NIFTY50 closes at record levels, VIX surge signals potential volatility

Upstox

3 min read • Updated: February 20, 2024, 8:08 AM

Summary

As highlighted in yesterday's blog, the BANK NIFTY is trading in a defined range between its 20-DMA (around 45,600) and 50-DMA (around 46,800). Traders should watch the price action around these levels closely. A breakout on either side could provide further directional clues.

_69622.png)

- BAJAJ-AUTO--

- LUPIN--

- HDFCAMC--

Asian markets update 7 am

The GIFT NIFTY (+0.02%) is flat, suggesting a subdued opening for Indian equities today. Asian markets are trading mixed. Japan's Nikkei 225 is up 0.4%, while Hong Kong's Hang Seng Index is down 0.1%. U.S. markets were closed on Monday for Presidents Day.

NIFTY50

February Futures: 22,171 (▲0.2%) Open Interest: 2,35,176 (▲1.2%)

The NIFTY50 index hit a new all-time high on Monday, recording its highest daily close ever. After opening higher, the index maintained its gains and traded comfortably above the 22,000 level throughout the session. Notably, the volatility index jumped over 5% to 16, which traders should remain mindful of.

A spinning top candlestick pattern formed on the daily chart of NIFTY50 on Monday, indicating indecision among investors. This pattern may indicate a potential reversal or continuation depending on today's close. Experts believe that resistance remains at the previous all-time high of 22,126. As discussed yesterday, a sustained close above this level could push the index higher. Immediate support for the index is at the 20-DMA (around 21,700).

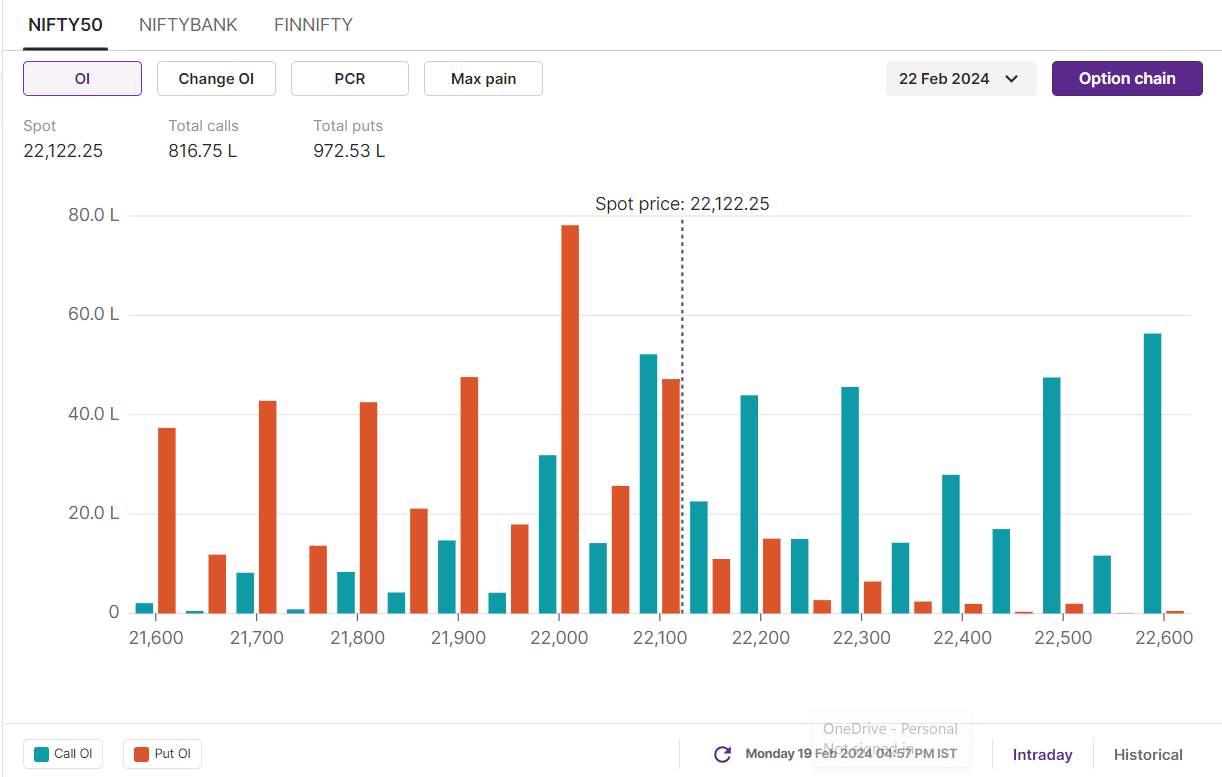

Open interest data for the 22 February expiry of the NIFTY50 shows a significant call base at the 22,600 and 22,100 strikes. Conversely, the maximum put base is at the 22,000 and 21,900 strikes. This suggests that for this week's expiry, market participants expect the NIFTY50 to trade in a range of 21,500-22,550.

