Trade setup for 2 February: BANK NIFTY eyes 50-DMA

Upstox

4 min read • Updated: February 2, 2024, 8:27 AM

Summary

The pullback in the BANK NIFTY is in line with our analysis of the January 29th, confirming the hammer pattern and the bounce from the 200 DMA. However, there are important resistances ahead at the 20 and 50 DMAs. The experts suggest a weight and watch approach. A daily close above 46,500 is crucial for further gains.

_66385.png)

Asian markets update 8 am

Indian equities are set for a flat to positive start today, mirroring the positive sentiment in major Asian markets. While the GIFT NIFTY is currently flat, Japan's Nikkei 225 is up 1.0% and Hong Kong's Hang Seng Index is up 1.3%.

U.S. market update

US stocks rallied on Thursday as investors adjusted their expectations for future interest rate cuts by the Federal Reserve. Meanwhile, shares of Amazon and Meta Platforms surged in after-hours trading following positive earnings reports. The Dow Jones rose 0.9% to 38,519 and the S&P 500 gained 1.2% to 4,906. The Nasdaq Composite gained 1.3% to close at 15,361..

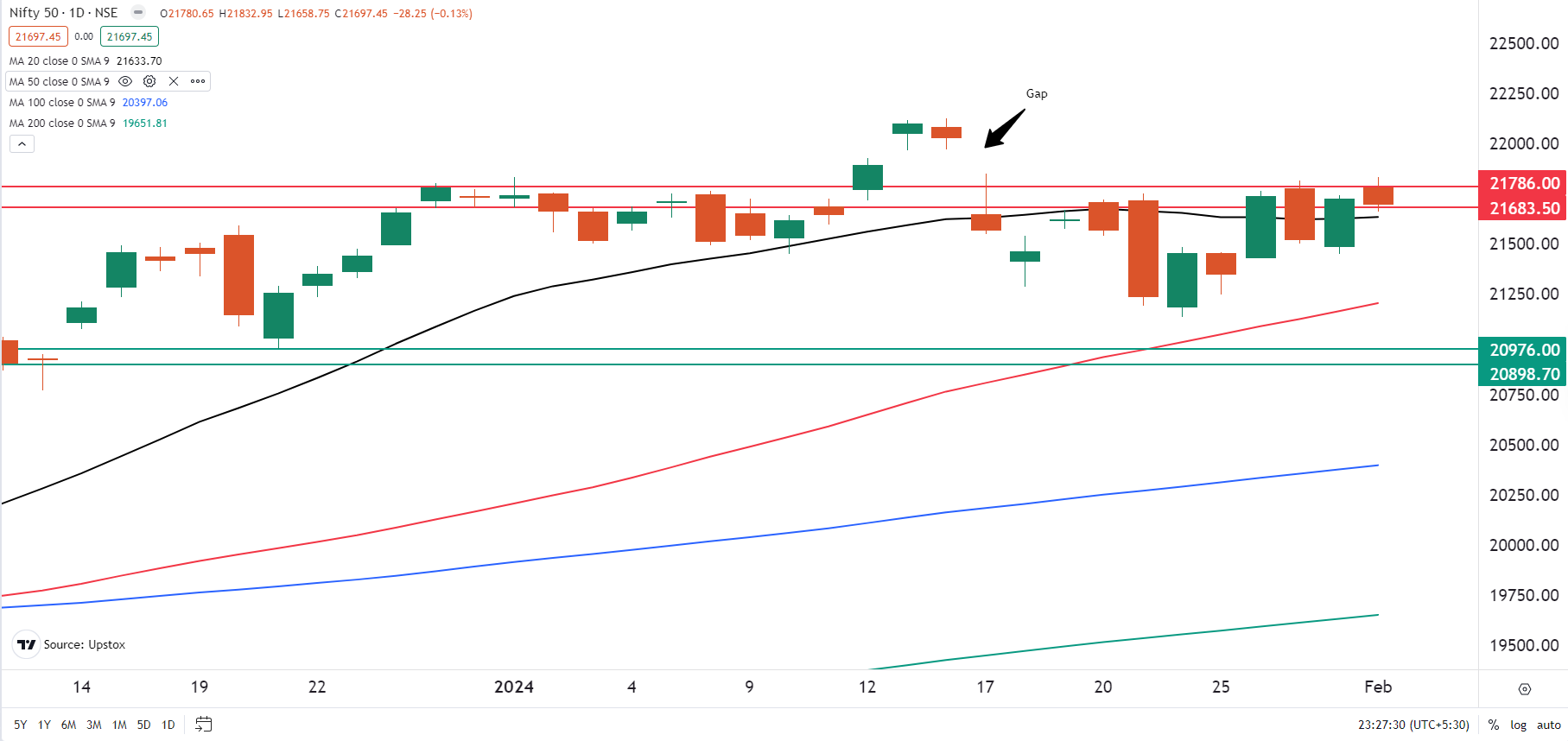

NIFTY50

February Futures: 21,751(▼0.3%) Open Interest: 2,26,836 (▲0.8%)

The NIFTY50 opened on a positive note and traded in a tight range after the interim Budget speech, closing the day slightly lower. Bearish sentiment seemed to prevail with 30 stocks declining against 20 rising. Among the sectoral trends, a contrasting picture emerged. PSU banks were the clear winners, rising 3%. Auto stocks also performed well with a modest gain of 0.5%. Conversely, Metals and Realty sectors faced headwinds, losing 1% and 0.9% respectively.

