NIFTY50 closes below 21,500 and BANKNIFTY slips below 100-DMA; key levels to watch for expiry

Upstox

4 min read • Updated: January 24, 2024, 2:47 PM

Summary

The GIFT Nifty is trading higher, suggesting a positive start for Indian equities today.

Asian markets update 7 am

The GIFT Nifty is trading 73 points higher, pointing to a positive start for Indian equities today. Meanwhile, Asian markets are trading mixed. Japan's Nikkei 225 is down 0.5%, while Hong Kong's Hang Seng Index is up 2%.

US market update

Despite choppy trading, Wall Street ended with modest gains, with the Dow Jones down 0.2%, the S&P 500 up 0.2% and the Nasdaq up 0.4%. Investors digested mixed fourth quarter earnings reports and wrestled with shifting interest rate expectations. A wait-and-watch attitude took hold in the futures market, pushing potential interest rate cuts from March to May.

NIFTY50

- January Futures: 21,194 (▼ 1.8%)

- Open Interest: 1,57,762 (▼ 10.7%)

The NIFTY50 closed below 21,500, confirming a bearish engulfing pattern on the daily chart which was formed on Saturday. Oil & Gas (-3.4%) and Metals (-3.4%) led the downfall, while Pharma (+1.6%) was the lone survivor.

As highlighted in yesterday's blog, the NIFTY50's initial rally proved to be short-lived as it ran into strong resistance around its 20-day moving average (DMA). This technical barrier halted the upward momentum and pushed the index back into familiar territory.

With the rally stalling, all eyes now turn to the next key support level: the 50-day moving average. As you can see on the above chart, this key indicator is currently within the highlighted area. A break below this area could signal further downward potential for the index.

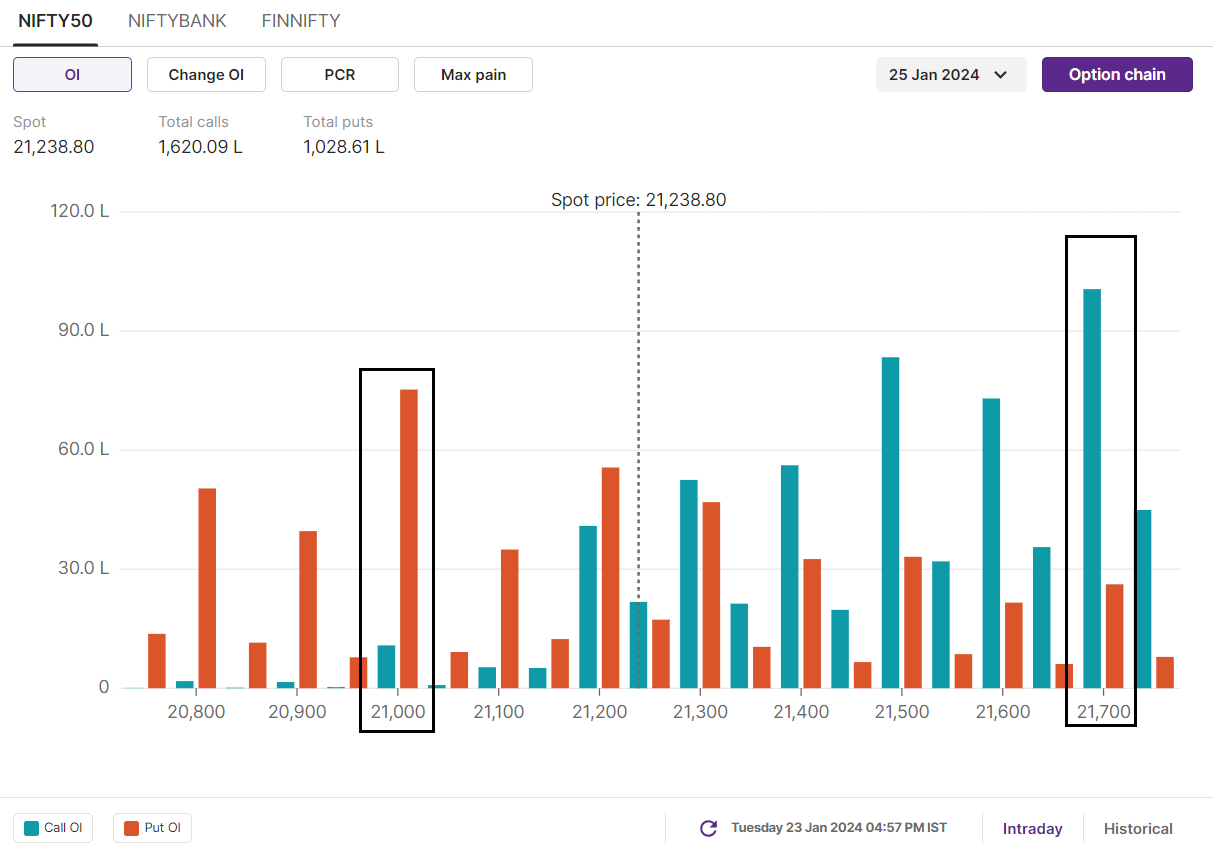

On the options front, the maximum open interest for call options is placed at 21,700 and 21,500 strikes. On the other hand, highest open interest for put options lies at 21,000 and 21,200 strikes for 25 January expiry. As per the options data, the trading range for NIFTY50 could be confined between 21,550 and 20,850.

