BANK NIFTY expiry: Key levels and trading range for 27 March

Upstox

4 min read • Updated: March 27, 2024, 9:02 AM

Summary

For today's BANK NIFTY expiry, the immediate hurdle is at 47,200 level, while support remains at 45,800. Experts believe that a close above or below these levels on a closing basis will determine the future direction of the market.

Asian markets update 7 am

Indian markets are off to a cautious start today with the GIFT NIFTY trading 42 points lower. Meanwhile, Asian markets are trading mixed. Japan's Nikkei 225 is up 0.7%, while Hong Kong's Hang Seng Index is down 0.8%.

U.S. market update

U.S. stocks gave up the day's gains late in the session to close lower on Tuesday, dragged down by technology stocks. The Nasdaq Composite fell late in the session to close 0.4% lower at 16,135, while the S&P 500 lost 0.2% to close at 5,203. The Dow Jones Industrial Average closed flat at 39,282.

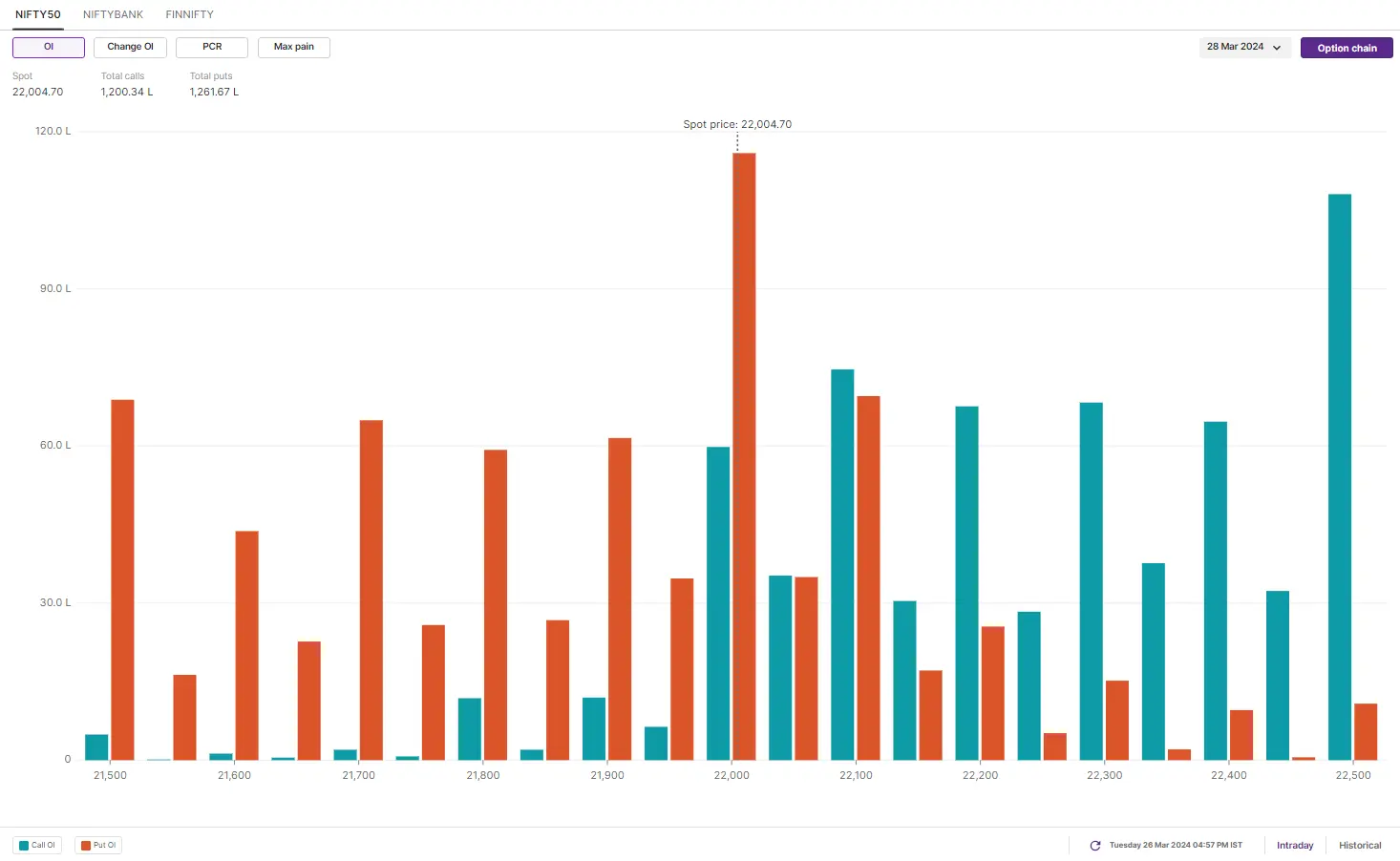

NIFTY50

March Futures: 22,088 (▼0.3%) Open Interest: 1,56,397 (▼22.0%)

The NIFTY50 snapped its three-day winning streak to end the range-bound session lower. During the holiday-shortened week, volumes remained subdued and the index consolidated around the 22,000 level.

On the daily chart, the NIFTY50 found support at its 50-day moving average (DMA), but failed to break above the day’s high formed in the first half of the session. The index is largely consolidating between its 20 and 50-DMAs, and a break above or below this range on a daily close basis will provide further directional clues.

