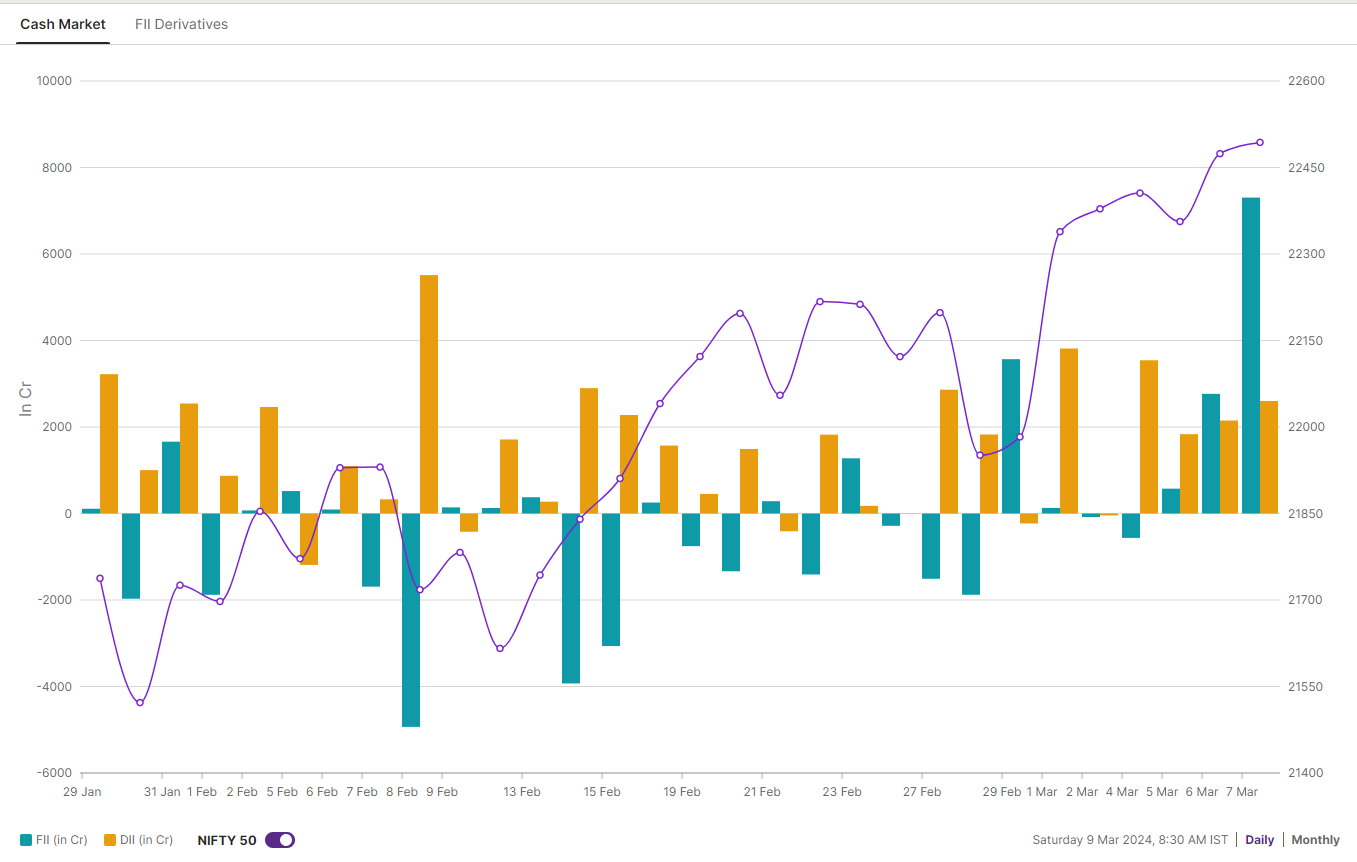

The reduction in short OI was also in line with the flows in the cash market. During the week, both the FIIs and Domestic Institutional Investors (DIIs) remained net buyers. The FIIs bought shares worth ₹9,999 crore and DIIs purchased shares worth ₹10,084 crore during the week, taking the net institutional flows to ₹20,083 crore.

