NIFTY50 and BANK NIFTY consolidate, key levels to watch for monthly expiry

Upstox

4 min read • Updated: February 26, 2024, 8:10 AM

Summary

Last week, the BANK NIFTY crossed above the recent swing high of 46,892 and reclaimed the 50-day moving average. Since then, it has been consolidating in a range of 47,200 on the upside and 46,500 on the downside, as highlighted in our Friday’s morning trade setup blog. We mentioned that until the index breaks out of this range on daily closing basis, it may remain range-bound.

Asian markets update 7 am

The GIFT NIFTY (-0.07%) is trading flat, suggesting a subdued opening for Indian equities today. Asian markets are trading in the green. Japan's Nikkei 225 is up 0.6%, while Hong Kong's Hang Seng Index rose 0.3%.

US markets update

U.S. stocks closed mixed on Friday after profit-booking in technology stocks. The Dow Jones Industrial Average gained 0.1% to close at 39,131, while the S&P 500 was flat with a positive bias. The Nasdaq Composite lost 0.2% to close at 15,996.

NIFTY50

February Futures: 22,228(▼0.1%) Open Interest: 2,04,893 (▼8.0%)

The NIFTY ended the week on a strong note (+0.7%), forming a bullish candle on the weekly chart. The index came out of its a month long consolidation zone and closed above its previous all-time high (22,124), which acted as a resistance.

The NIFTY 50 consolidated its recent gains near an all-time high on Friday, forming a negative candle on the daily chart. The index traded in a narrow 100-point range on Friday, with experts attributing the slight pullback to profit-taking ahead of the weekend. Despite the dip, they remain positive on the broader trend, citing strong support near the 20- and 50-day moving averages. Traders are advised to monitor price action around these key levels and adjust their strategies accordingly.

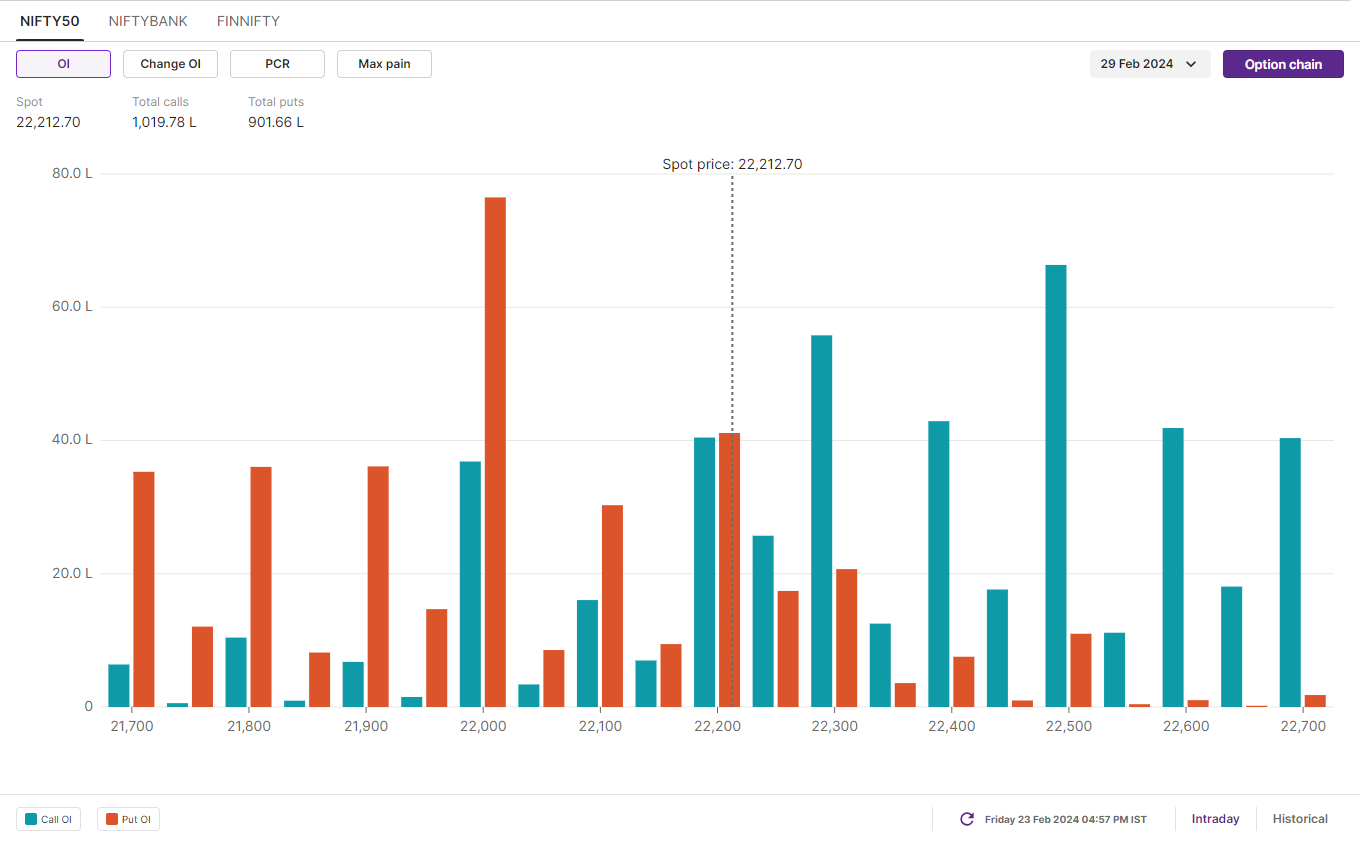

Option chain of 29 February expiry shows significant concentration of call options near 22,500 and 22,300 strikes. Conversely, the put base is concentrated on 22,000 and 21,500 strikes. Based on the initial positioning, traders are expecting NIFTY50 trade between 21,500 and 22,700 in the upcoming week.

