Trade setup for January 29: Union Budget in focus, NIFTY50 and BANK NIFTY could remain range-bound

Upstox

4 min read • Updated: January 29, 2024, 8:16 AM

Summary

Since 20 January, the NIFTY50 has been consolidating between its 20 and 50 day moving averages (DMAs). With the Union Budget on the horizon, experts believe that the index may remain rangebound with more bouts of intraday volatility. For further clues, traders can keep a close eye on the 20 and 50 DMAs.

Asian markets update 7 am

Indian markets are set for a positive start today, with the GIFT NIFTY already up 83 points at 21,623. The positive sentiment is mirrored across Asia, with Japan's Nikkei 225 up 0.8% and Hong Kong's Hang Seng index gaining 1.4%.

U.S. market update

Mixed signals dominated U.S. equities on Friday. While core PCE, the Fed's preferred measure of inflation, fell below 3% to its lowest level since March 2021. On the other hand, the tech giant Intel tumbled on weak earnings and a gloomy outlook, dragging tech stocks lower. The Dow Jones gained 0.1% to 38,109, the S&P 500 was flat at 4,890 and the Nasdaq Composite slipped 0.3% to 15,455.

NIFTY50

February Futures: 21,488 (▼0.4%) Open Interest: 2,44,428 (▲33.0%)

The NIFTY50 had a subdued start to the session on Thursday, trading rangebound before closing lower at 21,352, down 0.4%. The decline was influenced by the underperformance of key sectors with IT (-1.6%), Pharma (-1.3%) and FMCG (-1.2%) declining the most.

Since the 20th January, the NIFTY50 has been consolidating between its 20 and 50 day moving averages (DMAs). With the Union Budget on the horizon, experts believe that the index may remain rangebound with more bouts of intraday volatility. For further clues, traders can keep a close eye on the 20 and 50 DMAs. A decisive break from these levels will determine the next direction of the market.

