Trade setup for 8 February: Can NIFTY50 climb past 22,000? RBI policy and bank stocks hold the key

Upstox

4 min read • Updated: February 8, 2024, 8:07 AM

Summary

As noted in our daily analysis, NIFTY50 is consolidating in a defined range between its all-time high (22,126) and 20-day moving average (DMA) around 21,700. The market is largely expecting the RBI to maintain the status quo on interest rates. However, with the U.S. Federal Reserve recently indicating that it will not cut interest rates in March, traders will be closely scrutinising the RBI Governor's statements for future interest rate guidance.

_67349.png)

Asian markets update 7 am

Indian equities are set to start the eventful day on a flat note, as indicated by the GIFTY NIFTY (+0.1%). Meanwhile, Asian markets are trading mixed ahead of the release of China’s inflation figures. Hong Kong's Hang Seng Index is down 0.2%, while Japan's Nikkei 225 is up 0.6%.

US market update

U.S. stocks rallied on Wednesday, buoyed by a wave of positive earnings reports and strong corporate guidance. The continued influence of artificial intelligence fuelled investor optimism, pushing the S&P 500 closer to the 5,000 mark, rising 0.8% to 4,995. The Dow Jones rose 0.4% to 38,667, while the Nasdaq Composite gained 0.9% to 15,756.

NIFTY50

February Futures: 22,003 (▲0.1%) Open Interest: 2,42,256 (▲0.5%)

Mirroring global optimism, the NIFTY50 opened above the key 22,000 level. However, profit booking, particularly in technology stocks, erased the gains leading to a flat close. Traders were cautious ahead of the crucial RBI rate decision tomorrow.

As noted in our daily analysis, the index is consolidating in a defined range between its all-time high (22,126) and its 20-day moving average (DMA) around 21,700. The market is largely expecting the RBI to maintain the status quo on interest rates. However, with the US Federal Reserve recently indicating that it will not cut interest rates in March, traders will be closely scrutinising the RBI Governor's statements for future interest rate guidance.