You can track open interest of the NIFTY50 here: https://pro.upstox.com/

BANK NIFTY

January Futures: 44,913 (▼ 2.6 %) Open Interest: 1,27,860 (▼ 1.6 %)

The BANK NIFTY's promising start above 46,500 quickly turned volatile, nosediving over 1600 points from its intraday high before settling 2.2% lower. This relentless fall was fueled by two key factors: HDFC Bank's relentless decline and profit booking in public sector banks.

This steep descent resulted in a bearish engulfing candle on the daily chart, a strong technical signal indicating potential bearish continuation. As highlighted in our yesterday's blog, the BANK NIFTY's struggle between the 50 and 100 DMAs finally reached a resolution. The index decisively closed below the 100-DMA, indicating a potential shift in downward momentum. With both the 50 and 100 DMAs breached, all eyes now turn to the next crucial support level: the 200-DMA.

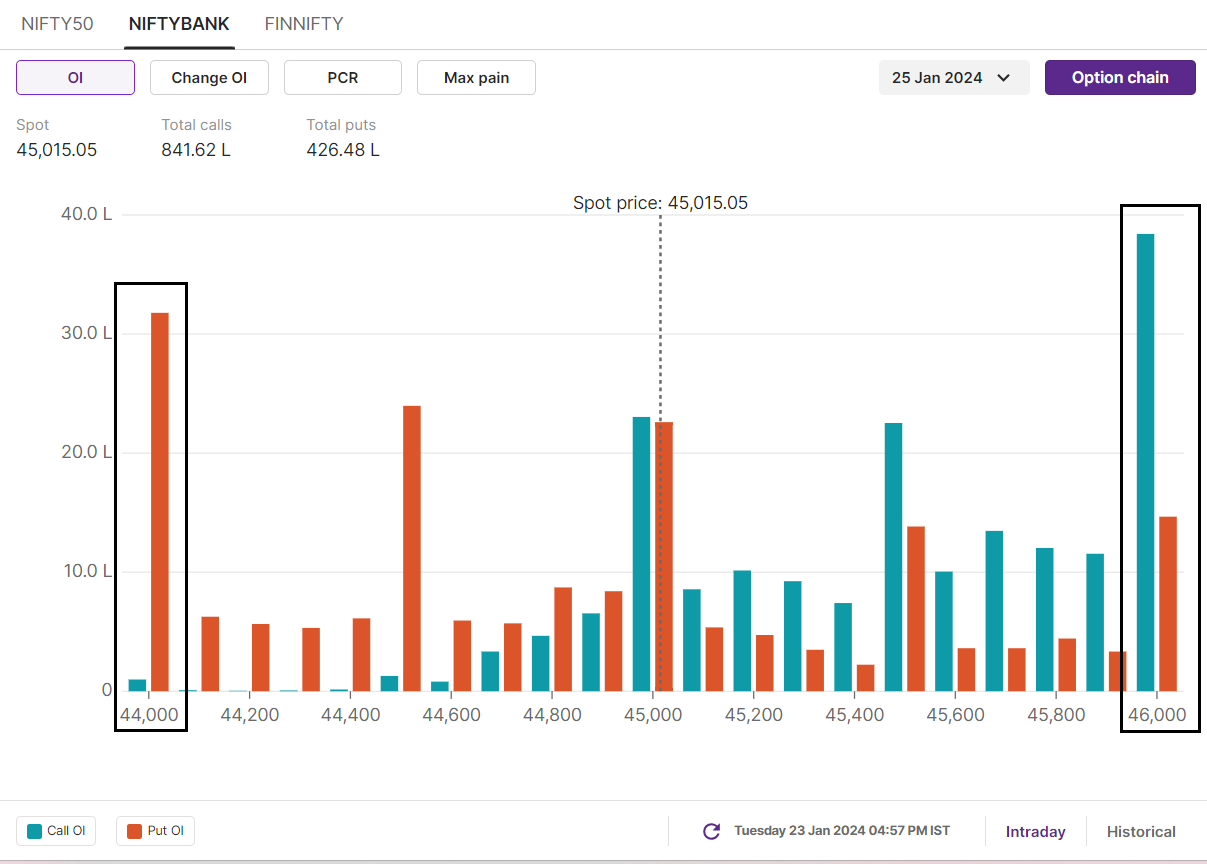

On the options front, the BANK NIFTY call options have the maximum open interest at the 47,000 and 46,000 strikes. Conversely, the highest open interest for the January 25 put options is at the 44,000 and 45,000 strikes. Based on the options data, the trading range for BANK NIFTY could be confined between 45,600 and 44,300.

You can track open interest of the BANK NIFTY here: https://pro.upstox.com/

FII-DII activity

In the cash market, the Foreign Institutional Investors(FIIs) sold shares worth ₹3,115 crore, while the Domestic Institutional Investors(DIIs) bought shares worth ₹214 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/

Stock scanner

Long build-up: Cipla, Petronet LNG, Bharti Airtel, Persistent System, Sun Pharma and Zydus Lifesciences

Short build-up: Oberoi Realty, GMR Infra, BHEL, IDFC First Bank and India Cements.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers , simply log in: https://pro.upstox.com/

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.