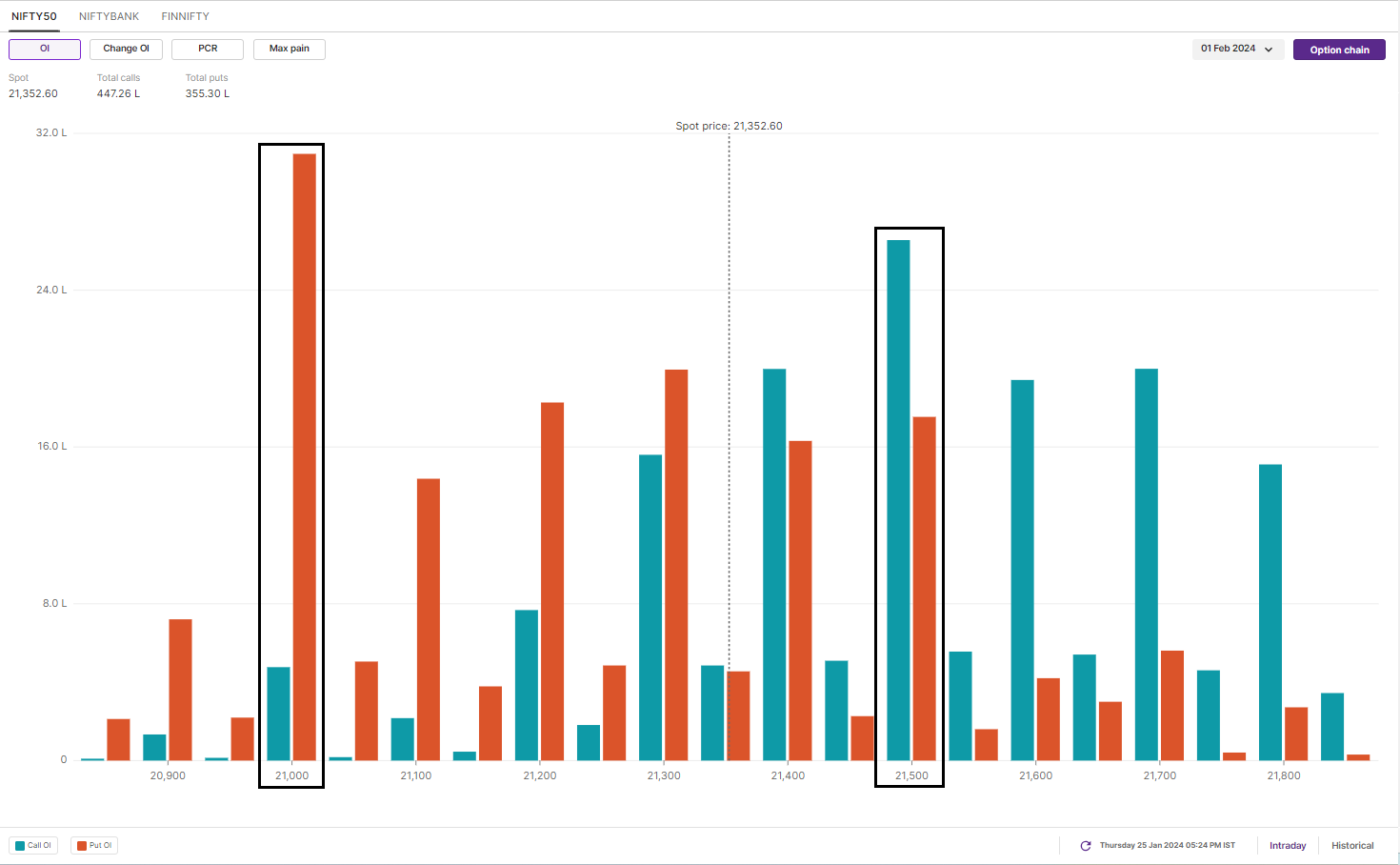

On the options front, the significant open interest for call options is placed at 21,500 and 22,000 strikes. On the other hand, highest open interest for put options lies at 21,000 and 21,300 strikes for 1 February expiry. As per the options data, the trading range for the NIFTY50 could be confined between 21,800 and 21,100 for the current week’s expiry.

You can track open interest of the NIFTY50 here: https://pro.upstox.com/

BANK NIFTY

February Futures: 45,291 (▼0.3%) Open Interest: 2,35,114 (▲80.0%)

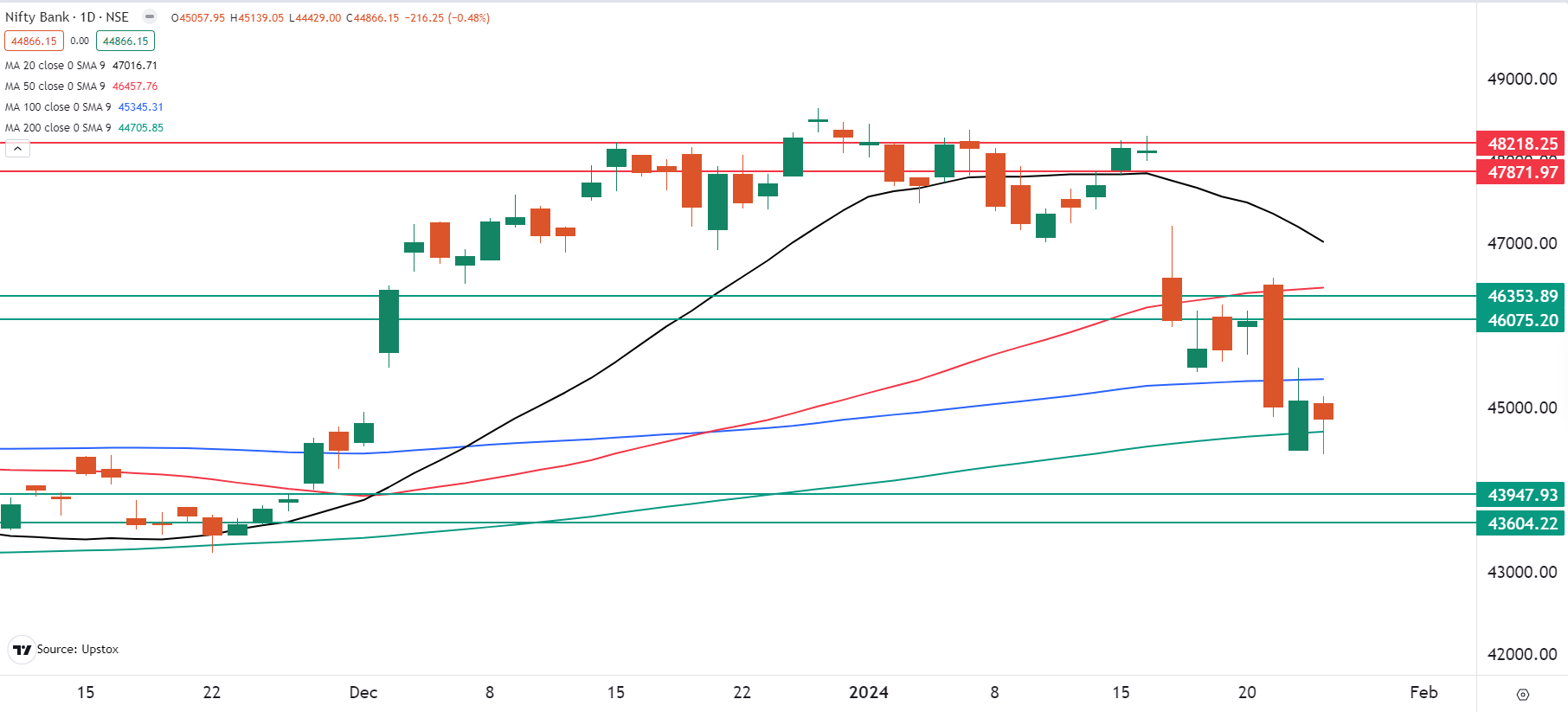

The BANK NIFTY fell over 2.5% last week, extending its two-week slide to a hefty 6%. It closed below the previous week's low on Thursday, weighed down by sharp fall in Indusind Bank (-8.0%) and HDFC Bank (-6.7%) during the week.