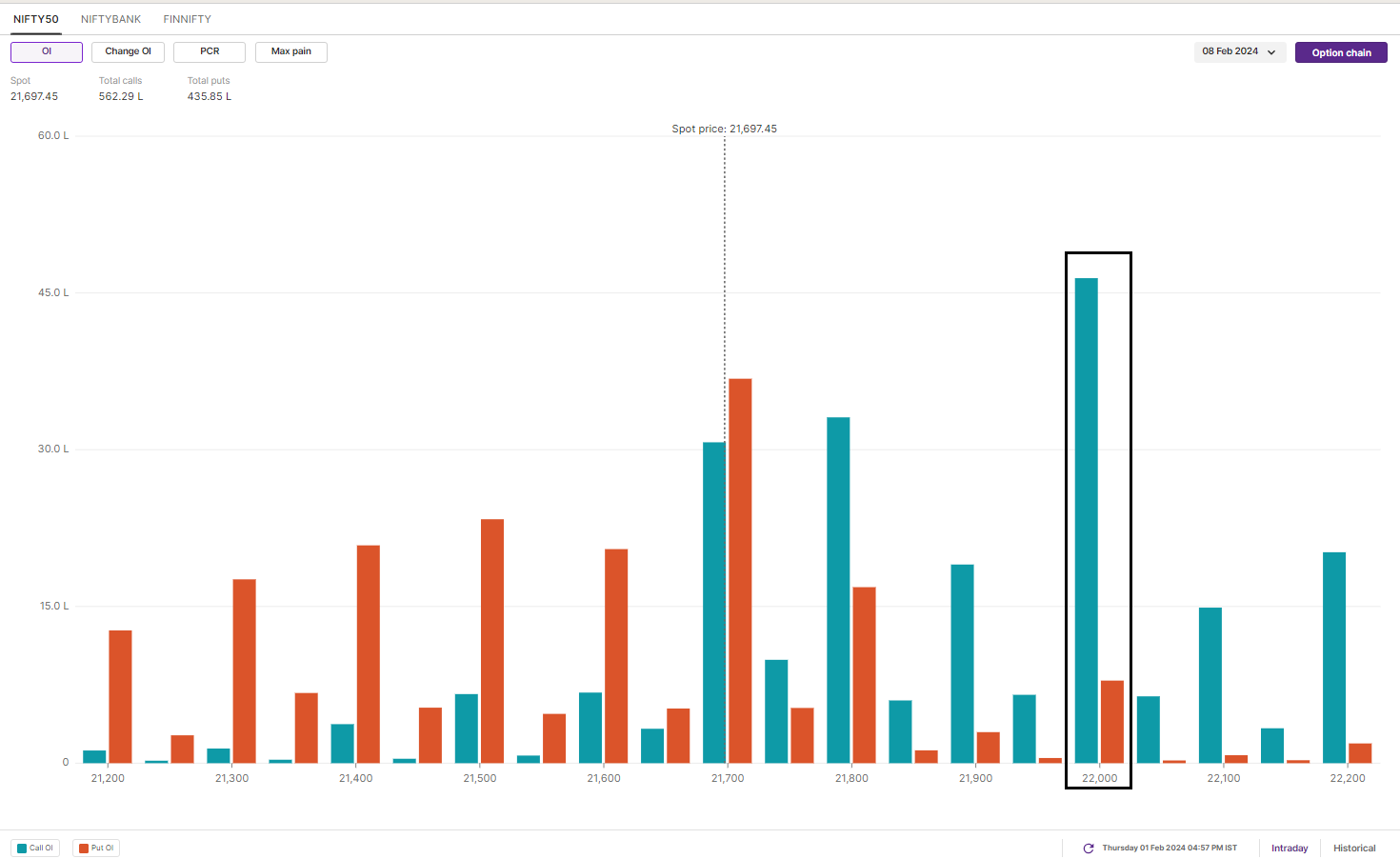

As per the open interest, the maximum call base for February 8 expiry is present at 22,000 and 21,800 strikes. On the other hand, the put options have base at 21,700 and 21,000 strikes. As per option premiums and open interest, traders are expecting NIFTY50 to trade between 21,200 and 22,200 levels.

