NIFTY50 awaits doji clarity, BANK NIFTY eyes 46,500 hurdle

Upstox

4 min read • Updated: February 16, 2024, 7:55 AM

Summary

In our previous blogs this week, we highlighted two key points for the BANK NIFTY, the five-day defence of the 200 DMA and the bullish harami candlestick formation on February 13. The pattern was confirmed on the 14th. With the BANK NIFTY reclaiming its 20-DMA, experts see the real challenge in the 46,500 and 46,800 zones, near the 50-DMA. Traders are advised to watch the price action around these levels with caution.

Asian markets update 7 am

The GIFT NIFTY is trading higher (+0.2%), signalling a green start for the Indian equities today. This follows gains in the Asian markets where Japan's Nikkei advanced 0.8% to 38,462, while Hong Kong’s Hang Seng index remains flat at 15,951.

U.S. market update

U.S. stocks closed higher on Thursday, recouping losses after the release of the latest inflation report. The Dow Jones climbed 0.9% to 38,773, while the S&P 500 gained 0.5% and ended the day at 5,029. The technology-heavy Nasdaq Composite added 0.3% to close at 15,906.

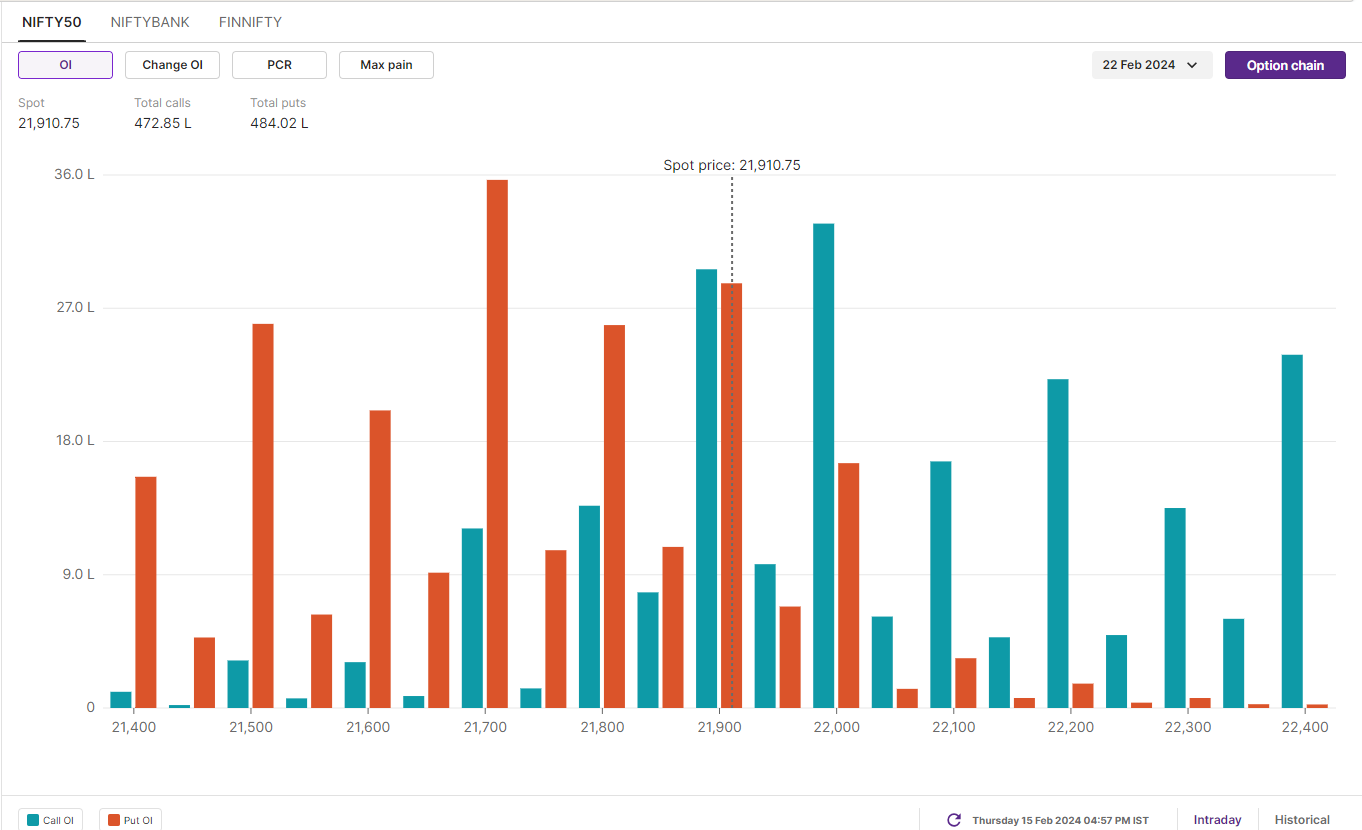

NIFTY50

February Futures: 22,005 (▲0.4%) Open Interest: 2,29,013 (▼3.1%)

The NIFTY50 extended its winning momentum for the third consecutive day and closed higher on the weekly expiry of futures and options contracts. The index formed a neutral candlestick, a doji pattern on the daily chart, indicating indecision among traders.

As highlighted in our yesterday's blog, the NIFTY50 confirmed the hammer pattern on February 14, which remains intact. However, the formation of a doji candlestick pattern suggests caution. Traders should monitor today's price action for confirmation of a further upmove. Experts believe a close above the Doji would signal continuation of the bullish momentum, while a close below could empower bears. The index has now strong support around 21,500, coinciding with the 50-day moving average.