The index is currently stuck between its 100 and 200 DMAs and analysts are expecting a rangebound market until the Union Budget. Traders should keep an eye on the 50 and 200 DMAs during the Budget, as a close above or below either could be a signal for a decisive direction.

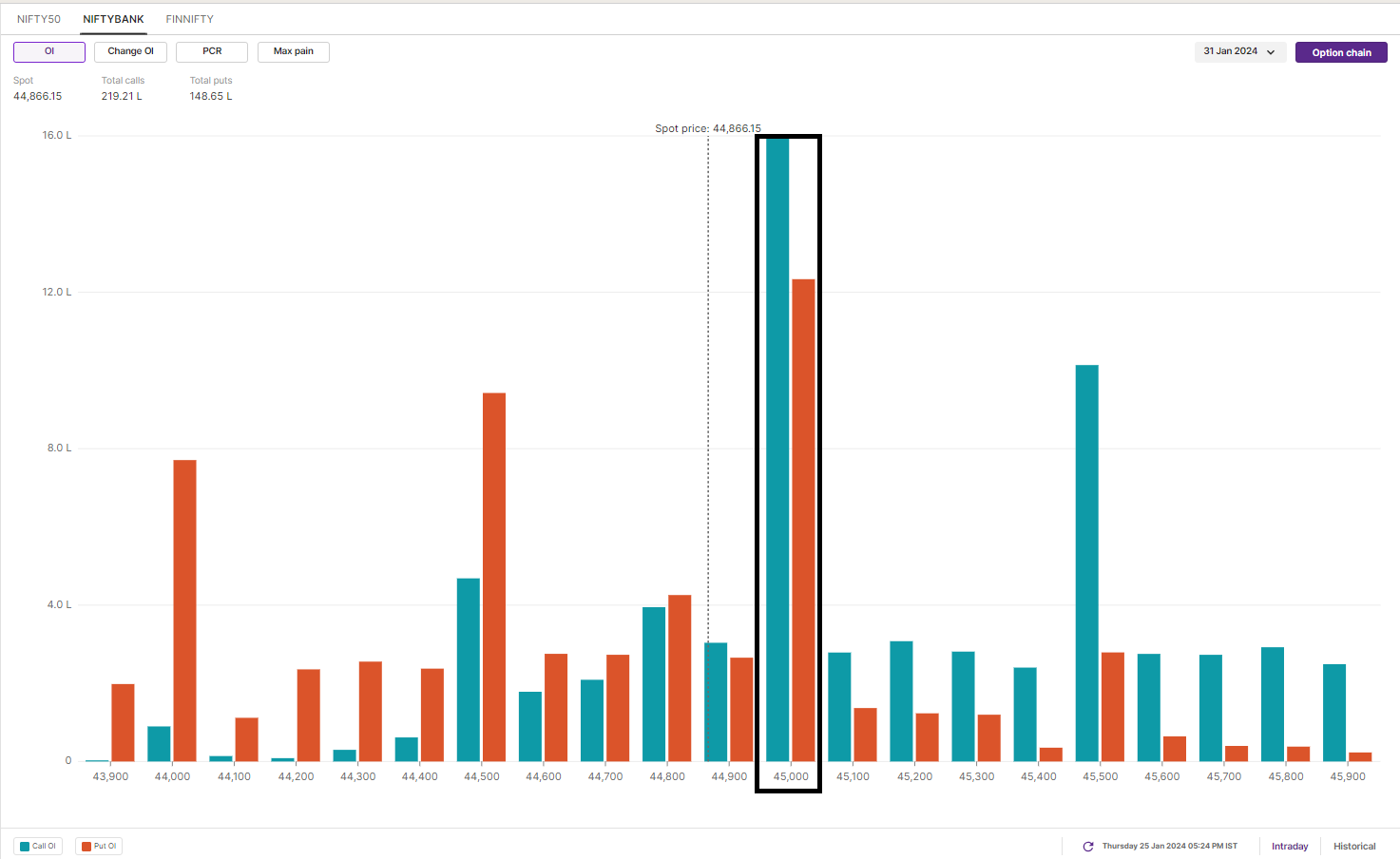

On the options front, the BANK NIFTY call options have the significant open interest at the 45,000 and 47,000 strikes. Conversely, the highest open interest for the 1 February put options is at the 45,000 and 44,500 strikes. Based on the options data, the trading range for the BANK NIFTY could be confined between 45,900 and 44,300 for the current week’s expiry.

You can track open interest of the BANK NIFTY here: https://pro.upstox.com/

FII-DII activity

In the cash market, the Foreign Institutional Investors (FDIIs) sold shares worth ₹2,144 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹3,479 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: ACC, Ambuja Cements, Samvardhana Motherson International, SAIL Bajaj Auto and National Aluminium.

Short build-up: Tech Mahindra, Indraprastha Gas, Hindustan Petroleum, AU Small Finance Bank and SBI Life Insurance.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.