Unlocking BANK NIFTY’s next move: Insights from consolidation

Upstox

4 min read • Updated: February 28, 2024, 1:56 PM

Summary

Following the breakout on the 20 February, the BANK NIFTY continues to consolidate within a range. This update provides a closer look at this consolidation phase on both the daily and hourly charts. As highlighted earlier, the index is trading between 47,200 and 46,300. A daily close above or below this range is crucial for the future direction.

_71617.png)

Asian markets update 7 am

Indian equities are expected to open higher, with the GITY NIFTY currently up 0.2% at 21,242. In contrast, Asian markets such as Japan's Nikkei 225 and Hong Kong's Hang Seng Index are trading slightly lower, each down 0.2%.

US markets update

U.S. stocks closed mixed on Tuesday as investors await Thursday’s crucial inflation report (PCE). Meanwhile, shares of Apple were in focus after the company plans to cancel its decadelong plans of making an electric car.

The Dow Jones Industrial Average fell 0.2% to 38,972, while the S&P 500 inched up 0.1% to 5,078. The Nasdaq Composite added 0.3% to 16,035.

NIFTY50

- February Futures: 22,203 (▲0.2%)

- Open Interest: 1,36,369 (▼25.4%)

Despite a volatile session, the NIFTY50 reversed two days of losses on Tuesday to close higher. Led by gains in TCS and Tata Motors, the index formed a bullish engulfing candle on the daily chart, once again indicating support based buying.

Even though it opened slightly lower, the NIFTY50 once again found support in the 22,080-22,115 zone, as highlighted in the previous blog. This reinforces the index’s recent consolidation pattern within the 22,300-21,900 range.

The experts remain optimistic, believing that the index is still consolidating near its all-time high with a positive bias. They highlight the 20-day moving average around 21,900 as a key support level, with 22,300 as the immediate hurdle. It is worth noting, that despite the index's upward movement, the volatility index remains elevated around 16, pointing to potential sharp swings ahead.