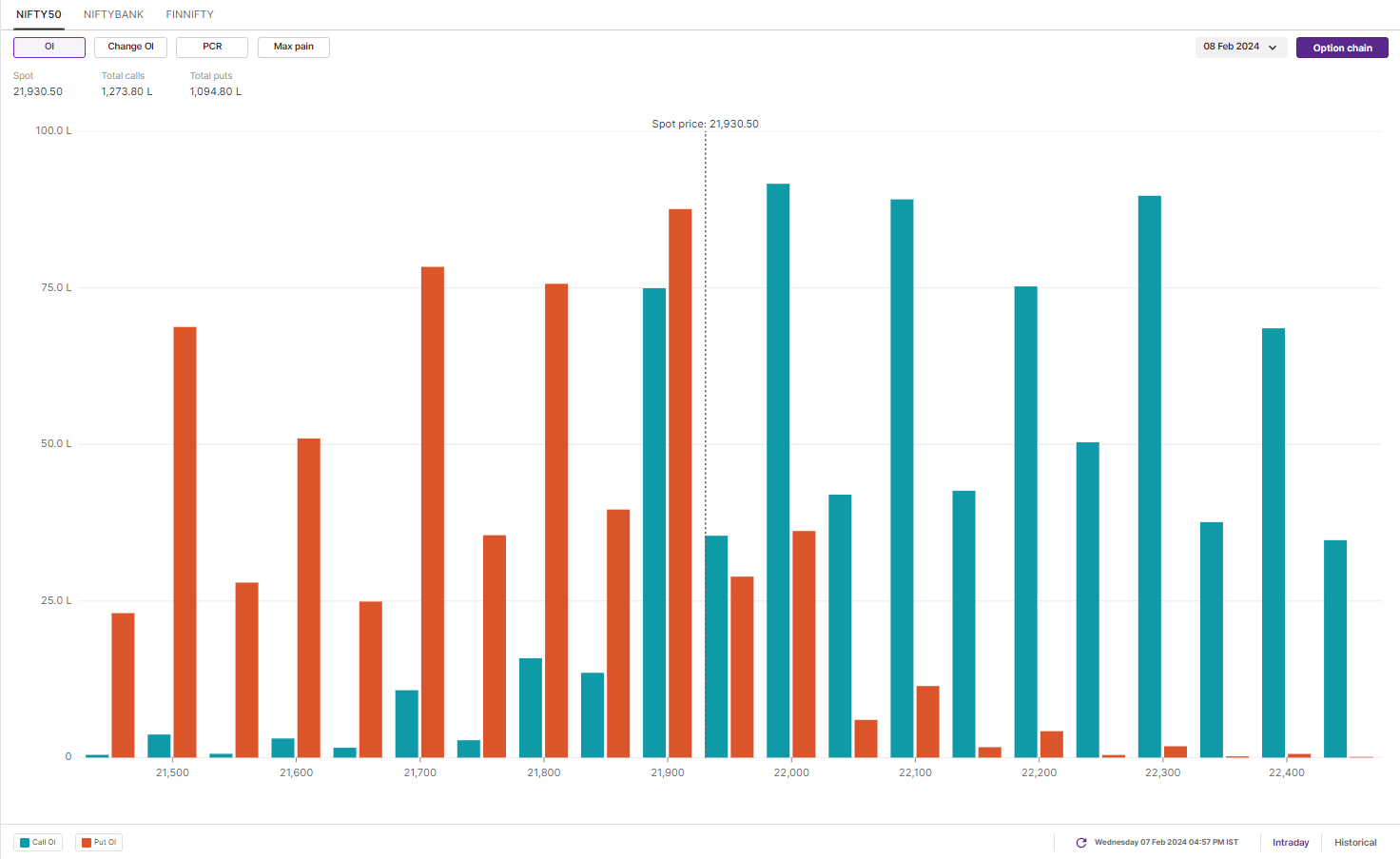

The NIFTY50 continues to trade within the range highlighted in our week ahead blog on Sunday. However, ahead of the RBI policy, open interest (OI) data shows that call OI is concentrated around 22,000 and 22,300 strikes, while puts see maximum open interest at 21,900 and 21,700 strikes. This translates into an expected trading range of 22,400 to 21,500 for today's expiry.

You can track open interest of the NIFTY50 here: https://pro.upstox.com/

BANK NIFTY

February Futures: 46,131 (▲0.5%) Open Interest: 2,12,393 (▲6.0%)