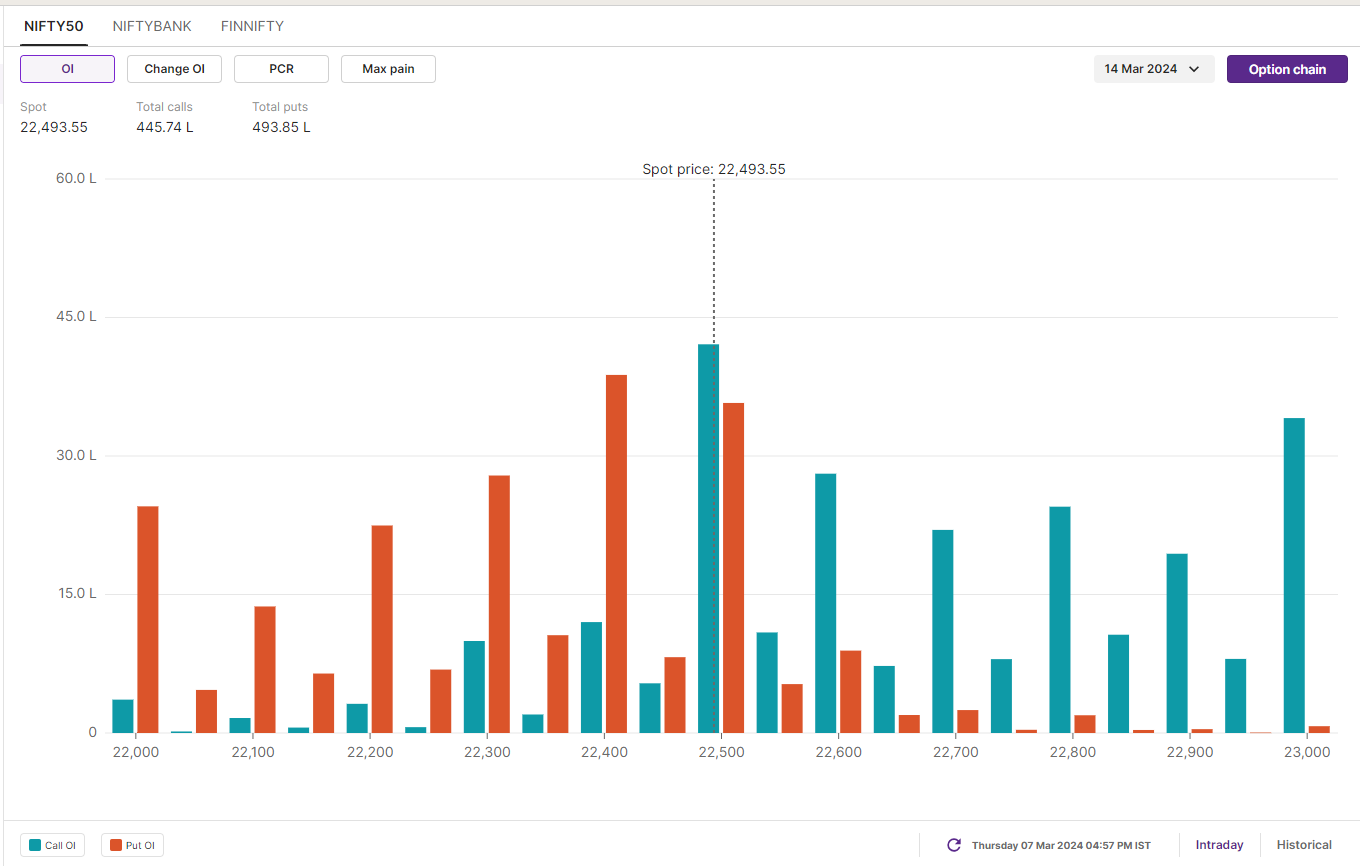

F&O - NIFTY50 outlook

For the 14 March expiry, the initial OI build-up of call writers is concentrated at the 22,500 and 23,000 strikes. The bulls, on the other hand, have established their put base at the 22,400 and 22,500 strikes. Based on options data, the NIFTY50 is expected to trade between 21,800 and 23,000 next week.

The NIFTY50 formed another bullish candle on the weekly chart, closing above the previous week's high for the third consecutive week. This further suggests support based buying at all-time highs. With the volatility index falling to 13.61 (-9.2% for the week), the bulls have established immediate support between 22,100 and 22,200, which also coincides with its 20 DMA.

F&O - BANK NIFTY outlook

For the 13 March expiry, significant call OI of BANK NIFTY was observed at 48,000 and 49,000 strikes, while the maximum put writing occurred at 48,000 and 47,500 strikes. Based on the options data, BANK NIFTY is expected to trade between 46,000 and 49,100 in the upcoming week.

In last week's blog we highlighted how the BANK NIFTY had formed an inverted hammer (marked in the image below). We advised our readers to pay close attention as last week's close was above the high of the reversal pattern, indicating positive momentum. For this week, the index has immediate support at 46,800-46,900 and immediate resistance at the all-time high (48,636).

📅Events in focus: Investors will be keeping a close eye on inflation data next week, with the release of the Consumer Price Index for both the U.S. and India.

💻Spotlight: Gold prices hit a new record high, extending their record run. Spot gold rose to $2,178 an ounce, up 4.6% from the previous week. This follows February's report from the U.S. which showed slower wage growth and a higher unemployment rate.

📊Stocks in focus: As per the open interest and futures prices, Tata Chemicals, Tata Power, Tata Steel and Bajaj-Auto saw long build-up. Similarly, to track the OI losers login https://pro.upstox.com/

📓✏️Takeaway: Last week's positive momentum in the banking sector lifted both the BANK NIFTY and the NIFTY50. All eyes will now be on next week's inflation data. With the BANK NIFTY nearing its peak, traders will be watching its price action closely for further clues. The good news is that both indices are currently in a positive structure on the daily charts, with higher highs and higher lows. This, along with strength in the banking sector, has helped the NIFTY50 consolidate support at 21,700.

For more clues, we'll keep you informed of any significant movements and potential opportunities via our morning trade setup blog, available every day before the market opens at 8 am.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.