NIFTY50 defies bearish engulfing, BANK NIFTY in wait-and-watch mode

Upstox

4 min read • Updated: February 23, 2024, 7:58 AM

Summary

The NIFTY50 invalidated Wednesday's bearish engulfing pattern. The index again showed resilience between the 21,800 and 21,900 zones, coinciding with its 20-day moving average. Experts believe, if the NIFTY50 closes above Wednesday's high (22,249), the index could extend its gains amid a rebound in IT stocks.

Asian markets update 7 am

Buoyed by gains on Wall Street, the GIFT NIFTY is trading 40 points higher, pointing to a positive start for the Indian markets today. However, Asian markets remain mixed. Japan's Nikkei is closed for a holiday, Hong Kong's Hang Seng Index is down 0.2%, while South Korea's Kospi is up 0.6%.

U.S. markets update

US stocks hit record highs on Thursday after chipmaker Nvidia reported better-than-expected quarterly results. The Dow Jones jumped 1.1% to 39,069, while the S&P 500 rose 2.1% to 5,087. The tech-heavy Nasdaq Composite rose 2.9% to 16,041.

NIFTY50

- February Futures: 22,243 (▲0.9%)

- Open Interest: 2,20,720 (▼0.5%)

After a flat start, the NIFTY50 dipped towards its 20-day moving average (around 21,800) in the first half of the session. However, the index found support and staged a sharp V-shaped recovery, rallying over 350 points from its intraday low to a new all-time high. The rally was led by technology stocks with TCS and Infosys gaining 2.4% and 1.5% respectively. Reliance Industries also contributed with a gain of 0.9%.

On the weekly expiry, the NIFTY50 invalidated Wednesday's bearish engulfing pattern. The index showed renewed buying momentum between 21,800 and 21,900 levels, coinciding with its 20-day moving average. Experts believe traders are expected to see a sharp spike in option premiums due to the sharp reversal and intraday volatility. In addition, if the NIFTY50 closes above Wednesday's high (22,249), the index could extend its gains amid a rebound in IT stocks.

The initial OI build of the options chain for the 29 February expiry shows a significant call base at the 23,000 and 22,000 strikes. Conversely, the put base is established at the 22,000 and 21,000 strikes. As per the initial build-up, NIFTY50 is expected to trade between 21,750-22,700 in the upcoming week.

BANK NIFTY

- February Futures: 46,980 (▼0.1%)

- Open Interest: 1,56,906 (▼12.3%)

The BANK NIFTY also had a choppy session, with a sharp reversal from the 46,500 level. The index formed a doji candle on the daily chart, indicating indecision and potential range-bound activity.

Having breached the recent swing high of 46,800, the banking index is now consolidating within a range of 47,200 on the upside and 46,300 on the downside. Experts believe the consolidation will continue until a decisive breakout above or below this range occurs on a daily closing basis.

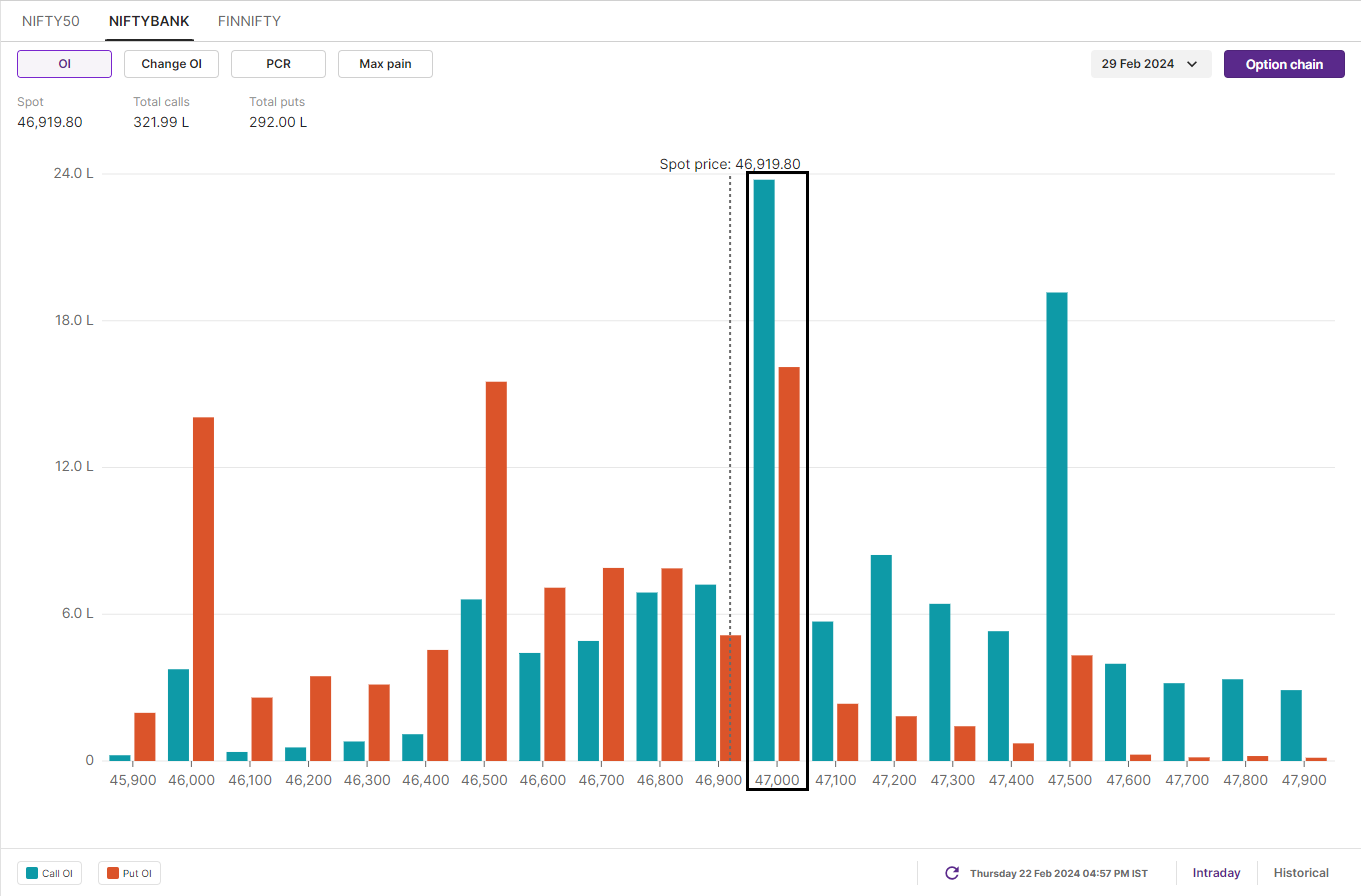

For BANK NIFTY's 29 February expiry, the options data shows significant open interest at the 47,000 & 47,500 call option strikes and 47,000 & 46,500 put option strikes. As per the open interest, traders eye BANK NIFTY’s trading range between 44,800 and 47,500.

FII-DII activity

In the cash market, the Foreign Institutional Investors (FIIs) sold shares worth ₹1,410 crore, while the Domestic Institutional Investors (DIIs) bought shares worth ₹1,823 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives.

Stock scanner

Long build-up: ABB India, Cummins India, Bharat Electronics, Eicher Motors and Siemens.

Short build-up: Indian Oil Corporation and Bharat Petroleum.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.