Trade setup for 19 March: Key things to know before market opening

Upstox

4 min read • Updated: March 19, 2024, 9:16 AM

Summary

The BANK NIFTY has once again found support at its 50-DMA and has formed a bullish reversal, a hammer pattern near the support zone and its 50-DMA. However, it is important to note that a reversal pattern is only confirmed by the close of the following trading day. Traders should watch today's close for confirmation of the reversal.

Asian markets update 7 am

The GIFT NIFTY is trading 0.3% lower, indicating a gap-down start for the Indian equities today. This follows other Asian markets which are also trading lower ahead of the monetary policy decision from the Bank of Japan. The Nikkei 225 slipped 0.6% and Hong Kong’s Hang Seng index dropped 0.8%.

U.S. market update

U.S. stocks closed higher, led by gains in technology stocks, particularly the magnificent seven. These include Microsoft, Apple, Amazon, Alphabet (Google), Nvidia, Meta Platforms and Tesla. The Dow Jones Industrial Average climbed 0.2% to close at 38,790, while the S&P 500 gained 0.6% to end the day at 5,149. The Nasdaq Composite gained 0.8% to close at 16,103.

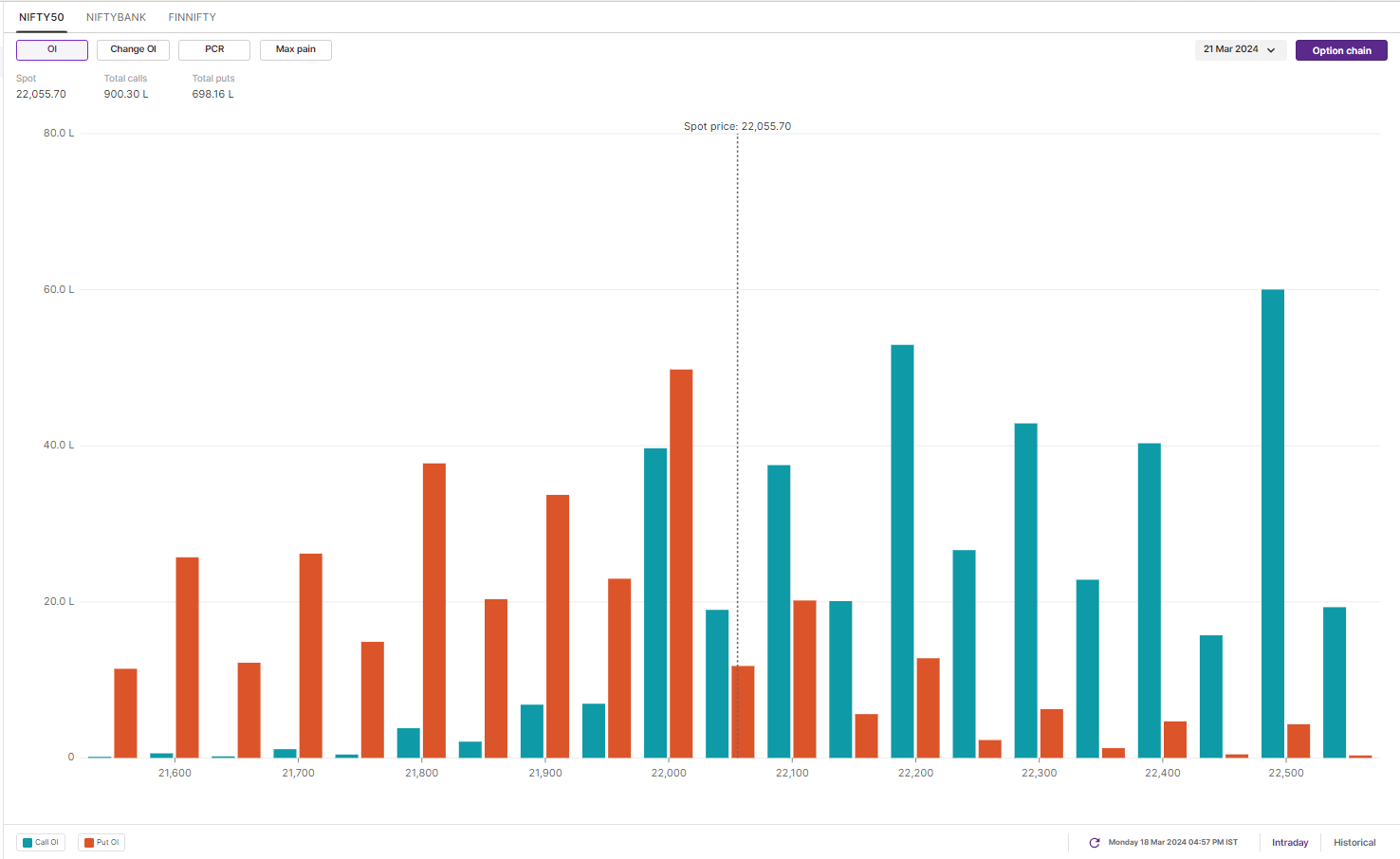

NIFTY50

- March Futures: 22,135 (▲0.8%)

- Open Interest: 2,53,731 (▲1.0%)

The NIFTY50 started the week with a lackluster performance, closing flat after a range bound session. The daily chart shows another doji candle, reflecting traders' indecision over the past two days.

This crossroads represents a critical moment for the NIFTY50. As mentioned in our previous blogs, the sharp daily corrections since January haven't translated into a sustained bearish move. Notably, the index has found support at its 50-day moving average (around 21,900) for the fourth time in four trading sessions. On the other hand, the immediate hurdle for the NIFTY50 is at 22,250.

Traders should closely monitor the price action around these key support and resistance levels. Experts believe a decisive daily close below these levels will provide further directional clues.