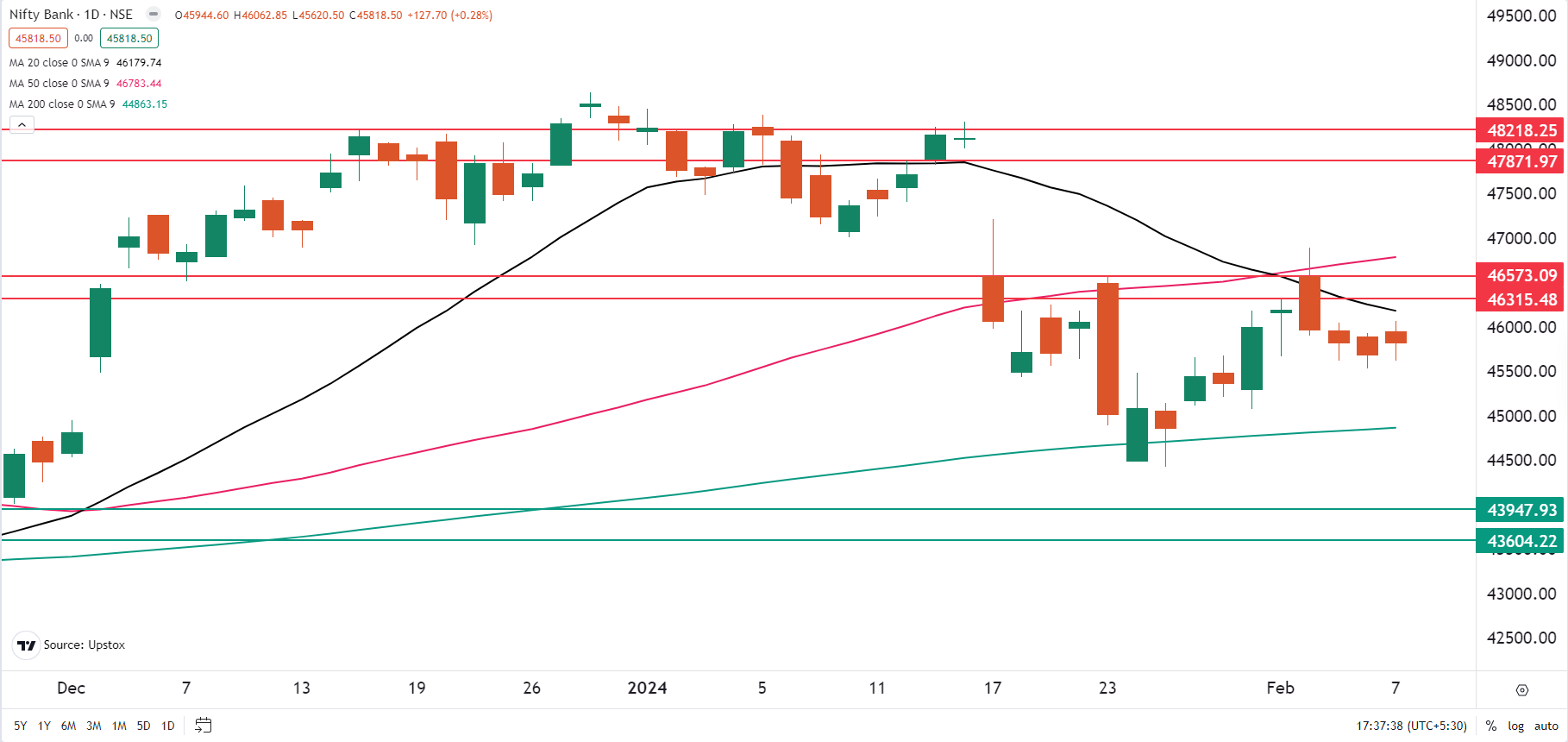

The Bank Nifty continued its sideways movement yesterday but managed to close in the green after three consecutive negative sessions. This was in line with our analysis in our morning trade setup blog, where we noted that the index has support near the budget day low of 45,600 and resistance near 46,000.

However, the upcoming RBI policy decision adds a layer of uncertainty. Market experts warn that the index could experience a breakout in either direction depending on the central bank's announcement. Notably, the index is currently trading in a consolidation zone between its 50- and 200-day moving averages, as shown in the accompanying chart. Traders can monitor price action around these levels and plan their trades accordingly.