Open interest (OI) build-up for 28 March expiry shows significant call base at 22,500 and 22,100 strikes. On the other hand, the base of put writers remained at 22,000 and 22,100 strikes. Based on the options data, traders are expecting NIFTY50 to trade between 21,700 and 22,600 this week.

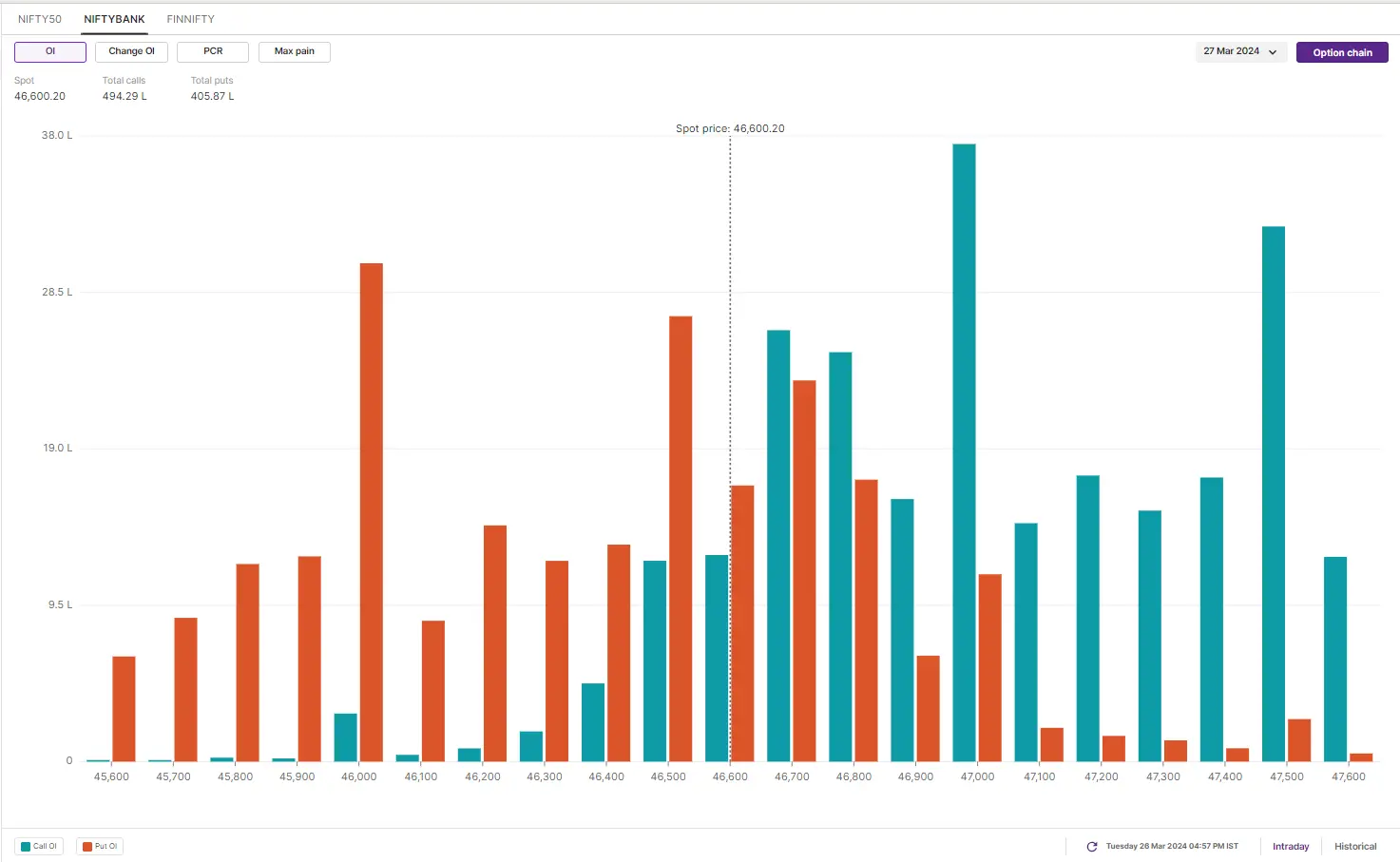

BANK NIFTY

March Futures: 46,717 (▼0.4%) Open Interest: 90,990 (▼21.6%)

After a gap down start, the BANK NIFTY rebounded from its intraday low and traded sideways throughout the day. The index traded below the day's opening level for most part of the session, giving the bears the upper hand.

On the daily chart, the BANK NIFTY is also stuck between its 20 and 50-DMAs, consolidating around the 46,500 level. For today's expiry, we have also added a smaller time frame chart for our readers. As seen in the chart below, immediate resistance for the index is around 47,200 and support is at 45,800. A close above or below these levels on a closing basis will determine the future direction of the market.

Open interest data suggests significant activity at the 47,000 & 47,500 call option strikes and the 46,000 & 46,500 put option strikes. This suggests that traders expect the BANK NIFTY to trade in a range of 46,800 & 47,200 for today's expiry.

FII-DII activity

Foreign Institutional Investors (FIIs) had a muted session and bought shares worth ₹10 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹5,024 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Dr. Lal PathLabs, Indus Towers, Oracle Financial Services Software (OFSS), Metropolis and NTPC

Short build-up: Power Grid and HDFC Bank

Under F&O ban: Steel Authority of India

Out of F&O ban: Biocon, Tata Chemicals and Zee Entertainment

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.