Trade setup for 8 April: 8 things to know before the markets open

Upstox

4 min read • Updated: April 8, 2024, 8:06 AM

Summary

The NIFTY50 formed an inside bar on the daily chart. This two-day pattern signifies consolidation, with the range constrained within the Thursday’s high and low. Traders should keep a close eye on the breakout above Thursday’s high or low for potential directional clues.

Asian markets update 7 am

Indian equities are poised for a positive open today, as reflected by the GIFT NIFTY (+0.1%). Meanwhile, the other Asian markets are trading mixed. Japan’s Nikkei 225 is up 1.5%, while Hong Kong’s Hang Seng index is flat.

U.S. market update

U.S. stocks closed higher on Friday despite the U.S. economy adding 3,03,000 jobs in March, well above the estimate of 2,05,000. The unemployment rate also dipped to 3.8% from 3.9% in February. With payroll strength of March the odds of at least one rate cut by the end of the Fed’s June meeting now stands at 49%.

The Dow Jones gained 0.8% and closed at 38,904, while the S&P 500 gained 1.1% to 5,204. The Nasdaq Composite advanced 1.2% to 16,248.

NIFTY50

April Futures: 22,595 (▼0.01%)

Open Interest: 1,93,716 (▼1.26%)

Despite weak global cues, the NIFTY50 consolidated its gains around the 22,500 level to close in the green. This comes after the RBI decided to keep interest rates unchanged in its policy last week.

The NIFTY50 has formed an inside bar on the daily chart. This two-day pattern signifies consolidation, with the range constrained within the Thursday’s high and low. Traders should keep a close eye on the breakout above Thursday’s high or low for potential directional clues.

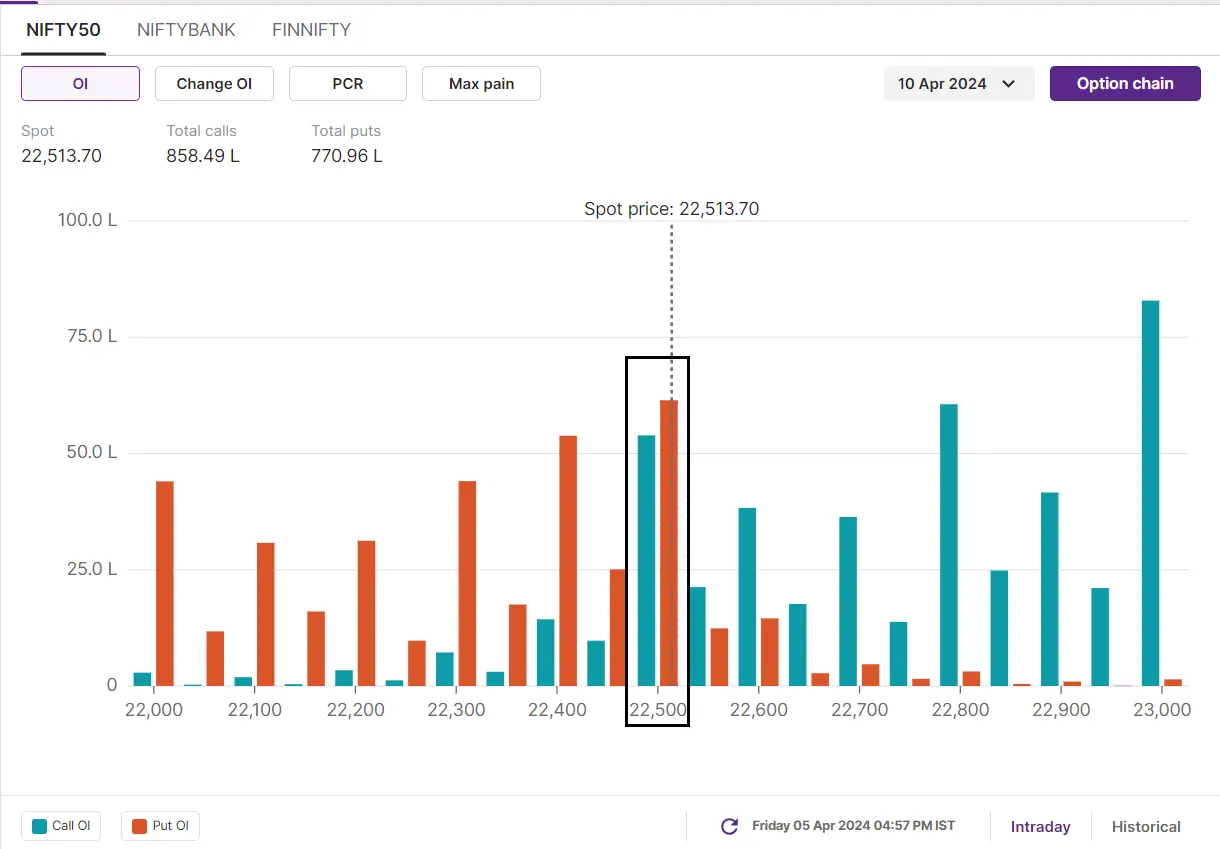

The Open Interest (OI) build-up for the 10 April expiry shows a significant call base at 23,000 and 22,800 strikes. On the other hand, the maximum put base is at 22,500 and 22,400 strikes. Based on options data, traders expect the NIFTY50 to trade between 21,900 and 22,900.

BANK NIFTY

April Futures: 48,658 (▲1.02%)

Open Interest: 1,38,134 (▲14.06%)

The BANK NIFTY extended its winning streak for the third consecutive day to close just shy of the psychologically important 48,500-mark. Led by gains in private sector banking heavyweights like HDFC Bank, the index is now 0.3% away from its all-time high.

As highlighted in our Friday’s blog, the BANK NIFTY formed a doji candle on the daily chart. We pointed out to our readers that the doji is considered as a neutral and highlights indecision of the investors. However, a close above or below the doji’s closing price will provide further clues of the ongoing trend. On Friday, the BANK NIFTY closed above the Thursday’s high (Doji candle) and continued its upward momentum. The immediate support for the index is now between 47,800- 48,000 zone.

For BANK NIFTY's 10 April expiry, the open interest build-up shows a significant base at the 50,000 & 48,500 call option strikes and 48,500 & 47,500 put option strikes. Based on the open interest, traders are eyeing BANK NIFTY’s trading range between 47,200 and 49,100 this week.

FII-DII activity

Foreign Institutional Investors (FIIs) turned net buyers and bought shares worth ₹1,659 crore, while the Domestic Institutional Investors (DIIs) sold shares worth ₹3,370 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Indraprastha Gas, Tata Chemicals, ICICI Prudential, ABB and Chambal Fertilisers

Short build-up: Asian Paints, Bharat Petroleum and Bajaj Finance

Under F&O ban: Bandhan Bank, Hindustan Copper, Steel Authority of India and Zee Entertainment

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.