Open interest (OI) build-up for 21 March Expiry shows significant call base at 22,500 and 22,200 strikes. On the other hand, the put writers have made base at 22,000 and 21,800 strikes. Based on the options data, traders are expecting NIFTY50 to trade between 21,500 and 22,500 this week.

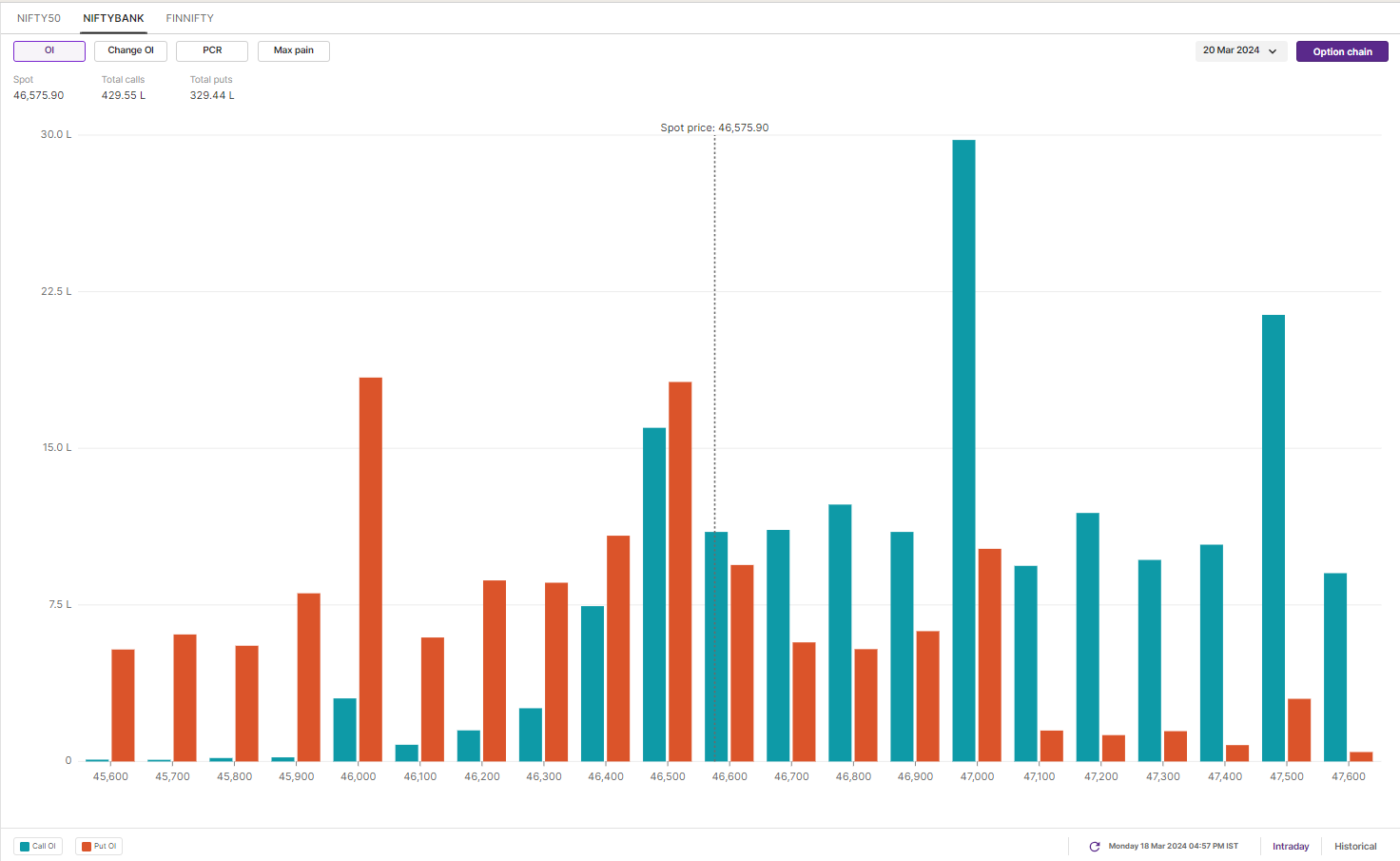

BANK NIFTY

- March Futures: 46,741 (▲0.1%)

- Open Interest: 1,28,321 (▲1.8%)

The BANK NIFTY once again protected its 50-DMA on a closing basis, forming a bullish hammer candle on the daily chart. The index fell to the 46,000 level, but rebounded sharply by over 1% from the day's low to close flat.

As you can see in the chart below, the BANK NIFTY has found support at key levels and has formed a possible reversal with a hammer pattern near the support zone and its 50 DMA. However, it is important to remember that reversal patterns are confirmed by the following day's close. Traders should watch today's close for confirmation of the reversal.

On the options front, the 47,000 and 48,000 call options have significant open interest, highlighting them as immediate resistance. Put writers have made their bases at the 46,000 and 46,500 levels, indicating support at these levels. Based on the options data, traders are expecting the BANK NIFTY to trade within a range of 48,000 and 44,800 for this week's expiry.

FII-DII activity

Foreign Institutional Investors (FIIs) sold shares worth ₹2,051 crore, while the Domestic Institutional Investors (DIIs) bought shares worth ₹2,260 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Oracle Financial Services and Godrej Consumer Products

Short build-up: Coforge, Persistent Systems, Ambuja Cements, Apollo Tyres and MCX

Under F&O ban: Aditya Birla Fashion and Retail, Balrampur Chini Mills, BHEL, Biocon, Hindustan Copper, Manappuram Finance, National Aluminium, Piramal Enterprises, RBL Bank, Steel Authority of India, Tata Chemicals and Zee Entertainment

Catch up on Monday’s trading insights from NIFTY 200! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.