BANK NIFTY

February Futures: 46,638 (▲0.3%) Open Interest: 1,80,337 (▼3.8%)

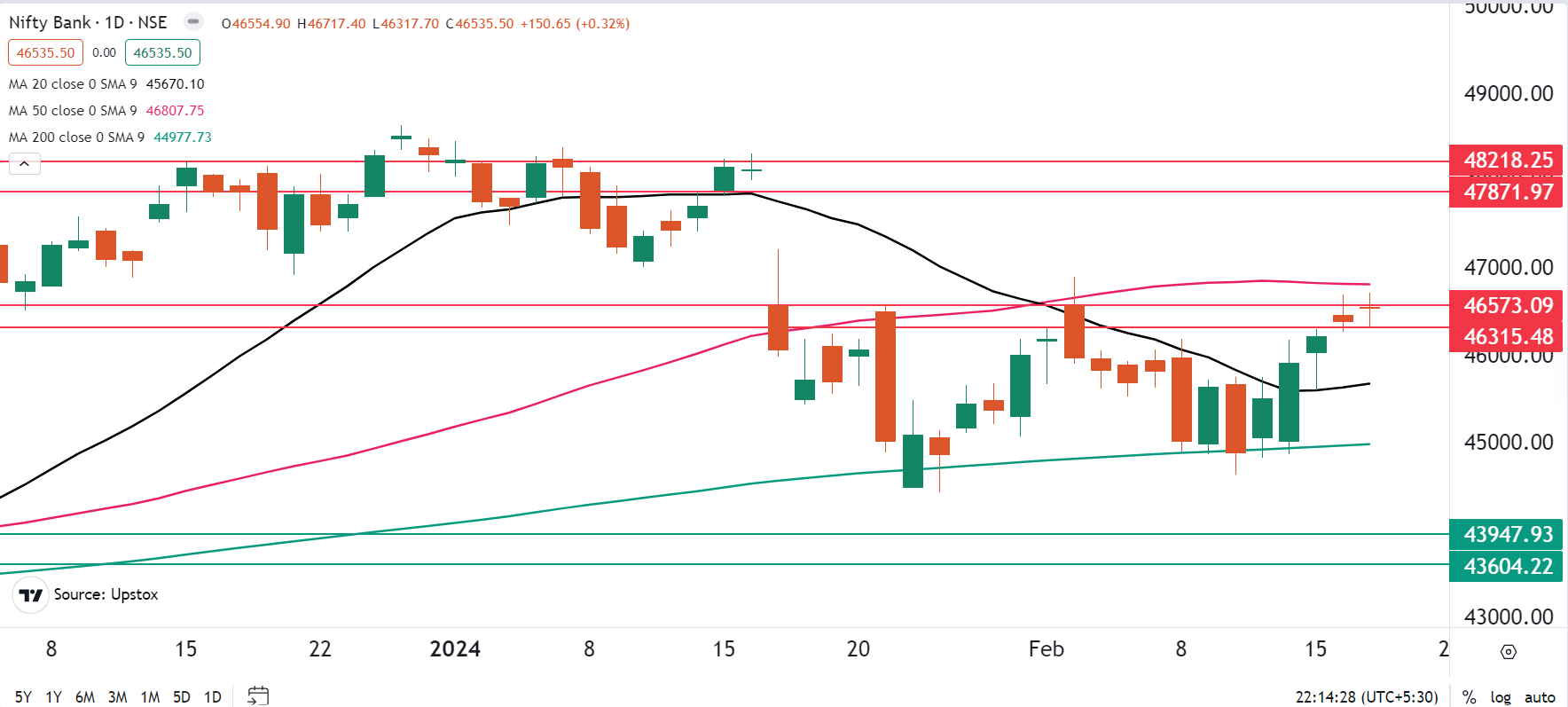

The BANK NIFTY showed strength and closed above the 46,500 level on Monday. However, the index has formed a doji candle on the daily chart, indicating indecision among investors.

As highlighted in yesterday's morning trade setup blog, the BANK NIFTY continues to trade between its 20-DMA (around 45,600) and 50-DMA (around 46,800). Traders should watch the price action around these levels closely. A breakout on either side could provide further directional clues.

For BANK NIFTY's 21 February expiry, the options data shows significant open interest at the 47,000 & 46,500 call option strikes and 46,000 & 45,000 put option strikes. As per the open interest, traders eye BANK NIFTY’s trading range between 44,800 and 47,500 for current week’s expiry.

FII-DII activity

In the cash market, the Foreign Institutional Investors (FIIs) sold shares worth ₹754 crore, while the Domestic Institutional Investors (DIIs) bought shares worth ₹452 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives.

Stock scanner

Long build-up: Dixon Technologies, Bajaj Auto, GNFC and GMR Infra.

Short build-up: Lupin and HDFC AMC.

Catch up on yesterday's NIFTY 200 insights! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.