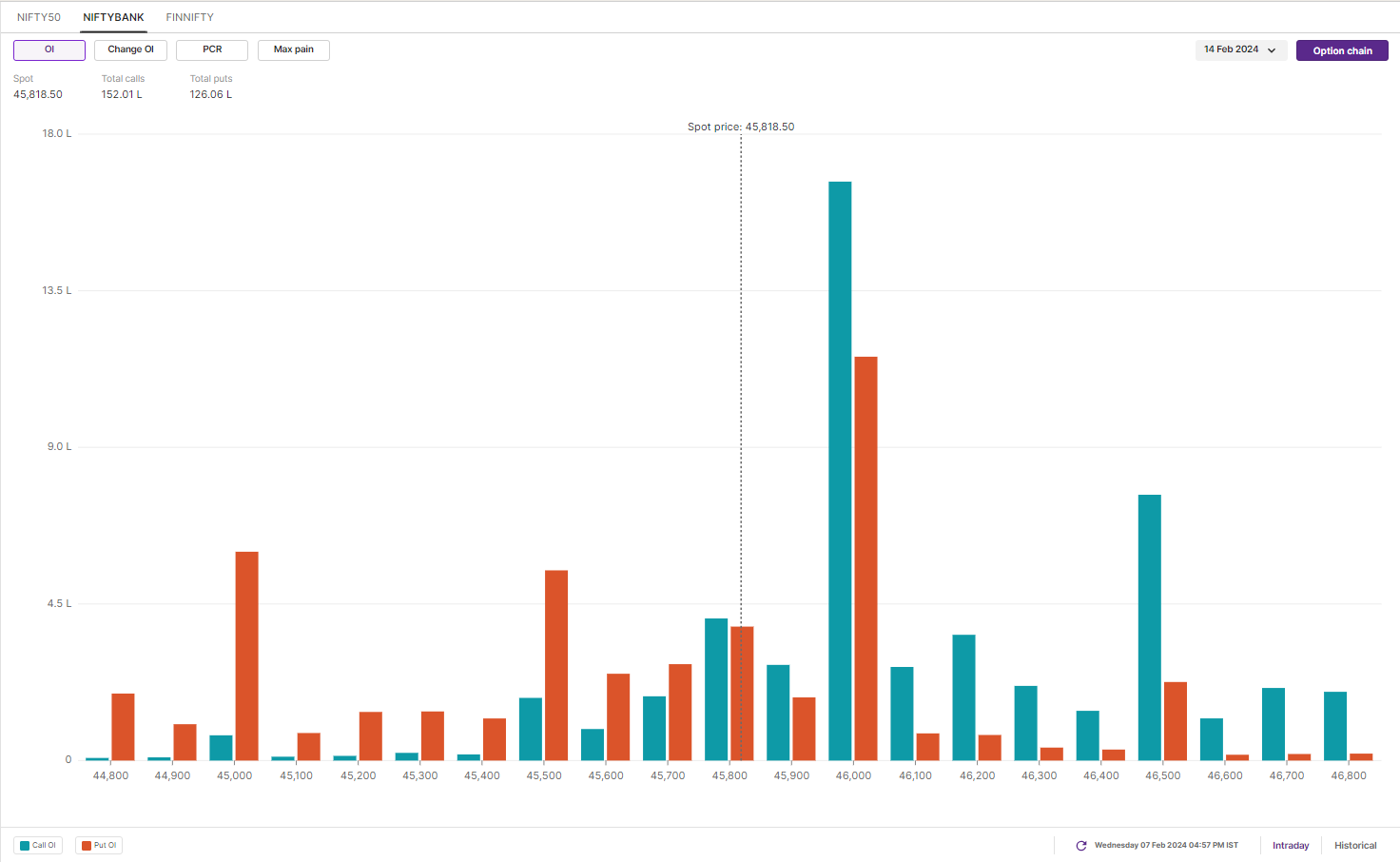

For BANK NIFTY's February 14th expiry, the options data shows high open interest at the 46,000 & 47,500 call option strikes and 46,000 & 44,000 put option strikes. As per the open interest, traders eye BANK NIFTY trading range between 47,200 and 44,500 for February 14th expiry.

You can track open interest of the BANK NIFTY here: https://pro.upstox.com/

FII-DII activity

In the cash market, the Foreign Institutional Investors (FIIs) sold shares worth ₹ 1,691 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹372 crore. The FIIs bought shares worth ₹92 crore, while DIIs purchased shares worth ₹1,096 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Trent, Delta Corp, Max Financial Services, Can Fin Homes and Vodafone Idea.

Short build-up: Indian Energy Exchange, Bank Of Baroda, Biocon and Power Grid.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.