You can track open interest of the NIFTY50 here: https://pro.upstox.com/

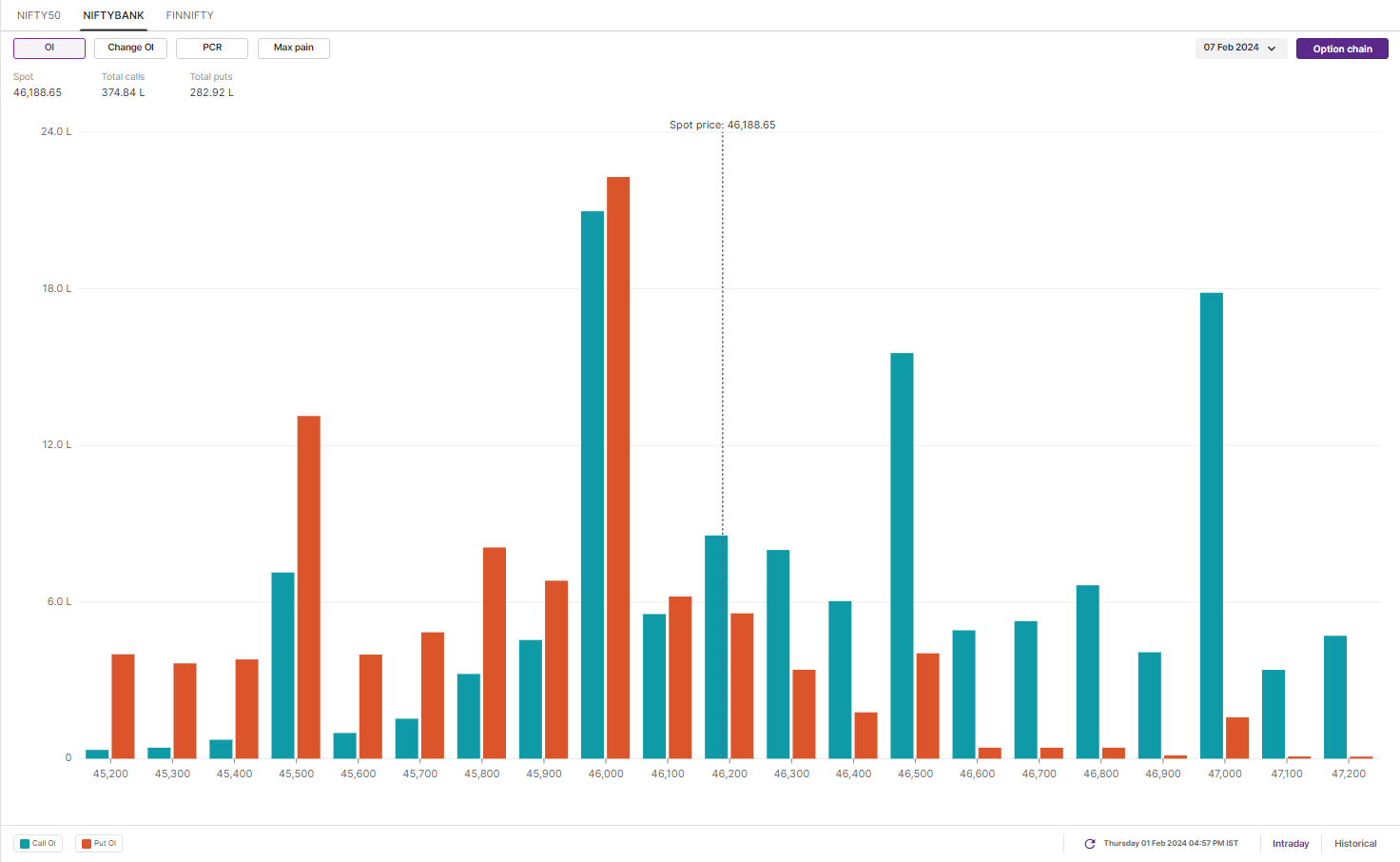

BANK NIFTY

February Futures: 46,437 (▲0.3%) Open Interest: 2,03,071 (▼1.7%)

Building on Wednesday's gains, the BANK NIFTY outperformed the NIFTY50, closing above the key 46,000 level. This development is in line with the analysis presented in our blog of the Januray 29th, where we highlighted the confirmation of the hammer pattern on the daily chart, along with the bounce from 200 DMA.

However, the index is now trading close to its key 20 and 50-day moving averages, which could act as resistance. According to experts, a close above the 46,500 level on daily charts will be crucial for the BANK NIFTY to further swing the momentum in favour of the bulls.

On the options front, the BANK NIFTY call options have significant open interest at the 48,000 and 46,000 strikes for the February 7 expiry. Conversely, the put options have the highest open interest at the 46,000 and 45,000 strikes. Based on the options data, the BANK NIFTY's trading range for the February 7 expiry could be between 47,900 and 44,900.

You can track open interest of the BANK NIFTY here: https://pro.upstox.com/

FII-DII activity

In the cash market, the Foreign Institutional Investors (FDIIs) sold shares worth ₹ 1,879 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹872 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives.

Stock scanner

Long build-up: State Bank Of India, Canara Bank, Maruti Suzuki and RBL Bank.

Short build-up: India Cements, Escorts Kubota, Jubilant FoodWorks, Cholamandalam Investment and ABB India.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.