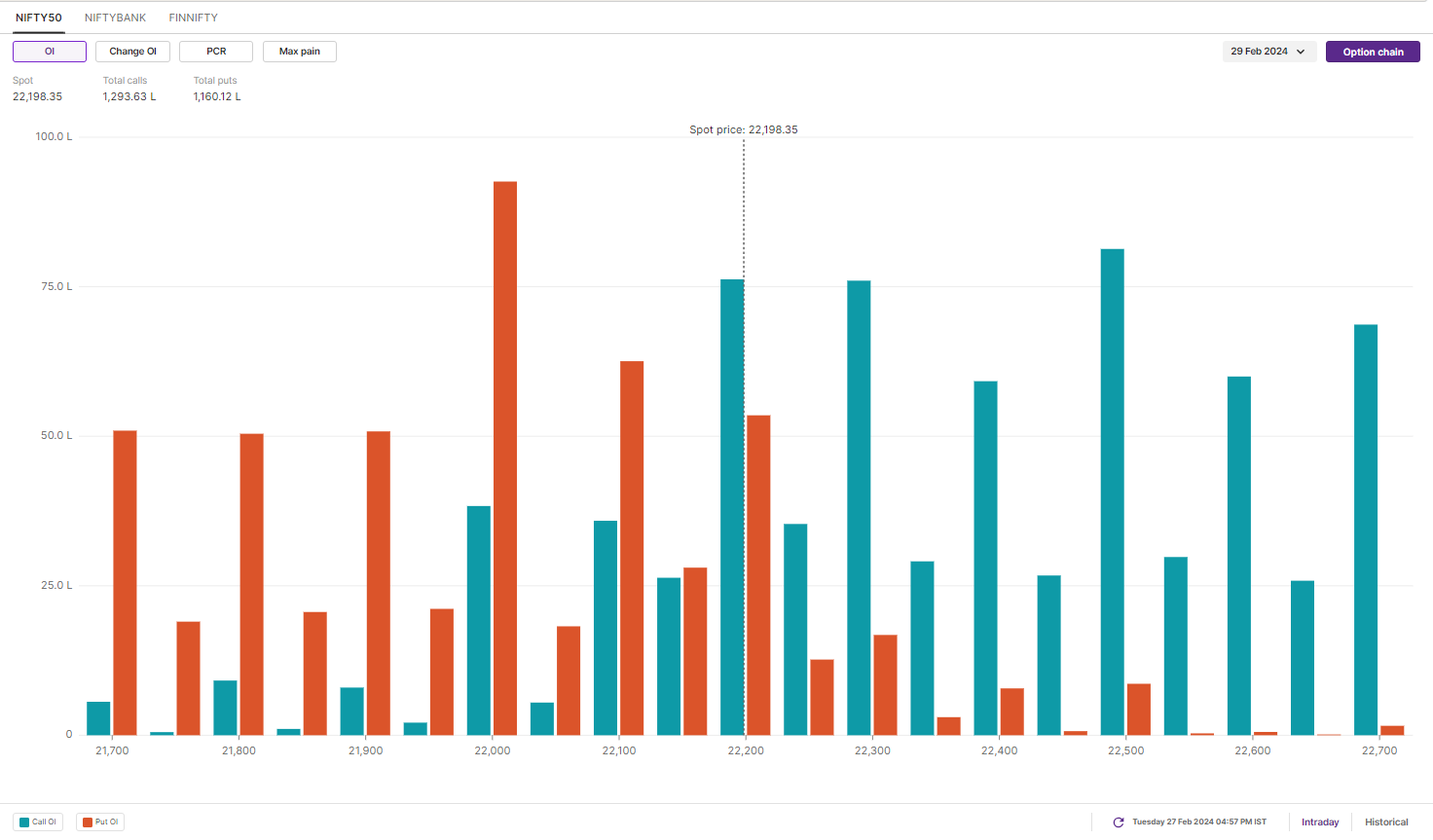

The February 29 option chain shows a significant concentration of calls near the 22,500 and 22,300 strikes. Conversely, the put base is concentrated at the 22,000 and 21,500 strikes. Based on the positioning of the OI, traders are expecting NIFTY50 to trade between the 21,700 and 22,600 levels for this week's expiry.

BANKNIFTY

- February Futures: 46,587 (▼0.03%)

- Open Interest: 1,21,765 (▼8.1%)

The BANK NIFTY ended its four-day losing streak and closed higher on Tuesday. The index regained support and protected the swing low of the breakout candle (20 February). However, it formed a doji candle on the daily chart, suggesting indecision among traders.

As we pointed out in our blog yesterday, the BANK NIFTY is consolidating in a range following the breakout on the 20 February. For the benefit of our readers, we have included a smaller time frame chart alongside the daily chart to highlight the consolidation area.

The daily chart shows that the index continues to hold the support after the breakout. The hourly chart clearly demonstrates its trading within the previously highlighted range of 47,200-46,300. Experts believe, a daily close above or below this will provide further directional clues.

We advise our readers to keep a close eye on the 50-day moving average (around 46,700), which coincides with the high of Tuesday's doji candle. As the doji is considered a neutral pattern, a close above or below it will also give traders more directional insights.

For BANKNIFTY's 29 February expiry, the options data shows significant open interest at the 47,000 & 47,500 call option strikes and 46,500 & 45,500 put option strikes. As per the open interest, traders eye BANKNIFTY’s trading range between 45,000 and 47,500 for this week’s expiry.

FII-DII activity

In the cash market, the Foreign Institutional Investors (FIIs) sold shares worth ₹1509 crore, while Domestic Institutional Investors (DIIs) purchased shares worth ₹2,861 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

-

Long build-up: ICICI Lombard, Havells India, Tata Motors, JK Cement and Tata Consultancy Services.

-

Short build-up: NMDC, Shriram Finance, Vodafone Idea, Hindustan Copper and Bharat Heavy Electricals.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.