Trade setup for 25 January: NIFTY50 fluctuates between key DMAs, BANK NIFTY finds support at 200-DMA ahead of expiry

Upstox

4 min read • Updated: January 25, 2024, 8:07 AM

Summary

Despite the rebound, the NIFTY50 is stuck in a tight range between its 20 and 50-day moving averages. Experts believe it faces a hurdle at 21,500 and a bigger test at 21,750. A decisive break above both levels could trigger further bullish momentum.

Asian markets update 7 am

Mumbai, 25 January: Indian equities are set for a flat to positive start today as the GIFT NIFTY is 20 points higher than yesterday's close. However, Asian markets are mixed, with Japan's Nikkei 225 down 0.4% and Hong Kong's Hang Seng Index up 0.1%.

US market update

US stocks closed mixed on Wednesday, reflecting investor caution as bets on a March Fed rate cut cooled. The probability of a March rate cut, as implied by investor positions, fell from 67% last week to 57% this week. However, tech stocks bucked the trend, buoyed by a strong earnings report from Netflix. The Dow Jones fell 0.3% to 37,905, the S&P500 rose 0.3% to 4,864 and the Nasdaq Composite climbed 0.4% to 15,425.

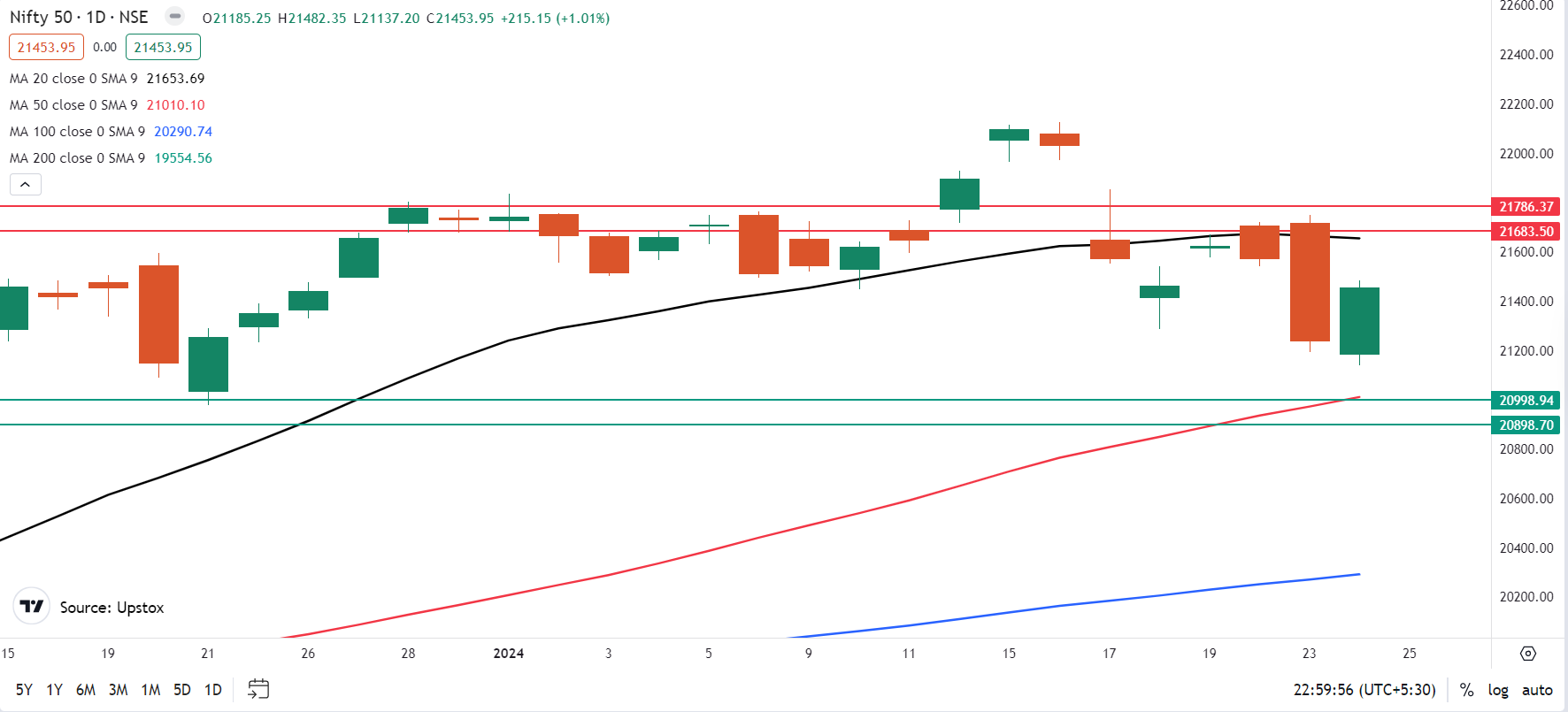

NIFTY50

January Futures: 21,477 (▲1.3%) Open Interest: 1,05,707 (▼33.0%)

The NIFTY50 recouped most of yesterday's losses, gaining over 1% on a short-covering rally in beaten-down stocks. All the sectors except Private Banks (-0.2%) were in the green, with Media (+3.0%) and Metal (+2.9%) leading the way.

Despite the rebound, the NIFTY50 remains trapped between its 20 and 50-day moving averages (DMAs), consolidating in a tight range. Analysts see immediate resistance at 21,500, with a tougher test likely around 21,750, the 23rd January high. A decisive break above both levels could trigger further bullish momentum.

On the options front, the maximum open interest for call options is placed at 22,000 and 21,700 strikes. On the other hand, highest open interest for put options lies at 21,000 and 21,300 strikes for 25 January expiry. As per the options data, the trading range for NIFTY50 could be confined between 21,750 and 20,200 for today’s expiry.

You can track open interest of the NIFTY50 here: https://pro.upstox.com/

BANK NIFTY

January Futures: 45,152 (▲0.4%) Open Interest: 1,05,602 (▼17.0%)

The BANK NIFTY started Wednesday's session on a shaky note. However, it found a foothold around the key 200 DMA support level. Despite the bounce, the index failed to close above the 100 DMA resistance and ended the volatile session flat. This leaves the BANK NIFTY in a consolidation zone between the 50 and 200 DMAs, awaiting a decisive break in either direction.

Analysts believe that the immediate hurdle for the BANK NIFTY is the 23rd January high of 46,892. Until then, any upside momentum could be short-lived, with profit-taking likely at higher levels.

On the options front, the BANK NIFTY call options have the maximum open interest at the 46,500 and 46,000 strikes. Conversely, the highest open interest for the January 25 put options is at the 44,000 and 45,000 strikes. Based on the options data, the trading range for BANK NIFTY could be confined between 45,600 and 44,300 for today’s expiry.

You can track open interest of the BANK NIFTY here: https://pro.upstox.com/

FII-DII activity

In the cash market, the Foreign Institutional Investors (FDIIs) offloaded shares worth ₹6,934 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹6,012 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: REC Limited, Indusind Bank, Aditya Birla Fashion and Retail (ABFRL), Indus Towers and NMDC.

Short build-up: Oberoi Realty, Axis Bank, ICICI Bank and IDFC First Bank.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.