BANK NIFTY

February Futures: 46,842 (▼0.3%) Open Interest: 1,50,879 (▼3.8%)

Banking stocks rebounded last week, pushing the BANK NIFTY (+0.9%) higher for the second consecutive week. However, the index faced selling pressure on Friday, forming a negative candle on the daily chart and closed near the day’s low.

Last week, the index closed above the recent swing high of 46,892 and reclaimed the 50-day moving average. Since then, it has been consolidating in a range of 47,200 on the upside and 46,500 on the downside, as highlighted in our Friday’s morning trade setup blog. We mentioned that until the index breaks out of this range on daily closing basis, it may remain range-bound.

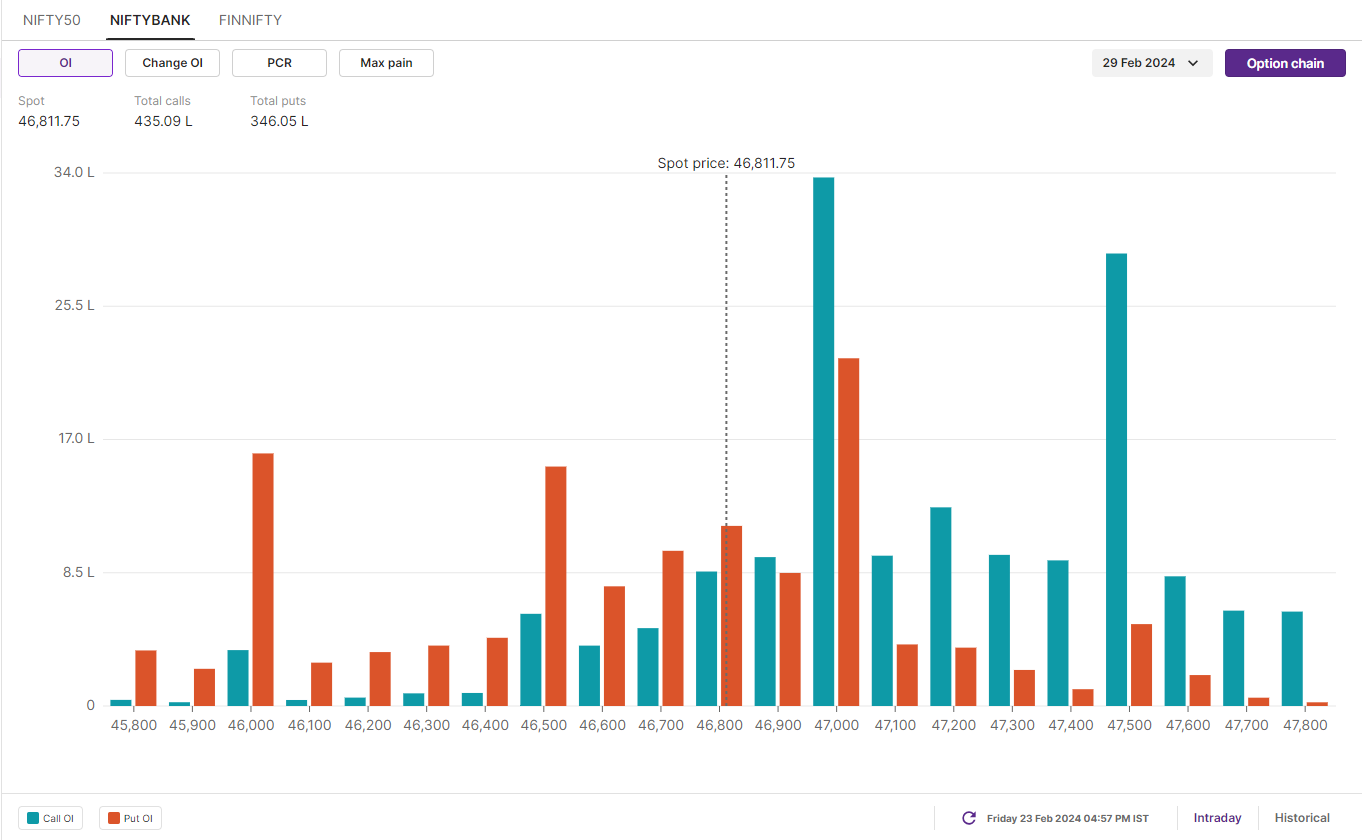

For BANK NIFTY's 29 February expiry, the options data shows significant open interest at the 47,000 & 47,500 call option strikes and 45,000 & 47,000 put option strikes. As per the open interest, traders eye BANK NIFTY’s trading range between 44,800 and 47,500.

FII-DII activity

In the cash market, both the Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) turned net buyers on Friday. The FIIs bought shares worth ₹1,276 crore, while the DIIs purchased shares worth ₹176 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Astral, Indian Hotels, Vodafone Idea and Bharat Electronics.

Short build-up: Asian Paints and Max Financial Services.

Catch up on Friday’s NIFTY 200 insights! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.