The initial build-up of the option chain shows a significant call base at the 22,000 and 22,600 strikes. Conversely, the put base is established at 21,000 and 21,700 strikes. As per the initial build-up, 21,700 has emerged as a immediate support, while resistance remains at all-time high (22,126).

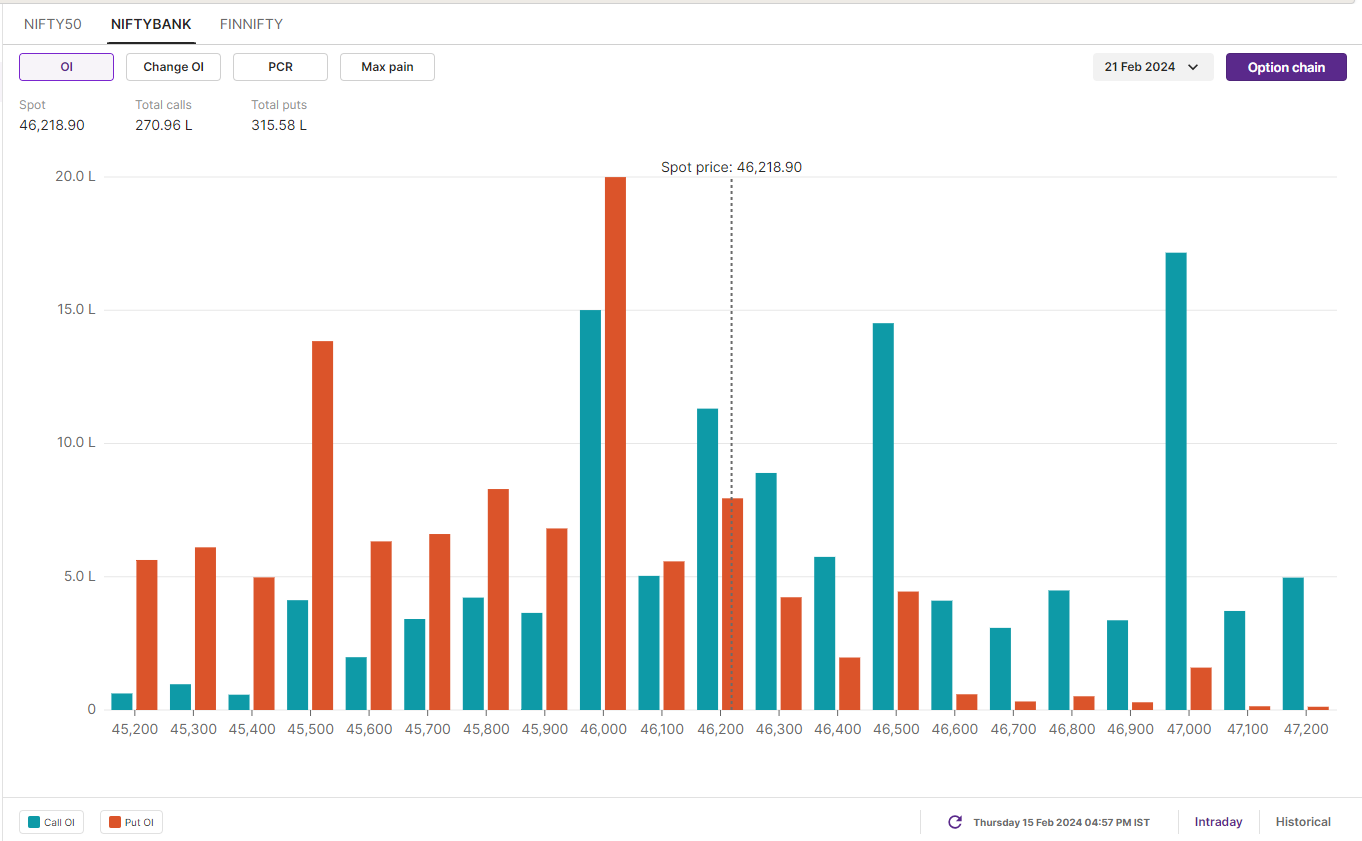

BANK NIFTY

February Futures: 46,835 (▲0.6%) Open Interest: 1,88,134 (▼9.5%)

The BANK NIFTY extended its rally and reclaimed the 20-day moving average (DMA) led by gains in SBI (+2.4%) and HDFC Bank (+2.1%). The index closed above the 46,000 level, which acted as an immediate resistance.

In our previous blogs this week, we highlighted two key points for BANK NIFTY, its five day defence of 200-DMA and the bullish harami candlestick formation on February 13. The pattern was confirmed on February 14.

With BANK NIFTY reclaiming its 20-DMA, experts see the real challenge in 46,500 and 46,800 zone, near the 50-DMA. Traders should monitor the price action around these levels with caution. On the flip side, the BANK NIFTY has established an immediate support at 45,000-mark.

For BANK NIFTY's February 21 expiry, the options data shows significant open interest at the 47,000 & 48,000 call option strikes and 45,000 & 46000 put option strikes. As per the open interest, traders eye BANK NIFTY trading range between 44,500 and 47,800 for February 14th expiry.

FII-DII activity

In the cash market, the Foreign Institutional Investors (FIIs) sold shares worth ₹3,064 crore, while the Domestic Institutional Investors (DIIs) bought shares worth ₹2,276 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Mahindra & Mahindra, Polycab, NTPC, Canara Bank and Federal Bank.

Short build-up: Vedanta, Muthoot Finance and Hindustan Unilever.

Catch up on yesterday's NIFTY 200 insights! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.